Showing posts with label Comex Silver Warehouse. Show all posts

Showing posts with label Comex Silver Warehouse. Show all posts

30 December 2016

29 November 2016

And the December Gold and Silver Contract 'Deliveries' Begin

For the first day of December, 493,800 ounces of gold have been taken for delivery at 1187.50. This represents a nominal first day delivery value of $586,387,500.

The 'big customer' at Goldman and the house account at Macquarie continue to disgorge their gold positions, in size, through the delivery process.

The buyers of these positions are the house accounts at HSBC, Nova Scotia, and JP Morgan, in addition to the big 'customer' at Morgan.

As for silver, the big deliverers of the December contract positions were customers at Goldman and Intl FCStone, and a smaller amount from the house account at Nova Scotia.

The big takers of December silver were the house accounts at Macquarie and JP Morgan.

As you may recall, JP Morgan is holding the biggest hoard of silver on the Comex in its warehouses, with over 81 million of the almost 179 million ounces of silver on deposit.

Still, if history is any indicator, these gold deliveries are merely the pushing of paper claims for a smaller percentage of physical silver around the plate, with little physical metal actually going anywhere.

Not so for silver, which continues to see large inflows and outflows of physical metal, especially in the warehouses of wholesaler CNT.

Category:

Comex Gold Warehouses,

Comex Silver Warehouse

26 February 2016

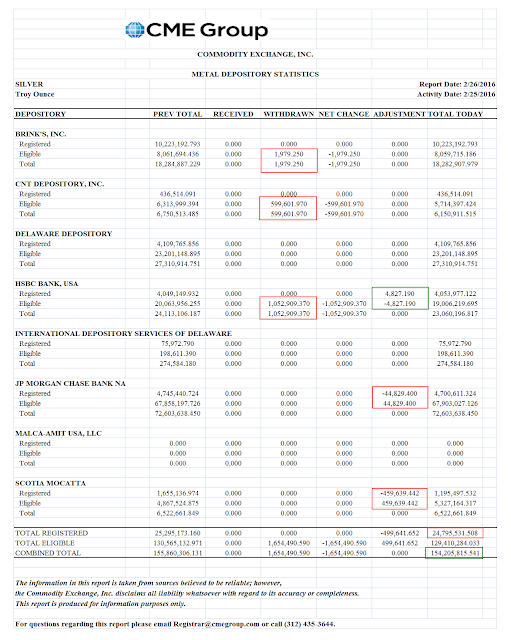

Silver Potential Claims Per Ounce of Comex Deliverable Climb To New High

"When running a Ponzi scheme, how does one avoid enormous, unexpected withdrawals, runs on the bank, so to speak, that would pull back the curtain and reveal a little man blowing smoke? One way would be to attract a core of investors who could be counted on to never withdraw more than a small percentage of principal each year."

Mitchell Zuckoff

As you know if you have been following the running commentary here, February has been a deadly dull month for silver on the Comex.

And yet the action in the warehouses, bullion coming and going, has been quite active as you again have heard here many times.

Much of this has to do with the fact that CNT is using their own licensed facility as a means of managing the flows of bullion for their wholesale silver supply business, notably to the US Mint.

As you can see from the chart below, the amount of 'registered silver' has been declining steadily, while the open interest, or number of contracts for this silver sold on the Comex exchange, has been climbing.

And so we have another interesting thing to watch, and which I assume we will be told not to look at, that it means nothing.

The potential claims per ounce of deliverable silver on the Comex Exchange has climbed to a new high. And this in a particularly inactive month.

If you look carefully at the charts below you will see that there is plenty of silver in the warehouses. It is that for some reason not so much of it is in the registered category, which is something 'new.'

Another thing you may notice is the huge hoard of silver in the JPM warehouse, and the declining stocks in the active wholesaler's warehouse, CNT.

Curiouser and curiouser.

Category:

Comex Silver Warehouse,

owners per ounce

29 January 2016

And Now For a Hard Drop In Comex Deliverable Silver

The 'registered' for delivery silver bullion at the Comex licensed facilities dropped by 7,792,110 troy ounces yesterday.

This takes the total from 36,322,409 to 28,530,299.

This is a one day decline of 21.5%.

This also brings the total deliverable silver down to some unfamiliar lows not seen since 2011. The level is not nearly as extreme as gold's, but it is getting there if this keeps up. I include a chart of the registered silver at Comex for the last ten years below.

Silver in these warehouses has been seeing some large movements for some time now, a fact which I attributed to CNT using the Comex as a delivery mechanism for the silver which they use in their wholesale business. But this kind of drop is not usual.

Comex Silver looks positively lively compared to Comex Gold, which is starting to resemble a Madame Tussaud's depiction of a commodity market, seeing very little activity, and almost frozen in time like some artifact from the past.

I bring these facts to your attention not out of some sense of alarm, and I do not wish to sensationalize them. Although some do. I think it is just something a bit unusual that bears watching, since it does not seem to be occurring in isolation and is an 'outlier' from the usual business. And I would not have brought it up except in passing if it had only related to CNT, which I would have then assumed was related to one of their large wholesale transactions.

Below is the statement of the warehouses from the day before, from last night's posting here.

Category:

Comex Silver Warehouse

11 September 2015

Comex Potential Claims Per Ounce of Registered (Deliverable) Silver

Although we have been watching the gold potential claims per deliverable ounce quite closely, we have not been reviewing the situation in silver.

As I have mentioned before, the situation with silver on the Comex is quite a bit different than with gold.

Thanks in large part to CNT, a large wholesale of silver bullion to the US Mint among others, the Comex silver warehouses often see large amounts of withdrawals of bullion for use by the buyers.

In the case of gold, the function of the gold in those warehouses seems to perform more of a collateral arrangement, with the physical delivery exchanges being located in London and in Asia.

So it is no surprise that the potential claims per ounce of silver, although a bit elevated of lat at 15 to 1, it is relatively modest compared to the 230 to 1 ratio of gold.

Category:

Comex Silver Warehouse

09 July 2015

COMEX Silver 'Owners Per Ounce' and the Great JPM Silver Hoard

The 'owners per ounce' for silver is trending a bit higher, thanks to the enormous open interest.

The most impressive hoard accumulated in recent times is the silver bullion held in the JP Morgan warehouse for 'someone.'

CNT is the big dealer in silver, using the COMEX warehouses to stage is silver wholesale business to the US government mint among others.

Look at the mass of registered (deliverable) silver which they hold. They are almost an anomaly in the paper markets of New York. And it is CNT that is boosting the deliverable silver that keeps the 'owners per ounce' down in the face of the increasing open interest.

Category:

Comex Silver Warehouse,

JPM Silver Short

01 May 2015

Silver in the Individual Comex Warehouses

Here is the current state of silver stockpiles in the Comex warehouses.

Several people have remarked on the accumulation of silver in the JPM warehouse.

CNT has become a major wholesale dealer in the silver market, largely as a result of their contracts to deliver silver to the US mint. The story of this small family coin business is interesting and you may read about it here.

It is not clear why JPM is accumulating silver in their warehouse, and why. And since this is a public warehouse, it is not even clear who in fact is the owner of the silver involved. Is this really JPM's silver, or are they merely acting as the agent for another party or group?

I would imagine if JPM is the owner then one would find some indication of this ownership on their 'books' and that one could look at their physical position in relation to their large derivative positions.

I would imagine if JPM is the owner then one would find some indication of this ownership on their 'books' and that one could look at their physical position in relation to their large derivative positions.

Category:

Comex Silver Warehouse,

silver

30 June 2014

Comex Silver Stockpiles at the End of 2Q 2014 - Coins 'N Things

As you know July is an active month for silver futures contracts at the Comex.

On paper at least, the Comex warehouses seem to be well stocked, with two relative newcomers CNT and JPM having built up some significant stockpiles. I was particularly taken with CNT.

I have broken out the registered (deliverable) from the total inventory in the second chart to show that while there is quite a bit of inventory on hand, only a modest portion of that is 'for sale' at these current prices. And a big chunk of that is held at CNT, a privately held family business in Massachusetts that grew from a single coin shop called Coins 'N Things.

CNT has become the largest wholesaler of gold and silver to the US government and has become a major reseller of American Silver Eagles. The company does not report its numbers and has no outside investors.

I wonder if they are subject to regulatory oversight or independent audits of any sort. Presumable Comex applies the same blanket disavowal of liability to silver as they do to gold in their authorized warehouses.

I don't think it is an overstatement to say that the near term deliverable silver market at the Comex is systemically dependent on CNT. An unfortunate event or a misstep at that relatively small company, or a major failure by one of their counterparties, would quite possibly trigger a silver market dislocation of sorts. And I would not rule out a declaration of force majeure.

This is not to say that it will happen, but rather that from a systems perspective that this is a major single point of potential failure with significant cascading results. It points to a locus of potential fragility.

These graphs are from the Data Wrangler from Down Under, Nick Laird at Sharelynx.com.

Category:

CNT,

Comex Silver Warehouse,

comex warehouse

Subscribe to:

Comments (Atom)