skip to main |

skip to sidebar

The pattern in the gold market has greatly clarified. It is now following a more gradual path higher as the banks of the world resist its upward trajectory, and the many still do not recognize the inherent value of bullion in the face of currency devaluation.

The gradual rise will take gold much higher over time than a parabolic spike higher would, although it demands more patience as things unfold.

At some point it will regain a more aggressive track higher, and then likely consolidate and resume a more gradual rise for a time.

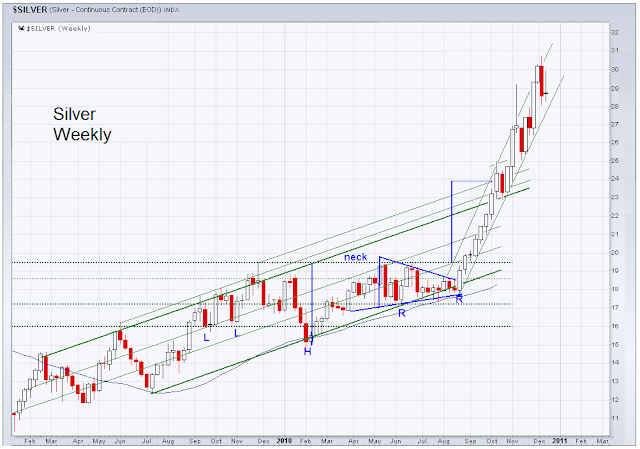

Silver is on an aggressive but sustainable rally path. The many years of suppression and the leverage in this market may call out a path and price much higher on a percentage basis than gold.

I like to buy both, but given a choice I would tend now to overweight silver for trading, and gold for the long term investment and wealth protection.

The 50 Day Moving Average once again provided support for a dip in bullion. I tended to view the bear raid today as tied to option expiration in equities moreso than in the bullion itself. Mining stocks have been hot, and the call buying may have gotten ahead of itself, setting up an incentive for players to hit the metals and take down the industry associated stocks.

Although the CFTC has enabled a position disclosure trigger at 10% at which the regulators can ask a market participant to show their net swaps, the actual position limits discussion was tabled today for a future meeting.

CFTC delays tough commodity speculation crack-down

Tomorrow is December options expiration for equities and the funds are also painting the tape to make their bonuses round up nicely into the year end.

Let's see how the markets go as they hit all our targets in the currently active chart formations. Wait for it, because Benny is in there pumping and it may take a stumble to turn this trend around, which for now is up.