Ambrose Evans-Pritchard has a bold headline US Money Supply Plunges at 1930s Pace that is sure to provide much referential action for the UK Telegraph.

I like to read AEP, but have to admit that he is given to sensational headlines on rare occasion. That is because it sells papers, and also draws blog clicks, as posters on the web are sometimes wont to emulate. Fear sells. The financial sectors also thrives on rumours and panic selling. It clears the decks for new Ponzi rallies. And it seems as though fear has become an inseparable partner and helpmate to central governments these days.

But there were some mildly disappointing elements to this particular piece in addition to its somewhat overstated headline. The US stopped publishing M3 several years ago. At the time I was not happy about this, and complained quite a bit.

Several enterprising fellows, including my friend Bart over at Now and Futures, as well as John Williams at Shadowstats, have been attempting to extrapolate the M3 figures, and doing a fine job given what they have to work with. In an added footnote, AEP says he is using John Williams' service. He also incorrectly states that the still Fed publishes all the components. They do not disclose eurodollars. The basis for discontinuing M3 was to eliminate the 'inordinate expense.' Obviously if they still published all the components, that could not be a credible case. This is not just being picky. Eurodollars are a remarkably volatile component these days, and also a method of buying Treasuries via London if one were so inclined to monetize US sovereign debt that way. Could the BoE and the Fed be scratching each other's backs as they say? The BoJ has already paid for one false US recovery, so they deserve a break.

Here is a quick review of the components of the Monetary Supply figures including M3 for your review. You may also wish to refresh your knowledge here: Money Supply a Primer.

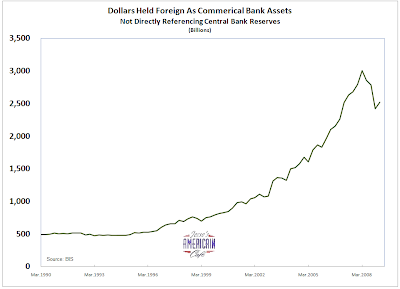

The chief component that is 'missing' these days which must be estimated is "eurodollars," which as you may recall are US dollars being held overseas. You know, those dollars that Bernanke has been sending over to Europe en masse lately through the swaplines.

The fellows can estimate this, but the reporting of eurodollars lags by a quarter or more, the only reliable source of information being the forex commercial banking reports from BIS.

I would very much like to have M3 back, but in particular I would like the Fed to be releasing a more accurate and contemporary measure of Eurodollars, the dollar overhang overseas, particularly in light of the huge swings in the DX index, and its almost undeniable relationship to the recent dollar short squeezes on the European banks. The Dollar Rally and the Deflationary Imbalances in the US Dollar Holdings of Overseas Banks.

But alas, we do not have this, so we can only estimate M3, particularly the eurodollar component. But the good news is that we still have both M2 and MZM.

Here are the most recent figures for MZM and M2 from the St. Louis Fed, expressed as a percent of change YoY, not adjusted for seasonality. For good measure I have added GDP and PPI Finished Consumer Goods in the mix.

It might also be wise also to keep in mind that after a period of sharp growth in response to a developing recession that flattens out afterward, the year over year percentage growth can fall precipitously and look quite impressive on a growth chart without necessarily providing a meaningful decline in the nominal values. This can be seen in the M2 chart below.

And it is also true that during a period of slack growth in GDP the demand for money is lessened such that normal or even flat money supply growth would seem to the Fed monetarists to be 'inflationary.' This does not mean that they have forgotten where the 'ON' button to printing press is located. Of all the things that might concern us about the Bernanke Fed, the least of them is that they will be too stringent in supplying liquidity when and where it might be needed, in substantial volumes, at least to the banking system.

MZM is the broadest measure of liquidity, and is very much a creature of the Adjusted Monetary Base. As one can see from the chart, the Fed, using their various policy tools, jams the short term money supply higher in response to a lagging economy, and the broader measures like M2 tend to follow with a lag.

The Fed then backs off, and waits to see the effect of their actions, as well as any accompanying fiscal programs, on the real economy as measured by GDP, with an eye on inflation. In this case I am using PPI, but I greatly prefer John Williams' unadulterated CPI measure. Unfortunately I do not have it in the proper format for this study. But PPI finished goods will do.

Now, looking at this chart, it appears that the Fed is following their usual gameplan. The excess reserves that the banks are holding, at least indirectly in response to the balance sheet expansion and interest rate payments on their own deposits by the Fed, are enormous and unprecedented. If the Fed were to start pulling some levers to motivate those reserves into the real economy through loans, the impact could be dramatic. The Fed will do this if their fear of inflation begins to be overcome by their fear of deflation.

For the moment, the great bulk of liquidity is being used by the banks to bolster their reserves, and their unresolved bad debt, as if the bad debt itself was the cause of the problem. The problem is that a credit bubble left consumers with the inability to pay their debts, and while nothing is done for the median wage, and the bad debt is not written off, the problem continues. This was the story of the zombie economy of Japan's lost decade, because their kereitsu corporate combines would not take the 'hit' for their land bubble.

Right now it appears to me that they are overly preoccupied with the status of the biggest of the banks and their asset quality problems an under stimulating the real economy. I think this will be regarded as a policy error as were the actions of the Federal Reserve in 1932 wherein the Fed overreacted to a spike in CPI and tightened prematurely. The Fed may be engaged now in a policy error of a different sort.

I am not saying what MUST or WILL happen. I am not arguing from theory. I am just attempting to demonstrate what is happening now based on the data. And right now Ben is indeed printing money, and figuratively dropping it from helicopters. The problem is that the helicopters are hovering over Wall and Broad Streets, and not Main Street. And so we obtain asset bubbles in paper favored by the denizens of the Street.

If you want to know the theory, in a perfectly fiat system (no external standard constraint) deflation and inflation are always the outcome of policy decisions amongst a number of variables and competing interests. Period. That is how it is, and that is why central banks prefer it to the discipline of an external standard like gold.

Once the US relaxed its adherence to the gold standard and devalued the dollar, deflation became a moot point. What was not handled well was the continuing lack of organic aggregate demand, and velocity of money, because of the resistance of the Republican minority in Congress to jobs creation, and the overturning the New Deal minimum wage initiatives and labor reforms by the US Supreme Court. Consumers cannot generate healthy demand when they are unemployed, or being paid near starvation wages. But if you are in a well-to-do minority, things couldn't seem better, unless of course you were living in Germany, Italy, or perhaps even Japan.

I am not saying what the 'right thing' to do is. But what I am attempting to get across is that one way or the other, excess financial sector debt is going to be liquidated, either through default, or through inflation, or through a mixture of higher taxes and sluggish growth with a disparity of income that increasingly resembles 19th century serfdom and political instabilty, the rise of demagogues, and some vicious ghosts from the past.

At some point this dynamic is going to become less 'economic' and more political and the equilibrium will be reached. A good leading example of this is found in Iceland.

See also The Case for Deflation, Stagflation, and Implosion

For those relying on the Output Gap and slack Aggregate Demand please see Price, Demand, and Money Supply as They Relate to Inflation and Deflation

People tend to become very emotional over this sort of topic. There are many who are afraid that what they have will be taken, and there is even a vocal minority of the self-identified elite who wishes to obtain greater power and riches by leveling the middle class and the poor to improve their own supreme vistas. The funny thing is that to the genuinely powerful these 'elites' are about as significant as a bug on the wall, and their turn will come if that is the way it goes.

The most touching example of delusion that I have witnessed recently was an unwavering prediction about what will happen in the future because 'the majority of the people on the this chatboard have agreed on it.' Well, perhaps history gives a hoot. But I suspect that we are in His hands now more than ever. And you might do well to prepare yourself accordingly.

By the way, and this is just a stab at my own theory, a strawman as opposed to an examination of the data, I think the US is hammering the ECB to devalue the Euro, because they wish to further devalue the US dollar. If the major fiat currencies can be devalued in a relatively uniform manner, and some other statistics and prices controlled, the people can be subtly relieved of their savings and wealth, and be none the wiser. But those stubborn Germans had to be brought to heel first. And so it is.

Here is something from an old trading acquaintance of ours. Stage Set For Another Bernanke Adventure - Brady Willett of FallStreet