“It’s no accident that the size of the financial sector today as a percentage of GDP is at levels equaled only on the eve of the Great Depression. Like the decade leading up to the financial crisis of 2008, the Roaring Twenties were marked by not only financial boom and technological wonder, but also massive income inequality. Worker wages stagnated and those of the upper classes grew, bolstered in large part by stock prices. Another similarity was a rise in debt, both public and private, which was used to mask the declining spending power of the lower and middle classes and its dampening effect on GDP growth."

Rana Foroohar,

Makers and Takers, 17 May 2016

"Financial collapses that are not due to natural disasters or war are always founded in fraud. And if you dig a bit, you will find that there are individuals behind it. It is not some random madness, but a weakness of character, a perennial gullibility, a feeling that 'everyone is doing it,' that seems to be exploited periodically by heartless individuals. In certain periods of history they become more socially acceptable.

When things seem to come mysteriously rushed out of nowhere with little factual basis behind them, and don't make sense, then they probably don't. This holds true for the Iraq war, and the bank bailouts, MF Global, and the financial and commodity market scandals that are yet to be revealed."

Jesse,

The Myth of Alan Greenspan, 10 May 2012

“Ronald Reagan and Alan Greenspan pulled off one of the greatest frauds

ever perpetrated against the American people in the history of this

great nation, and the underlying scam is still alive and well, more than

a quarter century later. It represents the very foundation upon which

the economic malpractice that led the nation to the great economic

collapse of 2008 was built.

They came up with the perfect strategy for the redistribution of

income and wealth from the working class to the rich."

Allen Smith,

The Greatest Fraud Ever, 14 April 2010

"Hillary's record on this subject [financial reform], and her service to

Big Money, and the role that she and Bill played in gutting the

progressive wing of the Democratic Party while making themselves rich on

their speeches to the Big Money crowd, speaks for itself. To expect

anything different from her if she gets in office will be like the hope

and change from Obama which didn't make it past his third week in

office, when he brought back Clinton's financial policy team."

Jesse,

Wall Street Reform and Fiscal Policy, 6 February 2016

"There is now abundant evidence of widespread, unpunished criminal behavior in the financial sector. The evidence is now overwhelming that over the last thirty years, the U.S. financial sector has become a rogue industry. As its wealth and power grew, it subverted America’s political system, including both political parties, government, and academic institutions in order to free itself from regulation. The rise of predatory finance is both a cause and a symptom of an even broader, and even more disturbing, change in America’s economy and political system. The financial sector is the core of a new oligarchy that has risen to power over the past thirty years, and that has profoundly changed American life."

Charles Ferguson,

Predator Nation

"The Clintons, along with a large group of Republican Congressmen and compliant Democrats, put a 'for sale' sign not only on the Lincoln bedroom, but on the rest of the White House and the Capitol. They certainly did not do it alone, as it was a bipartisan effort to overturn the protections established in the darker days of the Great Depression. And it became the thing to do in Washington and New York, to partner up with big money to take the public for a wild ride.

The Clintons turned the Democrats into the Republicans, while the Republicans were turning into a mob."

Jesse,

Role the Clintons Played in Enabling the 2008 Financial Crisis, 13 February 2016

"Less than two months after stepping down from the Fed, Yellen was raking in huge fees from the mega banks on Wall Street, the very banks that are supervised by the Fed.

When Yellen was nominated by President Joe Biden for the post of Treasury Secretary, she had to file a new financial disclosure form. That form revealed that she had received more than $7 million in speaking fees, the bulk of which came from Wall Street mega banks and trading houses, after stepping down from the Fed."

Pam and Russ Martens,

The Fed's Trading Scandal Broadens,, 24 October 2022

"And so these reformers, throwing their constituency under the bus, have become the facilitators of the deep capture of our regulatory and political system in a bipartisan effort to get rich. Most are just people, being carried along by an unsustainable tide of cynicism and personal greed that has imprinted itself on the minds of our privileged elites.

They choose to commit criminal acts through a wonderful power of rationalization, in a downward spiral of moral decline. This perverse mindset, which used to be a denizen of rural enclaves and big city bosses is becoming pervasive in Washington and New York."

Jesse,

Wall Street's Double Agent, 9 July 2015

"It's not just America. The whole world has sort of turned muddy. By and large, the world is increasingly run by ignoramuses, wackos and psychotics. This was long before Donald Trump. But we've got more crazy people running the world now than ever.

I think it's the one reason a guy like Donald Trump ran. They understood where he was coming from. That Trump is just a blowhard. They laughed at him. They knew Trump doesn't know what he's talking about. But Trump wasn't the same old big smile and a lot of good words.

The Democrats have been going around saying, 'We're for the people, we're for the little guy.' And all they do is run to Wall Street for money. And the one guy that didn't, Sanders, was sabotaged by the Democratic National Committee. If I were the Democrats I would stop worrying about Donald Trump and start talking to the American people about jobs and health care.

"

Seymour Hersh, 23 July 2019

"We are coming apart as a society, and inequality is right at the core of that. When the 90 percent are getting worse off and they’re trying to figure out what happened, they’re not people like me who get to spend four or five hours a day studying these things and then writing about them — they’re people who have to make a living and get through life. And they’re going to be swayed by demagogues and filled with fear about the other, rather than bringing us together."

David Cay Johnston, Inequality's Looming Disaster, May 2014

“Each day we are becoming a creature of splendid glory, or one of unthinkable horror.”

C. S. Lewis

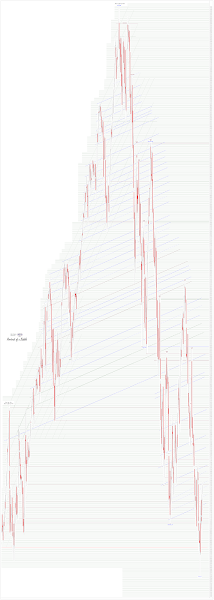

Stocks managed to pull themselves together and extend their rally higher, up to the key overhead resistance levels they are visited before.

Gold and silver fell a bit.

The Dollar chopped sideways.

VIX remain essentially unchanged.

What time is the next wash and rinse?

Risk levels remain elevated, and the underlying fundamentals of the equity markets are shaky.

Stagflation, that most improbable of natural outcomes, spawned by a twisted monetary and fiscal policy has come to pass.

How was it forecast here some years ago, when most were arguing for the inevitability of deflation, or the abandonment of any rational perspective on monetary policy?

You have hardened your hearts, and surrendered yourself to lies.

How can you hope to understand anything?

Have a pleasant evening.