"Caesar was swimming in blood, Rome and the whole pagan world was mad. But those who had had enough of transgression and madness, those who were trampled upon, those whose lives were misery and oppression, all the weighed down, all the sad, all the unfortunate, came to hear the wonderful tidings of God, who out of love for men had given Himself to be crucified and redeem their sins.

When they found a God whom they could love, they had found that which the society of the time could not give any one— happiness and love."

Henryk Sienkiewicz, Quo Vadis: The Time of Nero

"Do not abandon yourselves to despair. We are the Easter people and hallelujah is our song."

John Paul II

"He went about doing good and healing all those oppressed by the devil, for God was with him. We are witnesses of all that he did both in the country of the Jews and in Jerusalem. They put him to death by hanging him on a tree.

This man God raised on the third day and granted that he be visible, not to all the people, but to us, the witnesses chosen by God in advance, who ate and drank with him after he rose from the dead. He commissioned us to preach to the people and testify that he is the one appointed by God as judge of the living and the dead.

To him all the prophets bear witness, that everyone who believes in him will receive forgiveness of sins through his name.”

Acts of the Apostles 10:37-43

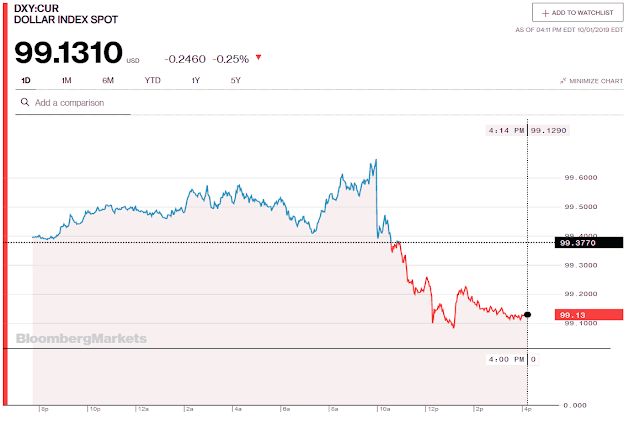

The 'highly anticipated' Fed minutes came out at 2 PM and basically added nothing new to the conversation given the recent speeches by Fed heads Bulland and Mester.

Stocks were meh, although the NDX showed some strength all things considered.

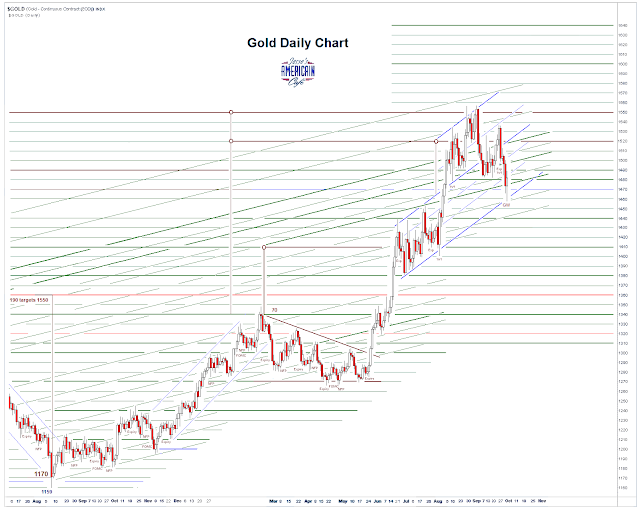

But not to waste an opportunity, gold and silver were lower as the Dollar edged higher.

And I am shocked, shocked, that silver got smacked down after the seemingly uncorrelated rally.

As noted in yesterday's commentary.

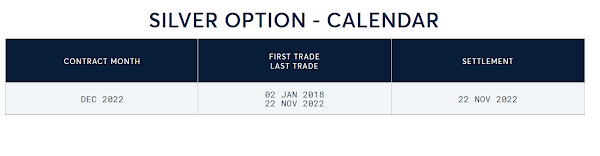

"Silver was the standout, rallying up for most of the day, contra just about everything. We have an option expiration for silver on the Comex coming on the 23rd. Forewarned is forearmed."

Have a pleasant evening.