skip to main |

skip to sidebar

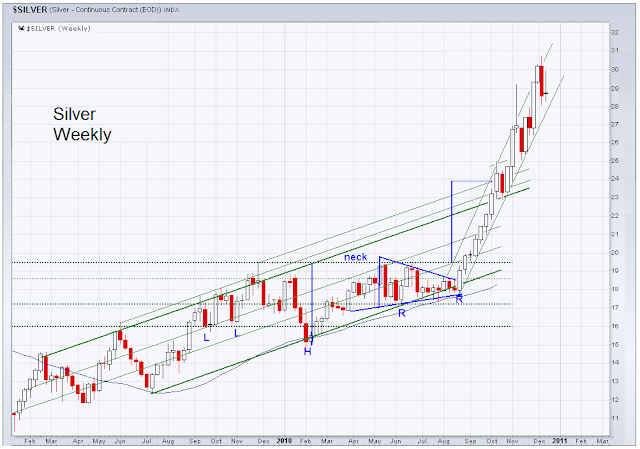

The 50 Day Moving Average once again provided support for a dip in bullion. I tended to view the bear raid today as tied to option expiration in equities moreso than in the bullion itself. Mining stocks have been hot, and the call buying may have gotten ahead of itself, setting up an incentive for players to hit the metals and take down the industry associated stocks.

Although the CFTC has enabled a position disclosure trigger at 10% at which the regulators can ask a market participant to show their net swaps, the actual position limits discussion was tabled today for a future meeting.

CFTC delays tough commodity speculation crack-down

Tomorrow is December options expiration for equities and the funds are also painting the tape to make their bonuses round up nicely into the year end.

Let's see how the markets go as they hit all our targets in the currently active chart formations. Wait for it, because Benny is in there pumping and it may take a stumble to turn this trend around, which for now is up.

"Currency values and precious metals prices can be volatile, but the long-term weakness in the U.S. dollar and relative purchasing-power-preservation attributes of gold and silver, and the stronger currencies outside the dollar, remain in place. As with systemic risks in the United States, risks in other areas of the world — such as among the countries using the euro — likely will be addressed by the spending or creation of whatever money is needed (indications of any needed U.S. backing are in place) in order to prevent systemic failure.

Keep in mind that the U.S. remains the proverbial elephant in the bathtub in terms of pending effective sovereign bankruptcies. The various European crises remain an intermittent foil for the U.S. dollar, pulling market attention away from the unfolding solvency crisis in the United States and a likely move to massive selling against the U.S. currency.

Accordingly, high risk of the early stages of a hyperinflation beginning to unfold by mid-2011 continues. Rising inflation should become increasingly broad, reflecting an increasingly serious problem in the first-half of 2011.”

John Williams: Massive Selling of US Currency Ahead - KWN