Edmund Burke "Among a people generally corrupt liberty cannot long exist."

Hedge funds acting in a predatory manner towards other funds is like a dog bites man story.

Hedge funds acting in a predatory manner towards other funds is like a dog bites man story.

However there are a few new things in this story worth pointing out.

According to this report Goldman Sachs is disclosing the most largely held positions of some hedge funds and distributing the list to others with the objective of fomenting a group effort in shorting them, artificially driving down the price, creating more forced redemptions and losses for the fund investors.

Can you imagine if some other company was doing that? With the financial stocks?

Think the elimination of the uptick rule and the widespread toleration of naked shorting is an accident?

The second point of interest is the targeting of specific sectors such as emerging markets, mining, and energy stocks.

What this will accomplish, beside the obvious short term racketeering, is to exaggerate the downward move in some prior favorites, setting up some potentially lucrative short covering rallies when the stocks reach ridiculous valuations on the forced selling and targeted shorting, after the trading banks cover their shorts and buy in for pennies on the dollar.

And don't think for a minute that Goldman and their ilk does not have a 'most shorted' list that it is circulating around to its own select group of traders to target those buys.

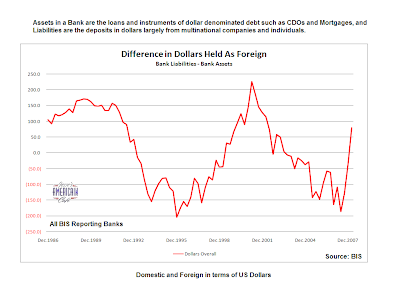

We still wonder if some of the Wall Street banks are using their privileged information to short squeeze the European banks who they loaded up with fraudulent debt and are now in dire need of short term dollar liquidity. This is a classic rip-their-face-off after you kick them maneuver.

Its like setting a fire in a crowded theatre after having charged high admission prices for a musical production that did not exist, and then having thugs at all the exits to charge even stiffer fees to leave the building.

And watch to see who benefits the most from this bailout plan and what they do with your money.

The Financial Times

Hedge funds prey on rivals

By Henny Sender in New York

October 2 2008 23:34

Hedge funds are embracing trading strategies designed to profit from the unwinding of large positions by their competitors, market participants say.

The increasingly cannibalistic activity stems from the wave of redemptions hitting hedge funds.

Because so many firms hold similar positions, forced selling by one in response to redemptions can have ripple effects, forcing other funds to sell.

More nimble hedge funds have sought to profit from the dynamic by taking short positions in securities known to be widely held by rivals. Goldman Sachs publishes a list of 50 “very important” hedge fund positions.

In its Wednesday update Goldman said: “Forced selling to cover redemptions and deleveraging . . . has put downward pressure on selected stocks.”

A favourite strategy of hedge fund managers during the bull market – mimicking the positions of others – has been turned on its head, Goldman said. “Buying the most concentrated stocks . . . has been a poor strategy during the current bear market.”

The announcement last month that Ospraie Management was winding down its flagship fund encouraged predatory activity.

One Hong Kong-based manager sent a note urging friends to short emerging and mining shares favoured by Ospraie.

Some hedge fund managers say they have been monitoring the positions held by Ospraie, if only to be ready if other funds with the same positions are forced to liquidate their holdings.

“I certainly wouldn’t want to be long any of these companies,” said one. “I want to lock up six-month borrowing on these shares and short them.”

Ospraie’s founder, Dwight Anderson, told investors on September 4 that 60 per cent of its losses in July and August stemmed from equities, mainly in energy and mining.

Its largest position was in Xto Energy, which had dropped from $73.74 in June to just under $43 and was among the 20 most widely held stocks by hedge funds, according to Goldman, Mr Anderson said.

Firms are also monitoring Deutsche Bourse because of a big position in its shares held by Atticus, which has told investors in its main hedge fund it is down 25 per cent so far this year.

Greenlight Capital, the hedge fund run by David Einhorn, told investors in a letter on Wednesday it was down 17 per cent so far this year, in part because “investors have been unwinding trades that they otherwise believe make sense”.

Greenlight said it would “try to be opportunistic” in response.