It was thoughtful of Time to give this award to Ben on the day before his confirmation hearings.

Flashback: Ben's Award Winning Performance for Wall Street Begins....

Coming Soon: Ben Burns the Big Pile of Money...

Life after the Treasury's financial debacle was hard for Tim....

"Yeah, I eat it. It's good!... Need your taxes done?"

16 December 2009

Time's Man of the Year: In Ben We Trust

15 December 2009

$38 Billion Tax Break Granted to Citigroup to Help Improve the TARP Results

Maybe it's a mistake. Did Timmy have time to run their return on TurboTax?

Maybe it's a mistake. Did Timmy have time to run their return on TurboTax?

Well, at least it will make the results of the TARP program look better on paper if it drives up Citi's stock price by inflating their financial results. That's a plus, right?

I guess raising the credit card rates to 26% and free money from Ben was not enough to push Citi over its capital objectives in time for bonus season. We'll all have to really tighten our belts for this one.

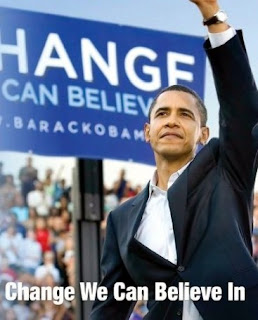

Change you can believe in.

Washington Post

Citigroup gains massive tax break in deal with IRS

By Binyamin Appelbaum

Tuesday, December 15, 2009; 8:05 PM

The federal government quietly agreed to forgo billions of dollars in potential tax payments from Citigroup as part of the deal announced this week to wean the company from the massive taxpayer bailout that helped it survive the financial crisis.

The Internal Revenue Service on Friday issued an exception to longstanding tax rules for the benefit of Citigroup and the few other companies partially owned by the government. As a result, Citigroup will be allowed to retain $38 billion in tax breaks that otherwise would decline in value when the government sells its stake to private investors.

While the Obama administration has said taxpayers likely will profit from the sale of the Citigroup shares, accounting experts said the lost tax revenue could easily outstrip those profits.

The IRS, an arm of the Treasury Department, has changed a number of rules during the financial crisis to reduce the tax burden on financial firms. The rule changed Friday also was altered last fall by the Bush administration to encourage mergers, letting Wells Fargo cut billions from its tax bill by buying the ailing bank Wachovia.

"The government is consciously forfeiting future tax revenues. It's another form of assistance, maybe not as obvious as direct assistance but certainly another form," said Robert Willens, an expert on tax accounting who runs a firm of the same name. "I've been doing taxes for almost 40 years and I've never seen anything like this where the IRS and Treasury acted unilaterally on so many fronts."

Treasury officials said the most recent change was part of a broader decision initially made last year to shelter companies that accepted federal aid under the Troubled Assets Relief Program from the normal consequences of such an investment. Officials also said that the ruling benefited taxpayers because it made shares in Citigroup more valuable and asserted that without the ruling, Citigroup could not have repaid the government at this time. (Thank God. Just in time for prime bonus season - Jesse) "This guidance is the part of the administration's orderly exit from TARP," said Treasury spokeswoman Nayyera Haq. "The guidance prevents the devaluing of common stock Treasury holds in TARP recipients. As a result, Treasury can receive a higher price for this stock, which will benefit the financial system and taxpayers." (George Orwell would have fun with this one. Let's give them a lot more money, so that when they give some back it will make our government program look better - Jesse)

"This guidance is the part of the administration's orderly exit from TARP," said Treasury spokeswoman Nayyera Haq. "The guidance prevents the devaluing of common stock Treasury holds in TARP recipients. As a result, Treasury can receive a higher price for this stock, which will benefit the financial system and taxpayers." (George Orwell would have fun with this one. Let's give them a lot more money, so that when they give some back it will make our government program look better - Jesse)

Congress, concerned that the Treasury was rewriting tax laws, passed legislation earlier this year reversing the ruling that benefited Wells Fargo and restricting the ability of the IRS to make further changes. A Democratic aide to the Senate Finance Committee, which oversees federal tax policy, said the Obama administration had the legal authority to issue the new exception, but Republican aides to the committee said they were reviewing the issue.

A senior Republican staffer also questioned the government's rationale. "You're manipulating tax rules so that the market value of the stock is higher than it would be under current law," said the aide, speaking on condition of anonymity. "It inflates the returns that they're showing from TARP and that looks good for them." (And a nice accomplishment for Timmy's year end performance review - Jesse)

Read the rest here.

Comex Acts to Curb Speculation (in Gold)

Did J. P. Morgan send up a flare as their short positions were taking on water and listing?

"As a heads up, Gold often gets hit with a bear raid on FOMC day. Since the

miners were hit a bit today with possible front-running that might be a good

bet. Who can say in these thin markets?"

Is the US Financial Crisis Over? 1:49 PM

And After the Bell...

"The COMEX gold margin requirement is going up overnight. New levels are $5403 initial per contract (the old one was $4500), and $4002 maintenance."Change you can believe in. Vox pecuniae and all that. LOL Why raise the margin requirments now after a ten percent correction?

The bullion banks (the bears) are edgy because the buying has been particularly robust in the physical metal at this price level, especially the further one gets from New York. Open interest in the futures has been remarkably resilient, showing very little long liquidation. A failure of the commercials is never a pretty sight.

Let's see if the Wall Street Banks can hold their ground and keep shorting into the demand from overseas.

US Dollar Daily Chart And a Brief Comment on Estimated M3 and the Velocity of Money

If the dollar is going to manage a breakout from this counter-trend bounce, this is about the point where it should show some strength.

Perhaps the FOMC tomorrow will provide the impetus.

If it cannot move higher from here, the trend line may provide some support, but at a much lower level from here.

There is some excitement on chat sites from the dollar bulls with regard to the downtrending estimates of M3, as presented by our friend Bart at nowandfutures.com.

M3, as you may recall, is no longer tracked by the Fed, having discontinued its publication on 23 March 2006. But both Bart and John Williams estimate it from the available data on two key components, and extrapolations from prior relationship for the key missing variable which is Eurodollars.

We prefer to watch MZM as we have noted, and that chart is also showing a decline, but perhaps not as dramatic as the estimated M3.

There is a problem in estimated Eurodollars these days, and since that was the key driver behind the recent short squeeze as documented here many times, we tend to discount the reliability of the M3 estimates. We have discussed this with Bart, who realizes that he is estimating his best. We could do no better, and his work is above reproach, but based unfortunately on Federal Reserve opacity.

His site is a regular source of information, and his work is excellent. John Williams does great work as well on his shadowstats.com site. We just think that there M3 estimates are becoming less reliable with time.

We also have to caution the dollar watchers that the nominal levels of money supply are only one half of the function of value. Demand is the other half of that function, and with the US economy flat on its back, one would expect the nominal money supply figures to be declining. The velocity of money is cratering, and the liquidity that is in the system is flowing into an echo equity bubble, and not into productive economic activity. The result is a growing Federal budget deficit.

Speaking of the velocity of money, Dave Rosenberg notes today the correlation between the velocity of money, nominal GDP / M1, and the SP 500. We don't like to reference M1 since the Fed changed the overnight sweeps policy, gutting M1 in the process, but Dave's point is well taken. GDP and stocks should be correlated, and velocity of money is an indicator of monetization gaining traction in the productive economy.

Here are some other widely followed measures of the Velocity of Money Supply.

In closing, here are a few astute observation on the Federal Reserve Note from an interview by Ron Paul on CNBC. It would have been interesting if he had been elected President rather than the Great Reformer, although it is charitable at best to call that a 'long shot.' Maybe next time if America turns from the established two party system. It would be a change to see more third party and independent members of Congress.