"Caution in handling 'generally accepted opinions' that claim to explain whole trends of history is especially important for the historian of modern times, because the last century has produced an abundance of ideologies that pretend to be keys to history, but are actually nothing but desperate efforts to escape responsibility.”

Hannah Arendt, The Origins of Totalitarianism

"Flattening of the yield curve is happening so slowly no one noticing the 2s-10s gap is now 24 bps. Meanwhile yields on 30s are back to 3.02% & falling. Trump and media are talking pickup in US growth, but global institutional investors not buying it, and see trouble in the rest of world."

Dr. Harald Malmgren

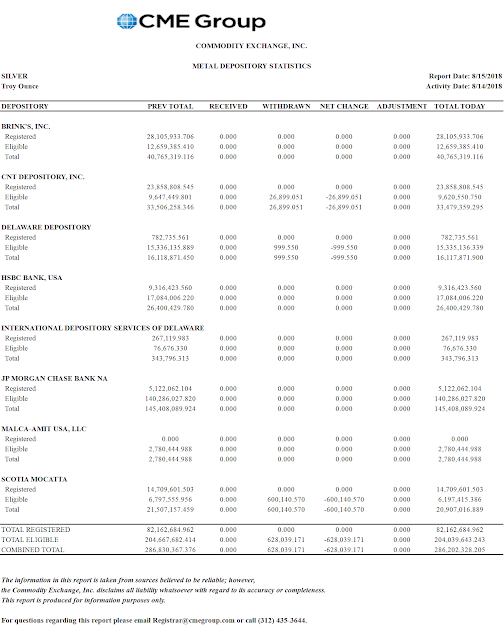

A brief respite, to unload the recent acquisitions from the car, has allowed me to at least post updated charts (and more fulsome commentary later in the evening).

As you can see, the metals were hammered a bit today, out of proportion to strength in the US dollar at least, which finished mostly unchanged.

That tells us something about the price action, right here, today and tonight.

As you may know, I think that there is more to this than meets the eye.

The problem is that the denouement is very difficult to forecast in time, so trading ahead of it, in anticipation of it, is only for the nimble.

For mere mortals, it is a more reliable strategy to get right and sit tight.

Stocks were weak, led lower by tech which is debubbling just a bit with regard to the real world results.

Never have so many lied so much for so few.

Have a pleasant evening.