Recession in U.S. Started in December 2007, NBER Says

By Timothy R. Homan and Steve Matthews

Dec. 1 (Bloomberg) -- The U.S. economy entered a recession in December 2007, the panel that dates American business cycles said today.

The declaration was made by the National Bureau of Economic Research, a private, nonprofit group of economists based in Cambridge, Massachusetts. The last time the U.S. was in a recession was from March through November 2001, according to NBER.

We feel vindicated in our prediction of this in February of this year.

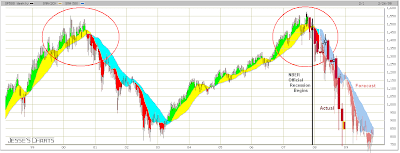

Here is the chart we used at the time to mark the top, and to forecast the coming decline.

Here is a chart with the monthly actuals added to it. The decline has progressed more quickly than anticipated.

If you start reading the blog entries in 2007, one can see how the case for recession was carefully built up based on the indicators, and the probability steadily increased from an estimate of 65% in early December.

Although fundamentals don't work in the short term, in the longer term the markets work, and the fundamentals count, probabilities pay off, and there is a reversion to the means. The trick in trading is not to be trapped by leverage, timeframes and capital risk.

Once again a special thanks to our friend Elvis_Knows for his excellent graphics.