skip to main |

skip to sidebar

The mechanics of what is happening with money now is fascinating, and seems to be clarifying in my mind. It is hard to imagine a more inherently ineffective system of capital and resource allocation than crony capitalism. It is a game which is rigged to deliver the money in the system to a minority of insiders, thereby bankrupting all the customers.

It is said that in a purely competitive capitalist system, all businesses are vectored to zero profit in a process of creative destruction. As a certain class of participants clearly recognizes this they take every opportunity to corrupt and game the system through fraud. This is why markets must have regulators. At times the fraud overcomes the regulation to such a degree that the normal market balances are rendered ineffective and the system passes to a crony capitalist system, if not an outright oligarchy.

In a crony capitalist system a similar outcome can be achieved, but with the insiders and powerful interests holding most of the money which ultimately becomes worthless because the foundation of the money, the labor of the people, is destroyed.

In other words, greed compels the materially obsessed to obtain the greatest piles of chips, but in the long term renders their chips to be worthless because they are unable to stop their fraud and plundering even when it is in their best interests. They are not governed by rationality or conscience or even common sense. For periods of time oligarchies are able to survive in an uneasy equilibrium enforced by power, but ultimately these wicked wither and die on their great piles of gains.

I now give more weight to the potential for hyperinflation, and will be exploring this topic during 2011. The Congress and the Fed are reckless to the point of self-destruction.

The pattern in the gold market has greatly clarified. It is now following a more gradual path higher as the banks of the world resist its upward trajectory, and the many still do not recognize the inherent value of bullion in the face of currency devaluation.

The gradual rise will take gold much higher over time than a parabolic spike higher would, although it demands more patience as things unfold.

At some point it will regain a more aggressive track higher, and then likely consolidate and resume a more gradual rise for a time.

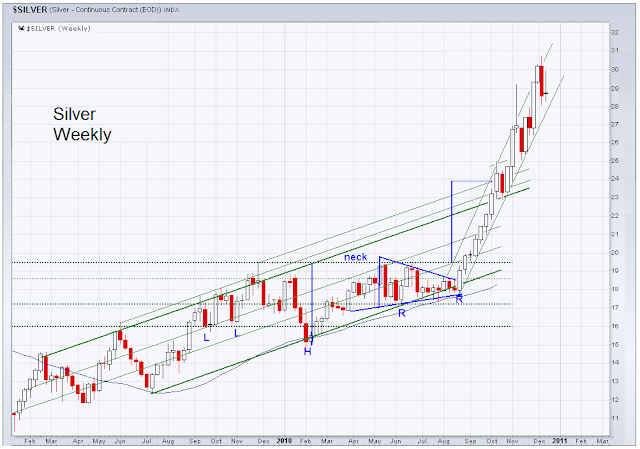

Silver is on an aggressive but sustainable rally path. The many years of suppression and the leverage in this market may call out a path and price much higher on a percentage basis than gold.

I like to buy both, but given a choice I would tend now to overweight silver for trading, and gold for the long term investment and wealth protection.

The 50 Day Moving Average once again provided support for a dip in bullion. I tended to view the bear raid today as tied to option expiration in equities moreso than in the bullion itself. Mining stocks have been hot, and the call buying may have gotten ahead of itself, setting up an incentive for players to hit the metals and take down the industry associated stocks.

Although the CFTC has enabled a position disclosure trigger at 10% at which the regulators can ask a market participant to show their net swaps, the actual position limits discussion was tabled today for a future meeting.

CFTC delays tough commodity speculation crack-down

Tomorrow is December options expiration for equities and the funds are also painting the tape to make their bonuses round up nicely into the year end.

Let's see how the markets go as they hit all our targets in the currently active chart formations. Wait for it, because Benny is in there pumping and it may take a stumble to turn this trend around, which for now is up.