"When running a Ponzi scheme, how does one avoid enormous, unexpected withdrawals, runs on the bank, so to speak, that would pull back the curtain and reveal a little man blowing smoke? One way would be to attract a core of investors who could be counted on to never withdraw more than a small percentage of principal each year."

Mitchell Zuckoff

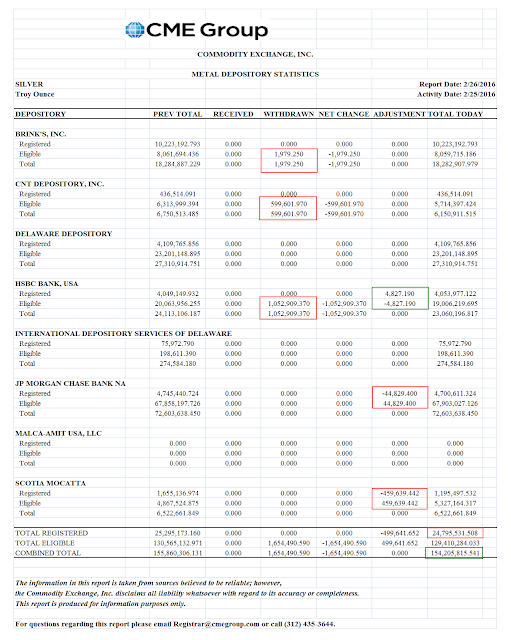

As you know if you have been following the running commentary here, February has been a deadly dull month for silver on the Comex.

And yet the action in the warehouses, bullion coming and going, has been quite active as you again have heard here many times.

Much of this has to do with the fact that CNT is using their own licensed facility as a means of managing the flows of bullion for their wholesale silver supply business, notably to the US Mint.

As you can see from the chart below, the amount of 'registered silver' has been declining steadily, while the open interest, or number of contracts for this silver sold on the Comex exchange, has been climbing.

And so we have another interesting thing to watch, and which I assume we will be told not to look at, that it means nothing.

The potential claims per ounce of deliverable silver on the Comex Exchange has climbed to a new high. And this in a particularly inactive month.

If you look carefully at the charts below you will see that there is plenty of silver in the warehouses. It is that for some reason not so much of it is in the registered category, which is something 'new.'

Another thing you may notice is the huge hoard of silver in the JPM warehouse, and the declining stocks in the active wholesaler's warehouse, CNT.

Curiouser and curiouser.