"And you could say in some respects this 'shadow behind the power' that makes money off war, period, no matter who's the belligerent, makes money off that volatility now, especially with computers that are able to assist them in doing so, like currency manipulation, for example, or just general speculation. And they don't care about what they're doing to the real economy, because they're raking in the dough."

Lawrence Wilkerson, former chief of staff to Colin Powell

"There are those contentious and disorderly people, who engage in useless speculation and deceptive talk, and focus on divisive points of dispute... All things are good to the pure of heart, but to these corrupt and disbelieving controversialists nothing can be good, since both their minds and and their hearts are corrupted. They may say that they know God, but by their actions they deny Him, being corrupt and disobedient, and of no use for any good purpose."

Titus 1:10,15-16

It is enlightening to see that even in the earliest of times there were those who made a trade out of controversy, and of spreading hatred and fear. There are those now who seek to inflame controversy, for their own purposes and those of their paymasters. Nowhere is this more apparent now than in our polarized political landscape, and most social discourse in the mainstream and on that modern public forum, the Internet.

Even those who think of themselves as good can get caught up in it. It is one of the greatest of ironies, that we become what we hate, because that is where we place our attention, and thereby our hearts..

There are sites and places that one can go to and be almost certain of a type of hateful and divisive focus, of easily provoked anger, and contempt for others, of incivility and almost childlike tantrums, with sweeping generalizations, conclusions and condemnations. They are 'playing to the mob' and venting their own disquiet hearts.

This is not the same as reform, or of the calling out of injustice to the light. This is the madness that makes a fog in the minds and the hearts, which serves one to escape the pain of thinking.

Why do we go to these sites, and listen to them, and repeat their deceptive assertions, if not for the thrill of a temporary distraction? And so often we excuse our participation, saying we only wish to 'inform' others, while poisoning the minds of our friends and our children.

|

| The weather started getting rough... |

When in doubt always step back and ask, if not of yourself then of the Lord, where is the love in this, where is the fruitfulness of good works? Is this serving good, or passionate anger of the self and its wrath?

By their actions they show what they are. And these produce nothing good, but only add to the destruction and confusion, for money, or for the sick release of their own disturbed and disordered minds and hearts, with which they infect many.

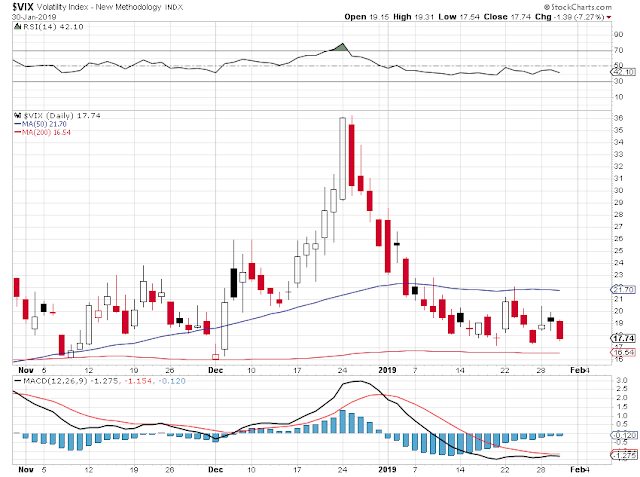

Speaking of infections, the Fed's turn to dovishness has reignited the animal spirits of the Bubbleonians™.

Stocks continued moving hired, fueled by a renewed optimism of the 'Fed Put' which is another term for the official backstopping of speculation in financial assets.

The Dollar rebounded a bit in the afternoon and so gold and silver pulled back a bit from the highs.

|

| Can you spot the little dog in the fold of our 'sherpa blanket'? |

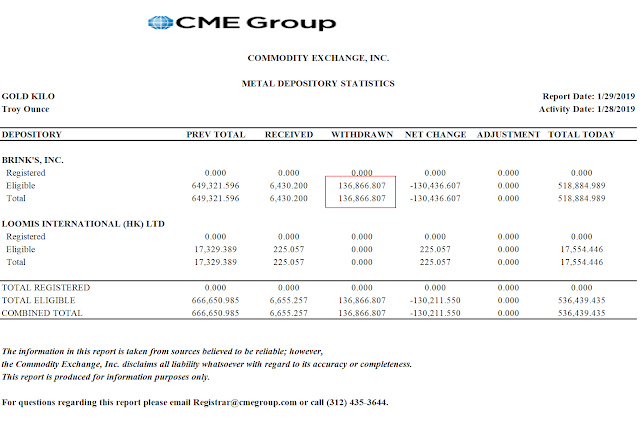

The deliveries have started on the February gold contracts, and the clearing report for that action is below. A large JPM customer was the selling, and the house accounts of Wall Street Banks were the stoppers at $1309.

But this is nothing compared to the big gold contract takedowns of the Goldman House account in the last contract month. I wonder if they sensed the Fed's change of heart?

Non-Farm Payrolls tomorrow. It will be interesting to see how the market reacts if it is overly strong, or overly weak.

The weather has turned brutally cold here last night and today. At first light there were birds and squirrels scratching for food in the snow, and one could not help but be moved with compassion for them. I put out a large amount of feed on the ground in the back yard, and the squirrels and chipmunks and birds were swarming it all day. They will need it to fortify themselves for the cold we face again tonight.

Every time I saw their happy feasting I was glad. The best way to shake off the cold and the gloom is to do something good for those from whom you expect nothing in return. My old teacher and mentor used to call this a princely gesture.

I have a pot of beef bones soup on the boil in my Instant Pot for dinner this evening. With some freshly made noodles it will be just the thing.

Dolly refuses to leave the warmth of our furry blanket after a very quick trip outside this morning. She won't even respond to suggestions of a walk, except with the most determined passive resistance. Smart girl.

Have a pleasant evening.