Gold often functions as a safe haven because it is a remarkably universal currency, both temporally and geographically, that is not subject to the liabilities of other parties or even national balance sheets, except potentially to the upside because of fractional reserve holdings and leveraged selling. The most significant downside to gold is the animosity that is felt by those that perceive it as a threat to the status quo, in this case the US dollar as the global reserve currency.

Silver is less constructive because it acts as both an industrial metal and a currency but with a high beta. Longer term is has significant potential, but in a crisis it will not perform as well as gold.

A reader informs us that 'investment gold' is exempt from the 15 to 20% VAT in Europe, whereas silver is not. This represents the thinking in Europe that gold is money, an alternative form of money or currency. So therefore as the Europeans seek safe havens in the event of a euro decline or devaluation, they are flocking primarily into gold and dollars, for which there is no VAT, and secondarily into other investments like silver, diamonds, etc.

The miners are a stockpicker's vehicle even in good times, but especially so in a bear market, since they are correlated to the SP 500 as well as the metal, often with significant leverage correlated to their cash flow and financing requirements.

04 June 2010

Gold Daily Chart Bounces Back on a Flight to Safety

SP Daily Chart: Looking Ugly as Baghdad Barrack Declares Economic Victory

The administration had nothing constructive to say this morning except for mindless sloganeering by the likes of Christina Romer, Obama's chief on the Council of Economic Advisor, who is unlikely to inspire confidence when delivering even good news, much less a clear sign of economic policy errors and a double dip in the making.

With Romer, Summers, and Geithner, the President has managed to put together the economic scream team. Even Volcker is starting to look tired and ineffective. His recent proposal of a VAT, the most regressive of taxes, sounded less like a democratic reform and more like something from the Bilderberg playbook. One has to wonder how long will it be until they start recommending the sale of key sovereign assets to corporate oligarchs.

And then there was Baghdad Barrack, talking up the economy and the jobs numbers this morning at a Maryland truck garage. He seems to be trying to run a bluff, talking his way past his team's economic policy errors and corruption, a reflexive strategy that may have served him better when he had no real responsibilities or quantifiable results.

One might feel better if the other party had not already proven itself to be the party of the elite and the wealthy special interests, without vision or ability, creating many of the problems that are sinking the US today. Things do indeed seem bleak when the reform government fails.

It appears that the SP futures may be forming a bear flag, with another big step down to follow. That would be 'bad news' because below the support at 1040 is a disturbing possibility of a triple digit SP 500.

Chart Updated at 3:30 EDT

03 June 2010

Gold Daily Chart: A Typical Fibonacci Retracement Pattern So Far

The key support levels in the pullback from the handle resistance are 1205, 1198, and 1190. These are the three key fibonacci retracement levels, although it would not be completely unusual to see a pullback to 1166. I don't think it will happen, but the market will have the final say and we must listen.

This has the look of a bear raid by the funds and banks. They were hitting the mining stocks hard first, and then the metals. The planting of negative articles and comments by funds with friendly authors was also apparent, to the point at times of silliness.

And there are plenty of investors who have missed the rally, or with a certain ideological bias, who want to see prices fall. Misery loves company. The irony is that most will never bring themselves to buy back in, because they are always looking for THE bottom, and a lower price. They will more likely buy closer in the second leg higher, when fear overcomes their greed.

This is how bull markets operate, and the reasoning behind chart formations. Charts attempt to capture typical market behaviour, and nothing more than this. They influence some trading if enough people follow them, but by and large they cannot change the primary trend. And so far this looks like a typical bull market climbing a wall of worry. Let's see if anything changes.

The 1206.80 price on the chart is as of 2:45 PM EDT.

Here is a chart comparing the Gold Bull Market compared to the famous Dow Jones Industrial Bull Market, courtesy of Mark J. Lundeen who posted it at LeMetropoleCafe.

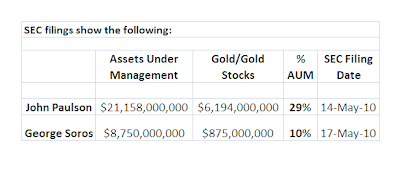

And finally, h/t to Tarlton Long, here is an example of some of the 'rubes' who are holding gold in their portfolio and its percentage of their Assets Under Management.

And finally Harvey Organ's June 2 Gold and Silver Commentary is worth reading.

02 June 2010

Obama Gives Us a Hint: Look for a Hot Jobs Number on Friday - Mission Accomplished

Since he is the commander-in-chief of the Washington bureaucracy that churns out government statistics, it is a good bet that the boss' expectations will be met by those who serve him. So watch those short positions into this Friday's Non-Farm Payrolls report. The President has declared that an economic recovery is at hand.

Since he is the commander-in-chief of the Washington bureaucracy that churns out government statistics, it is a good bet that the boss' expectations will be met by those who serve him. So watch those short positions into this Friday's Non-Farm Payrolls report. The President has declared that an economic recovery is at hand.

Obama gave a longish speech at Carnegie Mellon University in Pittsburgh today blaming most of the problems in the US on the Republicans and a few greedy Banks, extolling the reforms in healthcare and the financial system that he has been able to push through despite the minority opposition, and recalcitrant leftish supporters, after he saved the country by the unfortunate but unavoidably necessary bank bailouts.

His speech sounded good. And if you do not look too closely at what is going on, and how things are being run, and the lack of actual reform, you might have had a feel good moment. It was about as effectively staged as the case that George W made to the American people for the invasion of Iraq. And it was probably just as phony and self-serving.

I come away feeling that Lincoln had it exactly right. There will be a die hard group who will never lose faith in their party, or any of their chosen leaders, and will find desperate comfort in partisan blindness.

"If you once forfeit the confidence of your fellow citizens, you can never regain their respect and esteem. It is true that you may fool all of the people some of the time; you can even fool some of the people all of the time; but you can't fool all of the people all of the time." Abraham LincolnBut the great majority of the American people are waking up, and that spells trouble in the November elections for most incumbent politicians. So the pace and velocity of the spin will have to be adjusted. Hence the speech today. And the outlook for the tortured American economic system, and the official descriptions of it.

For a refresher, here is Matt Taibbi's caustic expose of the financial reform process. Wall Street's War

Dow Jones Newswire

Obama Says He Expects Strong US Jobs Report Friday

By Jared A. Favole

WASHINGTON -(Dow Jones)- President Barack Obama, speaking Wednesday at Carnegie Mellon University on the economy, said he expects strong job growth to be reported Friday.

The Labor Department is scheduled to report May's employment statistics Friday. Economists expect the unemployment rate to slide to 9.7% from 9.9% in April and for the report to show the U.S. added as many as 515,000 jobs last month after non farm payrolls rose by 290,000 in April.

Obama said an economy that was "once shrinking at an alarming rate" has now grown for three consecutive quarters and is moving in the right direction.

I watched this speech live on Bloomberg television. It is no exaggeration. Obama was declaring mission accomplished, for the record. So if something beyond his control should happen to derail the recovery, well, that could not be his fault.