Someone asked us to comment on the IRX index, and its relationship to the SP 500.

The IRX index is the discount rate of the 13 week Treasury bill. It is called the discount rate because it has no coupon, but matures to its full face value. But it does have an effective interest rate, and this is what the IRX index is.

So to understand the IRX we need a little understanding of Treasury Bills.

U.S. Treasury bills (T-bills) are among the safest short-term financial instruments denominated in dollars because these debt obligations are perceived to have virtually no default risk. Moreover, because T-bills mature in less than one year, with most maturing in a matter of months, they do not have a significant interest rate risk component, either. This is a major difference between T bills and T bonds and notes which are of longer durations.

There are four major influences on the price and yield (discount rate) of Treasury bills:

- Demand for risk-free fixed-income securities in general as opposed to other short term investment choices. For example, a "flight to safety" caused by concerns about default or liquidity risk in other financial markets may cause investors to shift to T-bills to avoid risk.

- Supply of T-bills by the U.S. government--for example, federal budget surpluses in 1998-2000 temporarily reduced the supply of some Treasury securities issues.

- Economic conditions may influence rates-- T-bill rates typically rise during periods of business expansion and fall during recessions.

- Monetary policy actions by the Federal Reserve--Fed actions that affect the Federal funds rate likely will influence interest rates for short-term instruments like T-bills.

- Inflation and inflation expectations also are factors in determining interest rates--for example, periods of relatively high (low) rates of inflation usually are associated with relatively high (low) interest rates on T-bills.

Here is a graph showing the profound effect that the Fed Fund Target Rate, with changes anticipated by the Effective Funds Rate, has on the 13 week T Bill rate in the secondary markets. The 13 week T Bill discount rate is called by the Fed the 3 month Treasury Bill secondary market rate. There is an index that tracks this yield that is called the IRX. The short term rates move lower with recession and higher with business expansions. This is not only the result of Fed actions, but also the demands of business as stated in the four influences above.

If we include the Ten Year Treasury Note Yield to the Chart, we can see the long end of the yield reacting to the perceptions of inflation. But perhaps more importantly we can see Yield Curve Inversions on the chart. These are times when the long end of the curve, represented by the Ten Year note, has a yield less than the effective interest rate of the short end of the curve, as represented either by Effective Fed Funds or the 3 Month T Bill Discount Rate.

If we add the SP 500 to this chart, we can now see the interaction of a relatively broad stock market index with the short end and the long ends of a the yield curve. Of special interest is the clear presaging that a yield curve inversion provides for an economic recession and a stock market bear market. Note the timing of the inversion, the recession, and the approximate stock market market bottom.

We find the example above just a little 'short' because it does not reflect the real SP 500 adjusted for inflation, but merely the nominal number. Of course the interest rates shown are not real rates, but the nominal rates. With inflation, the real interest rate has probably gone negative. The problem we have in most of these instances is that the CPI in our opinion is no longer a valid measure of inflation, having been corrupted by the Clinton and Bush administrations. So we will deflate the SP 500 by gold.

The chart above helps to illustrate the sad truth that the economic recovery after the bursting of the tech bubble was just a mirage caused by what we call The Great Reflation. The clever boys at the Fed, thinking they had learned their lesson from the Great Depression, were determined to pile on the monetary stimulus early and heavily. Alas, although it triggered a housing bubble and a reflating of the stock bubble, it was coopted and misspent by a corrupt financial sector. There is also a strong case to be made that one cannot reflate their way out of a bust following a boom, by attempting to recreate the boom. The recovery must come from reform, hard work, and savings.

It becomes difficult if not impossible for most people to pick out relationships on charts like these, unless they have a mathematical background or many years studying complex graphs. And personally we like to use the math anyway, because we find the eye deceives where the numbers tell the truth.

Let's just say that we're in for a rough time of it in equities in the US, and we are in a recession now. Why couldn't the Fed have kept rates low? Why did they have to raise the Fed funds rate and trigger the yield curve inversion? Why not just keep things as they were. The answer is clearly contained in the first chart. There are too few instances wherein you can unleash the inflation genie from the bottle, and hope to get it back in again gracefully. Volker did a remarkable job AND was exceptionally fortunate. It may not be so easy the next time, and the alternative is, for bankers at least, hyperinflation and the abyss.

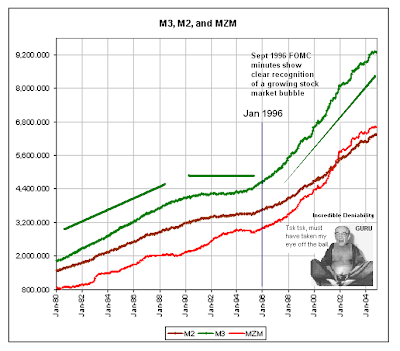

As a final note, we wanted to mention that some years ago a few clever economists found out that its not so much what the inflation rate is that triggers the inflationary spiral, but rather what people think it is. This is not some arcane Clintonian parsing of logic, but a clear connection between perception and behaviour. It is the behaviours that people take in anticipation of inflation that reinforce it like a feedback loop and make it particularly nasty. So if you can control their perception of inflation, the Fed will have a much greater degree of latitude in engineering the economy and money supply since inflation is a major pitfall. What might they do to manage that perception? They aren't being subtle about it, we'll say that much for now. (Hint: three major indicators of inflation are the CPI, broad money measures like M3, and Gold.)

To summarize, the economy is in a recession, and the SP 500 has more correcting to do by historical standards. Short term rates are moving lower ahead of the recession. The Fed will not be able to raise short term rates until the recession is behind us, which means that the US Dollar has further downside potential unless the G8 countries take some extraordinary actions to help the dollar, most likely by inflating their own currencies. The Fed has a tradeoff between the stock market and the economy on one hand, and the dollar and the Treasuries on the other.