LIBOR has ceased to function as a reliable benchmark suitable for commercial and residential loans in terms of US dollars.

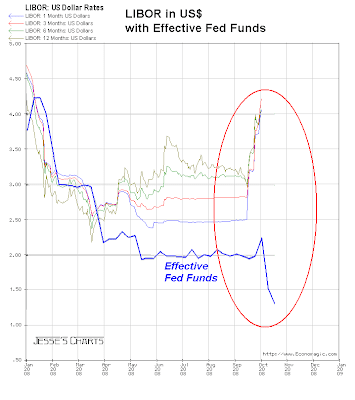

It is in backwardation with an inverted yield curve, and has significantly diverged from the Effective Fed Funds rate.

This is most likely because of the Eurodollar 'short squeeze,' as shown by the record TED spread, and the inappropriately small sample size of LIBOR reporting banks.

This is all a symptom of the greater issue of the US dollar, which is no longer suitable as the reserve currency for global central banking.

The Federal Reserve is no longer able manage the dollar to simulate the stability of an external standard, given their decision to ignore nominal money supply growth. Their current mandate instead focuses them on purely domestic economic metrics that may be inappropriate for the changing state and requirements of exogenous economic systems, unless those systems are willing to subordinate their fiscal and monetary discretion.

What is LIBOR?

The London InterBank Offered Rate, or LIBOR, is the average interest rate charged when banks in the London interbank market borrow unsecured funds from each other.

There are different LIBOR rates for numerous currencies, including U.S. dollars.

The world banking system has adopted the LIBOR as a benchmark for short-term, interbank loans.

The LIBOR rates are now internationally recognized indices used for pricing many types of consumer and corporate loans, debt instruments and debt securities across the globe, and is the reference for many loans including the vast majority of Interest-Only Loans in The United States.

LIBOR rates are fixed every UK business day by the British Bankers' Association BBA.

The Fed Funds Target Rate, America's benchmark interest rate, and the U.S. Prime Rate are managed by America's central bank: the Federal Reserve.

The LIBOR rates, however, are fixed by a relatively small group of large private international banks themselves

The Bank of America

JP Morgan Chase

Citibank, NA

Bank of Tokyo-Mitsubishi UFJ Ltd

Barclays Bank plc

Credit Suisse

Deutsche Bank AG

HBOS

HSBC

Lloyds TSB Bank plc

Rabobank

Royal Bank of Canada

The Norinchukin Bank

The Royal Bank of Scotland Group

UBS AG

West LB AG

Is LIBOR a stable benchmark of short term money rates?

There is a case to be made that LIBOR is an inappropriate reference to be used for commercial short term rates because it is subject to distortions given the relatively selective sample size of the reporting banks. One or two troubled banks can significantly impact average LIBOR.

The spreads between the highest and lowest quoted rates in an efficient measure should be narrow and convergent. Recently the spreads among the LIBOR quoting banks have become shockingly wide, reflecting the non-competitive nature of the short term interbank loans given the massive intervention by the central banks as they flood the markets with loans designed to recapitalize the banking system.

Here is the detail of the composition of the 3 Month LIBOR. One might expect this to be a scorecard of default risk amongst the reporting banks from the perspective of their peers.

How does LIBOR compare to a short term rate measure such as Effective Fed Funds?

There has been a strong correlation between the Effective Funds Rate and LIBOR dollar rate as one might expect.

However, recently there is a growing divergence between LIBOR $US rates and the Effective Fed Funds Rate. This is a symptom of distress in the banking system and shows the inappropriate character of LIBOR for use as a benchmark for the commercial and residential loans markets.

And perhaps most surprisingly, the LIBOR dollar rate curve is now inverted.

How can LIBOR be Inverted when the Effective Fed Funds Rate is steepening?

This is most likely a symptom of fear of risk of capital return in interbank lending. It may also be a sign that the current eurodollar short squeeze is expected to dissipate, as it will as the capital markets revert to the means and efficient operation.

One might also pointedly ask what the G7 will be doing to address the distortions being introduced into the European banking system by the US dollar and its shortages due to the precipitous deterioration of US dollar debt assets held by European banks, as the solution for this seems to be eluding the bureaucrats in Brussels.

As a hint, the US dollar, like LIBOR, is being used inappropriately and the basis for international trade must change to a more stable measure.