In the absence of effective regulatory oversight and objective restraint, the financial insiders rigged the market, not incidentally, but systemically and flagrantly over a long period of time.

Market manipulation is no obscure theory, not some secular transgression committed on the periphery by rogue traders, but a pervasive feature of the Anglo-American banking system that stubbornly resists reform through the accumulated power of a credibility trap.

A

credibilty trap is a situation where the regulatory, political and informational functions of a society have been thoroughly taken in by a corrupting influence and a fraud so that one cannot even begin to discuss the situation honestly without implicating, at least incidentally, a broad swath of the power structure and the status quo who at least tolerated it, if not profited directly from it.

Who will reform the reformers?

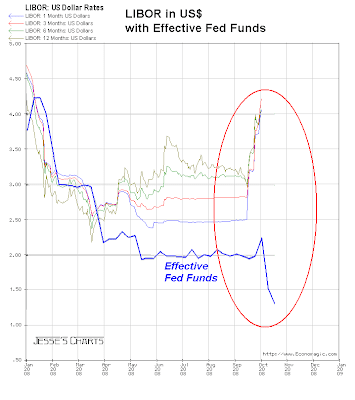

As I had hoped, the exposure of the LIBOR fixing scandal is proving to be a watershed moment, even though the common person outside the City of London hardly understands the implications of it yet. It may not gain traction without another collapse, in times such as these, but it is an irrefutable landmark.

I think in time even the true believers in unrestrained markets, and so often the haters of all government, might find their faith in the natural goodness of those modern

ubermensch, the financial corporations, to be shaken.

It was always a silly notion, that left to themselves people who are fraught with flaws and foibles and motivated by personal gain would act with perfect altruistic rationality like some sort of benign demi-gods. In prior days when educated people had learned history and philosophy and thereby some practical wisdom, as well as more marketable skills, the purveyors of such nonsense would have been laughed out of the room when proposing such an outlandish theory.

But change is hard to do. And we have several decades of the free-market follies running at a higher tide then normal now, with the utopian notion that we must knock down or cripple all the laws regulating the markets in order to be free. Free of the government, but naked and defenseless against private rapaciousness and the organized plunder of increasingly powerful supra-national corporations.

Their philosophy has been tried and found not only to be wanting, but barking mad. The problem with madness is that it is often unemcumbered by doubts and self-restraint, even as it falls into the abyss.

Martin Wolf's primary contribution to this is not some new and valuable insight, but rather the voice of a respected name, a 'serious person, who notes somewhat drily that

the emperor is naked and we need to do something about it before he attacks the women and children in his ravings.

I chafe a bit at Mr. Wolf's somewhat unambitious prescription, that banks should be encouraged to charge higher fees, so they would not be so tempted to steal from their customers and the public, to fund their extravagant lifestyles. It does often appear to be a somewhat one-sided arrangement.

Some US Banks Now Require Customers to Pay ALL Legal Fees in Disputes Regardless of Outcome.

I seem to recall a long period of time during which investment and utility banking were separate, and the incomes and lifestyles of the utility bankers were modest, more in keeping with an electric utility worker than a financial potentate.

Perhaps we should look to what went wrong with the banking and financial system, and re-learn the lessons of the past.

But do not expect this obvious thing to come easily. For as Robert F. Kennedy once observed, "About one fifth of the people are against everything, all the time." And the monied interests seem to have about one fifth of the people wrapped around their little fingers and whipped into a self-destructive hysteria these days.

But it seems as though the Allies are about to cross the Rhine, and the kings of Wall Street are huddling in their bunkers and ratholes, planning their final counterattack, moving divisions of hardened mercenaries and true believers to their defense, even as their enablers and sycophants in the Congress and the media start slipping slowly away.

This too shall pass, but not without causing further damage in the process. These are tricky and unscrupulous boys, and they have co-opted quite a bit of the system. But they have reached and surpassed their zenith, and their power begins to wane. And so now it is time to leave.

It is always the hubris, and overreach, a step too far.

"My interpretation of the Libor scandal is the obvious one: banks, as presently constituted and managed, cannot be trusted to perform any publicly important function, against the perceived interests of their staff. Today’s banks represent the incarnation of profit-seeking behaviour taken to its logical limits, in which the only question asked by senior staff is not what is their duty or their responsibility, but what can they get away with.

As my colleague John Kay, has frequently point out, such behaviour, which might seem to be the logical consequence of profit-maximisation, is incompatible with the survival of a sophisticated market economy. Without trust in the probity of those one deals with a host of potentially profitable long-term arrangements will collapse. This is particularly true in banking, Trust is not an optional extra in banking, it is, as the salience of the word “credit” to this industry implies, of the essence. ('credo, credere,' and all that - Jesse)

It is difficult to know how to restore not just the reality, but the perception, of trustworthiness, to this industry. But part of the answer must be a separation of the self-interested trading culture of today’s investment banking from the service-oriented culture of old-fashioned commercial banking. That has always seemed to me to be a strong argument for the ring-fencing of retail from investment banking that the ICB proposed...

The banking industry performs a set of vital public functions – the provision of credit and the management of money. But its culture is not that of service-oriented utilities, but rather of huge entities acting solely for their own purposes.

A full retail ring-fence, which separates the investment banking from the retail banking, (colloquially known as Glass-Steagall - Jesse) plus much higher capital requirements, would be a good start. This combination would, I believe, see the disappearance of much unnecessary trading activity. Good riddance, I would say. But the UK would also have to accept that the present charging model for retail banking – free, if in credit – is also one of the reasons for the endless series of scandals. The model is broken, in the current low-interest rate environment. Banks must be encouraged to charge open fees for service, rather than make money by covert means...

Read the rest here.