skip to main |

skip to sidebar

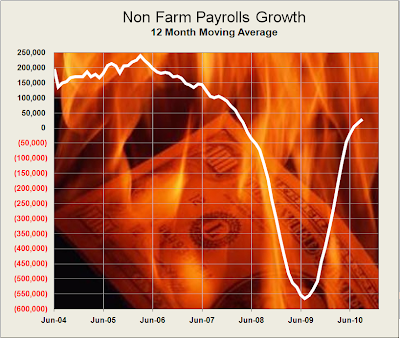

The September Non-Farm Payrolls report was not good news.

This is a remarkably unnatural US economic recovery, with gold, silver, and other key commodities soaring in price, the near end of the Treasury curve hitting record low interest rates, and stocks steadily rallying as employment slumps and the median wage continues to decline.

The US is a Potemkin Village economy with the appearance of prosperity hiding the rot of fraud, oligarchy, and political corruption.

As monetary power and wealth is increasingly concentrated in fewer hands, the robust organic nature of the economy and the middle class continues to deteriorate.

This is what is happening, and monetary policy cannot affect it. The change must come from the source, which is in political and financial reform. And the powerful status quo is dead set against it.

The long term trend of employment has not yet turned lower which would make the second dip 'official' from our point of view. But the prognosis does not look good.

What could a TBTF bank possibly do to deserve an official reprimand from their friends at the Fed? Bank Secrecy Act and Anti-Money Laundering (BSA/AML) related it appears, protecting flows of secrets and cash.

I hope it is not related to HSBC's position as the primary custodian for GLD and helping to 'start of the gold rush' back in 2009 by kicking out all the small fry to make room for more unemcumbered and leaseable London-ready bullion.

"WHEREAS, the Federal Reserve Bank of Chicago (the “Reserve Bank”) reviewed and

assessed the effectiveness of HNAH’s corporate governance and compliance risk management

practices, policies, and internal controls, and identified deficiencies..."

Press Release

Federal Reserve

Release Date: October 7, 2010

The Federal Reserve Board on Thursday announced the issuance of a consent Cease and Desist Order between HSBC North America Holdings, Inc. (HNAH), New York, New York, a registered bank holding company, and the Federal Reserve Board. The order requires HNAH to take corrective action to improve its firmwide compliance risk-management program, including its anti-money laundering compliance risk management.

Concurrent with the Federal Reserve Board's enforcement action, the Office of the Comptroller of the Currency announced Thursday the issuance of a Cease and Desist Order against HSBC Bank USA, N.A., McLean, Virginia, for violating the Bank Secrecy Act and its underlying regulations.

A copy of the Board's order is attached.

Attachment (pdf)

There is not a lot of doubt in my mind that this action in the US stock indices is indicative of bubble liquidity, but unfortunately underpinned by weak, cynical hands and thin volumes, and unrelated to economic fundamentals. Some of this is the effect of the upcoming November elections.

You will know the economy is improving when the median wage and employment start increasing. There is no evidence of this yet. Jobs creation remains below the level of population growth.

The Fed created a monetary bubble in 2004-07 which resulted in a bull market in stocks, and spawned a massive housing bubble and bank fraud overhang, the latter of which remains unremediated and a serious impediment to genuine economic growth.

Any serious exogenous event can now lead to a significant correction without direct Fed intervention of a scale much greater than their current POMO activity. Fraud and insider dealing is pervasive, and the Congress is largely under the influence of the banks and corporations because of the existing process of campaign financing.

Gold corrected back to trend as we noted it might the other day, and said we were taking profits in gold and silver on the short term trades only.

This consolidation was predictable given the extension above trend. Long ago we said we expected gold to move to 1375 and consolidate after the breakout from the handle in the cup formation. This is of a common pattern. We may have already seen this consolidation off the spike up.

Gold will remain in a bull market until the fundamentals change in the real economy with regard to honest stores of value. If you do not understand this by now you may not do so until it is too obvious to do anything about it.