In 1991, Blythe Masters read in economics (presumably with a heavy influence from H.P. Lovecraft and Stephen King) at Trintity College, Cambridge. In 1997, Blythe headed a small team of economists at J.P. Morgan bank in New York which developed the concept of the Credit Default Swaps as a means of insuring loans. This has led to Masters being described by The Guardian newspaper as "the woman who invented financial weapons of mass destruction." Regrettably, the quote from the Bhagavad-Gita about Shiva, destroyer of worlds, had already been taken by J. Robert Oppenheimer.

In April 2010 Masters told the Economic and Monetary Affairs Committee of the European Parliament that "there are definitely lessons that have to be learnt. I for one feel that I have learnt from that experience and there are things I may like to have seen done differently." There is nothing better than on-the-job training when manipulating the world's economy, as Ben Bernanke can attest. Theory is all well and good, but there is something to be said for the good old trial and error method.

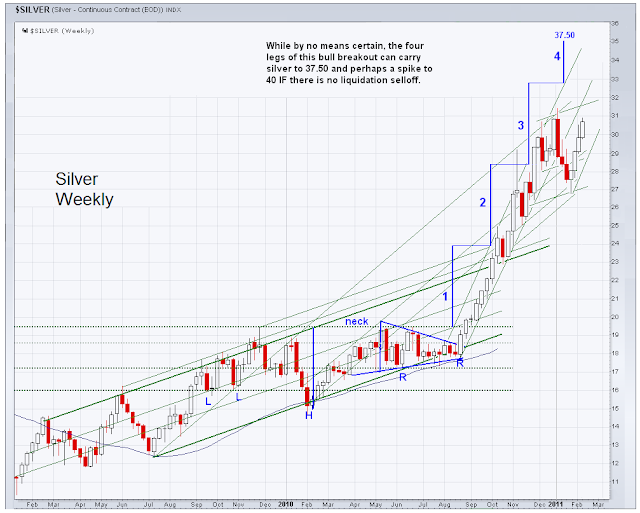

Blythe has been the head of Morgan's commodity trading since 2006, and was reponsible for notably heavy losses in the firm's portfolio last year. JPM does not specifically disclose its own market positions, but is rumoured to be short a multiple of the solar system's estimated reserves in the silver market. The positions are said to be 'almost as volatile as Lindsay Lohan's personal life' and 'about as far underwater as the Titanic.'

16 February 2011

Gold Daily and Silver Weekly Charts, and a Tribute to Blythe Masters

Category:

gold daily chart,

silver weekly chart

Wall Street and the Financial Crisis: Nobody Goes to Jail - And Therein Lies the Problem

It all comes back to the credibility trap, much more intractable than a liquidity trap. The US government cannot perform effective change without admitting the corruption and placing the powerful status quo at risk. So this malaise and period of selective recovery will continue until there is a another, more destructive crisis.

In a partnership of Wall Street and Government, justice is a scarce commodity. As Jeffrey Sachs of Columbia said, both political parties are on the take, and the political process is horribly compromised.

Unfortunately this prevents the discovery of root cause, and the necessary systemic reform and reconstruction that would allow for a sustainable recovery.

As all reform efforts are co-opted by Big Money, the lies are coming thick and fast, often modulated only by people's specific self-interests in a continual drumbeat of slogans and propaganda. This is a fairly accurate description of a social system in decline. There will be a bull market in hysteria and demagoguery, a very bad time to be weak or a minority.

And if the people rise en masse, the very powerful will throw their lesser fellows to the wolves. This is why it is important to understand your real place in the hierarchy. If you have less than five millions per year in net income, there is little difference between you and a day worker in the eyes of the truly rich and powerful, except for your value as a useful idiot, cannon fodder, and finally as prey. A cow is only valuable while it provides milk. You do not understand the will to power if you think otherwise.

I am no longer surprised that some people are willing to give themselves over to the power of this world, and to sell their honor and sometimes even their souls to its cause. The recent cases of the politicians, economists, regulators, and rating agencies is a fairly good example. The real surprise is how readily they do it, and so cheaply. And the pretenses they are willing to suffer to hide their complicity.

"Why Richard, it profits a man nothing to give his soul for the whole world--

But for Wales."

Thomas More, on the occasion of the perjury at his trial of Sir Richard Rich

Nice piece from Taibbi worth reading.

Why Isn't Wall Street in Jail?

By Matt Taibbi

...Nobody goes to jail. This is the mantra of the financial-crisis era, one that saw virtually every major bank and financial company on Wall Street embroiled in obscene criminal scandals that impoverished millions and collectively destroyed hundreds of billions, in fact, trillions of dollars of the world's wealth — and nobody went to jail. Nobody, that is, except Bernie Madoff, a flamboyant and pathological celebrity con artist, whose victims happened to be other rich and famous people...

Read the rest here.

Subscribe to:

Comments (Atom)