Here are three views of the SP 500 Futures on an hourly basis.

Here are three views of the SP 500 Futures on an hourly basis.

Notice that in the 'big picture' there is still an inverse head and shoulders bottom that is an active formation.

The question is whether this downturn is a natural fallback from the obvious tape painting exercise that occurred for the end of quarter, or a trend change that will challenge the inverse bottom.

Time will tell. But since the real economy continues to deteriorate, albeit at a less shocking rate of decline, we doubt this very much unless the government begins to encourage monetary inflation with abandon.

So, our bias is to the downside but keep an open mind. We would expect a fresh decline to test the prior near term bottom at the very least, with an eye to the lows if that gives way.

One might conclude that the rally we have seen is just a 'back-kiss' to the bottom of the longer term uptrend channel which, if it fails, brings a very bearish cast to the charts indeed.

We have to add, in editorial fashion, that the Obama administration is a complete failure when it comes to putting the economy in order. This is because of the embedded thinking from Summers and Geithner and their backers at the big five money center banks.

There will be no recovery until the banks are restrained, made into banks once again, and speculation is wrung out of system to be replaced by productive efforts and the creation of real wealth.

We prefer to attribute bad results to incompetence rather than inappropriate motives, but we're keeping an open mind with regard to these jokers.

01 April 2009

SP Futures Hourly Chart Updated at Noon

31 March 2009

Derivatives: the Heart of Financial Darkness

The heart of our financial crisis is reckless speculation with "too big to fail" funds by a relatively small group of US based money center banks.

There is sufficient circumstantial evidence from their concerted lobbying efforts to undo and resist regulation to show planning and forethought in what is an almost amazingly straightforward case of fiduciary and financial fraud. Many a blind eye was turned to the decline of the nation as it occurred, as the media and politicians and financial regulators were caught up in a seductive web of corruption.

The perpetrators are still in place, relatively unrestrained, and certainly not facing anything that might be called 'justice.'

Before there is any recovery, the banks must be once again restrained and balance restored to the economy and the financial system. The efforts of the Obama Administration are hopelessly ineffective, conflicted, and supportive of continuing losses.

The Prime Suspects

The Killing Field

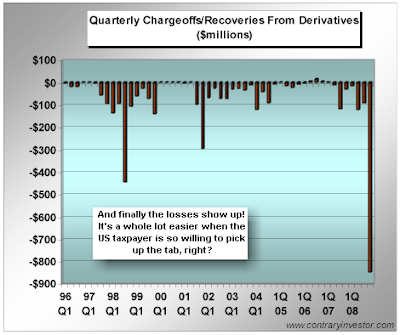

The Wagers on Failure

The Wages of Speculation

30 March 2009

How the Financial Industry Holds America Captive

You heard this here first.

"The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time."

The Quiet Coup - Simon Johnson - The Atlantic Monthly

24 March 2009

Here Come the Coupon Purchases by the Fed

The Fed made this announcement and the ETF we use to short the Treasury bond, TBT, took a nose dive.

FAQs on Fed Monetization of US Debt

Fed to start buying Treasurys on Wednesday

By Deborah Levine

2:58 p.m. EDT March 24, 2009

NEW YORK (MarketWatch) -- The Federal Reserve Bank of New York will begin making purchases Of U.S. Treasury securities on Wednesday, starting with debt maturing between 2016 and 2019.

It will continue purchases on Friday and next week, with some days dedicated to purchases of maturities as short as 2-year notes with others for debt maturing in 17 to 30 years, it said in a schedule posted on its website Tuesday.

It did not indicate how much it would buy. The Fed announced last Wednesday it would purchase up to $3000 billion in Treasurys over the next six months. Treasurys rallied, with yields on 10-year notes (UST10Y UST10Y) paring an earlier increase to traded up 1 basis point to 2.66%.