"Single acts of tyranny may be ascribed to the accidental opinion of a day; but a series of oppressions, begun at a distinguished period, and pursued unalterably through every change of ministers, too plainly prove a deliberate and systematical plan of reducing us to slavery."

Thomas Jefferson, 1774

"To some degree this is a battle between the politicians and the markets. But I am firmly resolved — and I think all of my colleagues are too — to win this battle. The fact that hedge funds are not regulated is a scandal. Britain has blocked previous efforts to do this. First the banks failed, forcing states to carry out rescue operations. They plunged the global economy over the precipice and we had to launch recovery packages, which increased our debts, and now they are speculating against these debts. That is very treacherous. Governments must regain supremacy. It is a fight against the markets and I am determined to win this fight."

Angela Merkel, Chancellor of Germany, Berlin, 6 May 2010

"The suspicions that the system is rigged in favor of the largest banks and their elites, so they play by their own set of rules to the disfavor of the taxpayers who funded their bailout, are true. It really happened. These suspicions are valid. Incentives are baked into the system to take advantage of it for short-term profit. The incentives are to cheat, and cheating is profitable because there are no consequences.

It’s implicit in so much of the regulatory structure that if you don’t make too many waves there will be a job for you elsewhere. So we have to limit those job opportunities and develop a more professional path for regulators as a career. So much of what’s wrong with Dodd-Frank is it trusts the regulators to be completely immune to the corrupting influences of the banks. That’s so unrealistic. Congress has to take a meat cleaver to these banks and not trust regulators to do the job with a scalpel.”

Gretchen Morgensen, Neil Barofsky: Into the Bailout Buzzsaw, NY Times, July 21, 2012

"At first, the love of money, and then that of power began to prevail, and these became, as it were, the sources of every evil. For avarice subverted honesty, integrity and other honorable principles and, in their stead, inculcated pride, inhumanity, contempt of religion and general venality. These vices first advanced but slowly, and were sometimes restrained by correction; but afterward, when their infection had spread like a pestilence, the state was entirely changed, and the government, from being the most equitable and praiseworthy, became the most rapacious and insupportable."

Sallust, Conspiracy of Cataline

"Dallas Fed President, Robert Kaplan, wasn’t just trading like an aggressive hedge fund kingpin in 2020, he’s been doing the same thing for five years at the Dallas Fed while simultaneously having access to non-public, market moving information from the Federal Reserve’s interest-rate setting FOMC meetings and other confidential communications.

In addition to speculating in stock index futures, Kaplan has also made tens of millions of dollars in purchases and sales of a litany of individual stocks over the last five years, including Big Tech and fossil fuel companies, rather than adhering to the customary ethical standard by Fed officials of employing a buy and hold position in diversified mutual funds. In 2020, the vast majority of Kaplan’s individual stock trades were also for 'over $1 million.'

The role of the brokerage firm that executed these trades is a very serious matter and every American should be demanding that Fed Chairman Jerome Powell release this information immediately. In this case, knowing your customer should have meant frantically calling your compliance department when an officer of the U.S. central bank, who sits on some of the most sensitive, non-public market intelligence in the world, instructs you to make 'over $1 million' trades, multiple times, in S&P 500 futures contracts. The S&P 500 futures trade request by Kaplan should have convened an immediate, all-hands-on-deck meeting of the entire compliance department of the brokerage firm.

Instead, the trading has gone on unimpeded for more than five years, according to Kaplan’s financial disclosures. Clients whose jobs involve having access to confidential market information, like an investment banker or a central banker, would have their trades closely monitored in a properly functioning compliance department. This compliance department was clearly not functioning and the American public deserves to know why.”

Martens, Trading Like a Hedge Fund Kingpin for Five Years, Wall Street On Parade, September 27, 2021

"The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery."

Jesse, May 2009

The Dollar rallied this morning early, and managed to hold on to the 109 handle.

VIX wallowed near its moving averages.

Stocks slumped badly, but did not set a lower low, recovering quite a bit into the close.

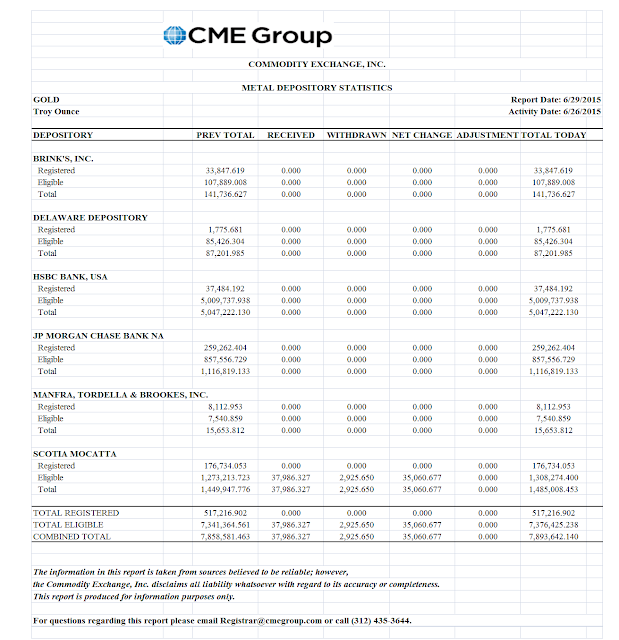

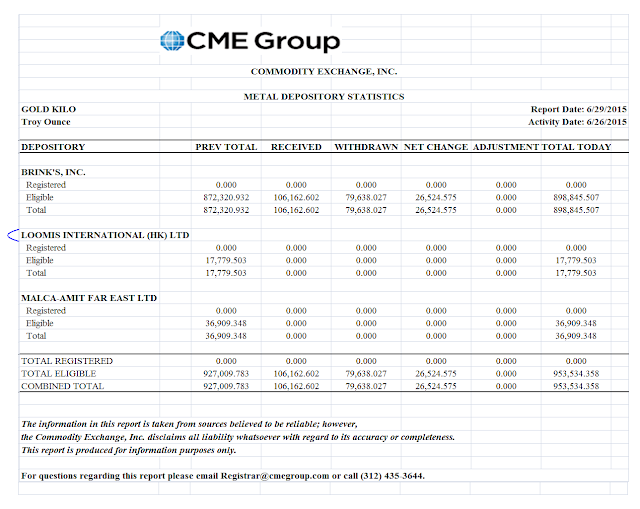

Gold and silver rallied. Gold has run up to the key resistance.

US markets will be closed tomorrow in observance of the funeral of Jimmy Carter.

The rest of the world will have to try and carry on without Wall Street.

As you know I try to suspend judgement on a new administration for the first 100 days.

I am doing the same thing again.

Well, let's see how this all unfolds.

I suspect that 2025 is going to be a year of historic, shocking changes.

See you on Friday.

Have a pleasant evening.