"But Peter and the apostles answered, 'We must obey God rather than men.'"

Acts 5:29

"People worshiped the dragon because he had given his authority to the beast, and so they worshiped the beast as well, saying, ‘Who is like the beast? Who can wage war against him?’ The beast was given a mouth to utter proud words and blasphemies and to exercise its authority for forty-two months."

Revelation 13:4-5

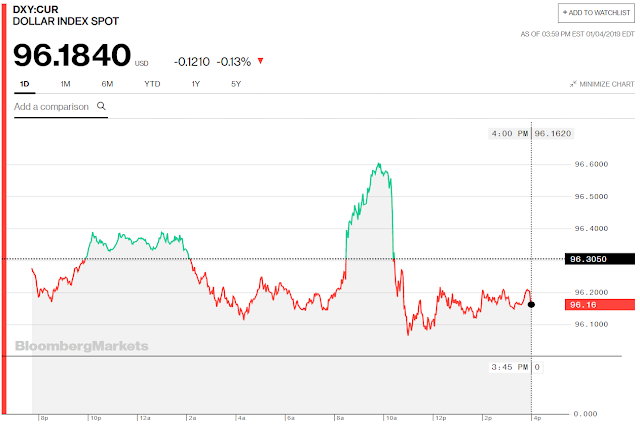

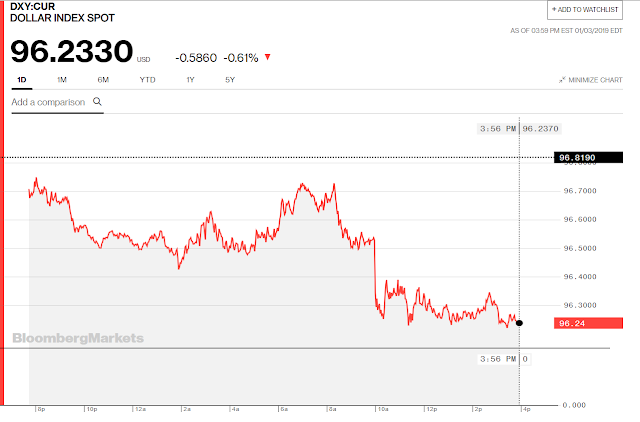

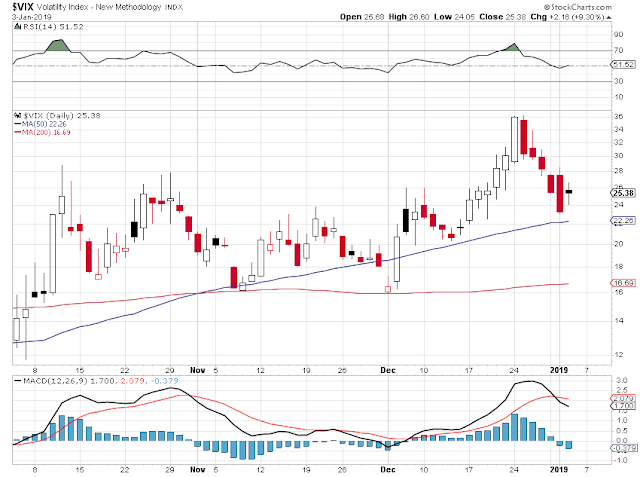

Today was quite the event, as the cowboys of Wall Street were hurrahing the townsfolk with a celebration of a rip-roaring risk on recovery.

There was a massive reversal of the past few days' trade as bonds were dumped and the punters piled into stocks.

Gold and silver held in exceptionally well.

To say that I am skeptical of this Jobs Report would be an understatement.

To say that the bipolar state of the markets, from extreme highs to lows and back again, does not inspire confidence is a certainty for anyone with a thinking mind.

Trump is engaging in the usual hysterics that pass for negotiation NYC style, threatening to declare a national emergency or shut the government 'for years' if he does not get his way about building a wall that hardly anyone except Rush and Ann think is a good value for the money.

What I would really like to see is this thing settled in binding arbitration, with Pelosi and Schumer meeting with Trump and McConnell in front of Judge Judy, for example.

I will spare you and myself any additional comments tonight because the cold that has been lingering on the periphery is making a proper nuisance of itself, and I am feeling just knackered.

At least the new season of Gotham has started. And a few other good ones are not too far away.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant weekend.