US Dollar Rally and Deflationary Imbalances Overseas

TED is an acronym for Treasury and EuroDollar. A Spread is just the difference or 'distance' between one thing and another.

Eurodollars are bank deposits denominated in U.S. dollars but held at locations outside of the U.S.

Initially, the term only referred to dollar deposits in London but has been expanded to include dollar deposits at any offshore location.

T bills are US Treasury debt of short duration are considered to be risk free.

TED Spread = Yield on Eurodollar deposits - Yield on T Bills

The TED Spread is the difference between U.S. Treasury bill yields and yields for Euro deposit contracts of the same maturity, generally three months.

Demystifying the TED Spread

02 October 2008

TED Spread Soars to a New Record - Symptom of the EuroDollar Squeeze?

The Dollar Rally and Deflationary Imbalances in the US Dollar Holdings of Overseas Banks

Dollar Assets and Liabilities in the International Banking System

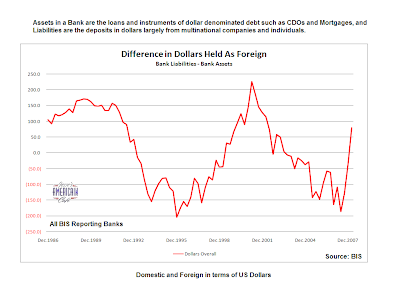

In reading the Assets and Liabilities reports of the Bank for International Settlements (BIS), we have been examining the holdings of the reporting banks with respect to the changes in US dollar denominated assets and liabilities.

The Eurodollar had been a component of M3 and was discontinued by the Fed in 2006.

When a multinational company deposits US dollar receipts from an export business in their domestic banks those deposits are frequently held in dollars. Think of it as a short term Certificate of Deposit denominated in US dollars.

Overseas banks may take those customer dollar deposits (liabilities) and place them in dollar assets such as CDO tranches and interest yielding debt instruments which are held as dollar assets on their books.

If those dollar assets decline because of a financial event as we are seeing today, the depositors may choose to withdraw their dollar deposit from the bank as they mature.

This places the bank in an awkward position since the corresponding assets have deteriorated in value, but the nominal value of the certificate of deposit liability remains the same with the requisite interest accrual.

As a result, a demand for dollars can be generated in the foreign country that is artificial but very real in terms of day to day banking operations.

This is the 'artificial dollar short' and monetary deflation about which so many have spoken. It is specific to Europe in this case because the ECB cannot print dollars, it can only obtain them from the Federal Reserve.

It has more of the characteristics of a supply disruption or a liquidity crunch in that demand is temporarily exceeding supply because of an exogenous event.

The central banks arrange swap operations, such as between the Fed and the ECB, to exchange Euros and Dollars to maintain the liquidity of their domestic operations.

If handled inefficiently or under event duress this could have the effect of creating a short term currency imbalance, increasing the cost of euro-dollar swaps, and driving the 'price' of the dollar higher in the short term, and perhaps quite sharply if the event is of sufficient magnitude.

As the imbalances are resolved the 'fundamentals' should reassert and relative values among currencies revert to the mean.

But in the short term a significant amount of dislocation and distress could occur in the arbitrage and banking markets.

We believe that we are in such an occasion now, as the European banks had been slow to markdown their degraded US assets, and had relied on swaps written by companies such as AIG which have failed, leaving the banks a day late and literally 'a dollar short.'

The resulting sharp rally in the US dollar is therefore likely to be an anomaly which will correct, and perhaps quite sharply, once the effect of the short term imbalances dissipates.

We do not have access to a Bloomberg terminal but would speculate that EUR.USD swaps have risen higher recently as the withdrawal pressures in the European banking system increased. This has little to nothing to do with the relative prospects for the fundamentals, but are what we like to refer to as 'the technical trade.' Real enough to the trader, but transitory.

Have you missed the exquisite irony that it was the US banks that sold the foul debt assets to the overseas banks that are now driving the demand for US dollars. And the US banks are quite possibly squeezing their foreign countrparts in the process?

We wonder if the ECB and other Central Banks agree with this and therefore understand that decreasing the value of the US dollar relative to their currency might be an effective policy response to some liquidity problems in their domestic banking system. They may already be attempting to accomplish this, given the recent increases in the Fed swaplines with their foreign central bank counterparts. But they may also be getting squeezed by some multinational trading banks and funds.

They may already be attempting to accomplish this, given the recent increases in the Fed swaplines with their foreign central bank counterparts. But they may also be getting squeezed by some multinational trading banks and funds.

Although we have been discussing this using the Euro as an example, the situation would apply to any national banking system which has been long deteriorating US debt and the monetary dollar fruits of the US current account deficit and their own mercantilism.

Don't confidence men generally rely on the gullibility and greed of their marks? We doubt the economic hit men are missing this opportunity to profit from a position of relative advantage.

No wonder some nations are complaining that they need a new basis for international trade not based on the dollar.

"It's good to be the King."

'Time of Dominance of One Economy, One Currency is Over'

The Economic Times of Asia

'Time of dominance of one economy, one currency is over'

3 Oct, 2008, 0417 hrs IST, PTI

MOSCOW: Apparently referring to the US, Russian President Dmitry Medvedev on Thursday said the time of dominance of "one economy and one currency" is over and called for collective steps to cope with the current financial crisis caused by "financial egoism".

"The problems caused by the global financial crisis have demonstrated that the time of dominance by one economy and one currency has irreversibly become a matter of past," Medvedev said addressing the Russian-German 'St. Petersburg Dialogue' in Russia's former imperial capital.

With German Chancellor Angela Merkel sitting by his side, Medvedev declared that a today not a single nation could alone play the role of a "mega regulator" of the global financial system.

For resolving the current financial crisis, which to a great extent is the product of financial egoism (of the US), there is a need for collective measures," Medvedev said.

Prime Minister Vladimir Putin, battling to insulate the former Communist nation's nascent economy from the global financial crisis, had yesterday blamed the US for showing "irresponsibility".

"We see an inability to take appropriate decisions. This isn't the irresponsibility of particular individuals, it is the irresponsibility of a system that as we know had claims to leadership," Putin said in his televised remarks at the Cabinet meeting yesterday.

Putin, who as the country's chief financial and economic executive has taken several steps to ease the credit crunch by releasing 1.5 trillion roubles and earmarking another 500 million roubles to buy securities to prop bourses, said that Russia could no longer remain unaffected by the "infection" originating from the US.

Discount Window Lending Soars to Another Record

American Banker

American Banker

Discount Window Borrowing Hits Another Record

By Steven Sloan

October 3, 2008

WASHINGTON — For the third consecutive week, lending through the Federal Reserve Board's discount window continued to soar, hitting a new record on Wednesday when total borrowing reached $409.5 billion.

The new high underscores the industry's struggle to regain its footing during the past week amid a financial crisis that toppled Washington Mutual Inc. and caused regulators to facilitate the sale of Wachovia Corp.

Much of the lending was concentrated in the Fed's backstop for money market mutual funds and the primary dealer credit facility. The Fed said it distributed $152.1 billion — more than twice the level a week earlier — through a program announced last month that lends against asset backed commercial paper held by the funds.

Meanwhile, borrowing through the primary dealer credit facility, established in March to lend to investment banks, jumped 38.7%, to $146.6 billion. Though major standalone investment banks no longer exist on Wall Street, the facility helps Goldman Sachs and Morgan Stanley, which are now bank holding companies, and the investment bank units of commercial institutions.

Traditional lending in the form of primary credit to commercial banks also reached a new high on Wednesday, when borrowing increased 26%, to $49.5 billion.

The Fed also said American International Group Inc., which the central bank bailed out last month, had tapped $61.3 billion of its $85 billion loan. A week ago, the insurance giant had borrowed $44.6 billion of the loan.

For the first time in three weeks, there was no lending to weak banks in the form of secondary credit and the remaining $42 million was in the form of seasonal credit to support banks in rural or resort regions.

The Fed's loans are carrying increasingly longer maturity terms. While the vast majority — $213.7 billion — will mature within 15 days, $61.3 billion will come due within one to five years. Another $21.3 billion matures between 91 days and one year while the remaining $113.2 billion will be paid within 16 to 90 days.

The Fed continues to expand its balance sheet to accommodate the growing demand at the discount window. Total assets jumped 23.5% in the past week, to $1.5 trillion.