Have you wondered why the Treasury asked for a $700 Bn emergency package with the full force of the Fed behind them, and gave the Congress less than a week to deliver it?

Have you wondered why the Treasury asked for a $700 Bn emergency package with the full force of the Fed behind them, and gave the Congress less than a week to deliver it?

Either these fellows have lost their nerve or the markets are riding to a fall, and it could be terrific.

We've been looking for some event, something that would have created such an extraordinary set of actions as we have seen in the past few days.

This just might be it. Special thanks to Yves Smith for flagging it.

Time to start settling those Credit Default Swaps for Fannie and Freddie (Oct. 6), Lehman Brothers (Oct. 10) and Lehman Brothers (Oct 23).

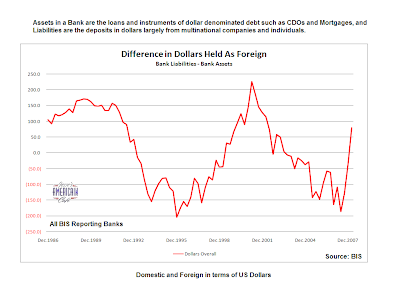

LIBOR is eight standard deviations from the norm, because the banks don't know who is holding what in their cards, but there might be some Aces and Eights in there. The TED spread is at an all time record high.

An insurance company is said to be heavily exposed.

Do you need to buy a vowel? Let's hope we get lucky.

Brace for impact.

Postscript 4 October - Given that the Congress has now passed the 'Economic Stabilization Act' and Hank and Ben have a fresh roll of walking around money, we'd like to think that a crisis can be averted on Monday. Obviously they have seen this coming and have not only a plan, the willing cooperation of the holders of the swaps, but also now sufficient taxpayer money to persuade certain institutions to accept settlements that are 'reasonable.'

Let's watch carefully how the Treasury acts this week, as best we can, for it will speak volumes. The Financial Times

The Financial Times

Settlement day approaches for derivatives

By Aline van Duyn in New York

October 1 2008 03:00

The $54,000bn credit derivatives market faces its biggest test this month as billions of dollars worth of contracts on now-defaulted derivatives on Fannie Mae, Freddie Mac, Lehman Brothers and Washington Mutual are settled.

Because of the opacity of this market, it is still not clear how many contracts have to be settled and whether payouts on the defaulted contracts, which could reach billions of dollars, are concentrated with any particular institutions.

According to dealers, insurance companies and investors such as sovereign wealth funds, which are widely believed to have written large amounts of credit protection through credit default swaps on financial institutions, could have to pay out huge amounts.

"There is a lot at stake," said an executive at one big dealer. "This is a crisis time, and if these auctions do not go well, or if the amounts investors and dealers have to pay is seen as not being fair, it could have further negative repercussions on the CDS market."

The "auction season" starts tomorrow, when the International Swaps and Derivatives Association has scheduled an auction for Tembec, a Canadian forest products company. This is followed by Fannie Mae and Freddie Mac auctions on October 6. Then, Lehman is settled on October 10, and Washington Mutual is scheduled for October 23.

Even though it is possible that some participants in the credit derivatives market will have to make large payouts, the flipside is there could also be big winners. For every loss in credit derivatives, there is a gain.

The amount of contracts outstanding that reference Fannie Mae and Freddie Mac alone is estimated to be up to $500bn. The default was triggered under the terms of derivatives contracts by the US government's seizure of the mortgage groups, even though the underlying debt is strong after the explicit government guarantee. The CDS contract settlement could result in billions of dollars of losses for insurance companies and banks that offered credit insurance in recent months. The recovery value will be set by auction. Usually, the bond that is eligible for the auction that trades at the lowest price - the so-called cheapest-to-deliver - is the one that sets the overall recovery value for the credit derivatives.

The CDS contract settlement could result in billions of dollars of losses for insurance companies and banks that offered credit insurance in recent months. The recovery value will be set by auction. Usually, the bond that is eligible for the auction that trades at the lowest price - the so-called cheapest-to-deliver - is the one that sets the overall recovery value for the credit derivatives.

In the Lehman case, numerous banks and investors have already made losses due to exposure to Lehman as a counterparty on numerous derivatives trades. The auctions next week are for credit derivatives which have Lehman as a reference entity. There are likely to be fewer contracts outstanding than for Fannie Mae and Freddie Mac because Lehman was not included in many of the benchmark credit derivatives. However, exposure remains unclear, which is one concern that regulators now have about the credit derivatives market.

Lehman's bonds have been trading between 15 and 19 cents on the dollar, meaning investors who wrote protection on a Lehman default will have to pay out between 81 and 85 cents on the dollar, a relatively high pay-out.

The previous biggest default in credit derivatives was for Delphi, the US car parts maker that went bankrupt in 2005 and which had about $25bn of CDS.