skip to main |

skip to sidebar

Late breaking news that Portugal will be seeking economic aid.

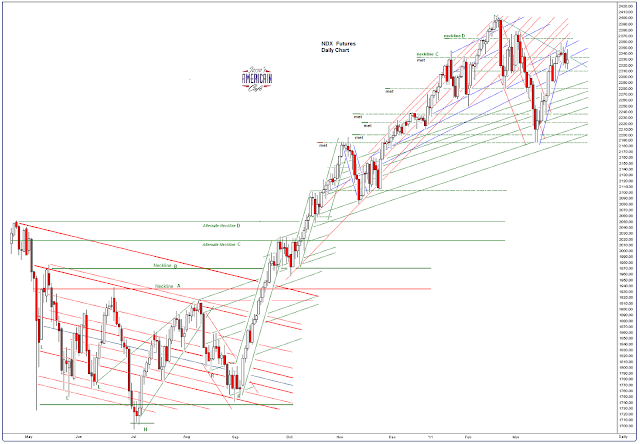

The volumes remain light, and the market vulnerable to a correction if something should happen which will cause a pickup in selling that overwhelms the Fed's monetary lift.

Marc Faber had an interesting interview with KWN: Bernanke Is Killing the Middle Class.

I am not sure it is Bernanke that is killing the middle class, as much as they are committing suicide to please the top one percent, and differentiate themselves from the poor, who they see as hopeless victims. Nothing else explains why ordinarily intelligent people spout slogans and support ridiculous notions and theories that are designed to reduce themselves and their own children to perpetual servitude. The politicians and pundits are obviously paid to say and act as they do. But why do the many willingly march to their own doom?

It tends to support the theory of Bernays, that the great bulk of people do not act on reason, but on emotions which are easily controlled and influenced, and therefore subject to manipulation. I can think of no better example of this than the manner in which the Tea Party was turned away from its initial cause of financial reform and put to the task of plundering the weak, the victims of the Wall Street and governing class frauds, upholding the very abuses by Wall Street that they had originally organized to protest. As propaganda campaigns go, it does not get much better this. No wonder the monied interests are so emboldened of late.

A little learning is a dangerous thing;

drink deep, or taste not the Pierian spring:

there shallow draughts intoxicate the brain,

and drinking largely sobers us again.

Alexander Pope, Essay on Criticism

"Anger makes dull men witty, but it keeps them poor."

Francis Bacon

These quotes remind me of some of the rhetoric I see on the web, especially with regard to economic matters wherein people make long winded argument full of rhetorical flourishes about how this or that CANNOT happen, and that those who hold some other view are obviously istas who are ignorant beyond belief.

One could almost feel badly, except that these arguments are so often held by those with a general contempt for those weaker or less fortunate than themselves, and are often obviously self-serving, intolerant, and strident.

And yet they are mostly wrong and wrong again, acting against their own interests, and likely losing sums of money if they actually invest in accordance with these wrong-headed conclusions. It seems almost like some sort of karmic justice.

Sophocles was right. Many are the wonders, but nothing stranger than man. Everyone serves something, and if not a God of the highest good, then more likely some boastful bully or unworthy idol, or even worse, themselves, and so they serve a fool.

Turning to the markets, this is where I would look for some sort of trend consolidation or correction. Having said that, it is good to recognize that we are in extraordinary circumstances, with the Fed and the developed countries printing the major currencies without a firm anchor to something external like gold, silver, or even GDP growth.

Need the end of the day it was announced that Portugal will be asking for aid as it teeters on insolvency in support of the banks.

There is also talk that the ECB will be raising rates tomorrow. The right hand gives while the left hand takes, the better to deceive you, my dears.

Let's see how this develops.

“Since ancient times, credit markets have undergone periodic booms and busts. In 594 BC, for example, the Greek state of Attica found itself under severe economic stress because of the massive debt incurred by many of its citizens. The ensuing civil disorder resulted in a handover of power to Solon, one of the ‘seven wise men’ of Greece . Solon took radical steps to restore balance to the economy, such as canceling debts, freeing those enslaved for failing to repay their loans, and devaluing the currency by 25 percent.” FDIC Outlook, Summer 2006

The metals soared today breaking out across the board with mining stocks starting to follow. It appears that we have hit the target of 1455 which I had called out when gold was trying to break out of the big cup and handle formation around 1200.

The bulls need to stick the breakout, and resist any attempts to break back down again, and set up the next leg up to $50 Silver and $1590 Gold.

I think it will take a stock market crash to stop this advance which is intimately tied to global monetary expansion and a corrupt financial system.

Not yet, but some day. Down Goes Morgan, Down Goes Morgan..

At some point they will be carrying them out of the silver pit on stretchers.