skip to main |

skip to sidebar

"You must unlearn what you have learned." Yoda

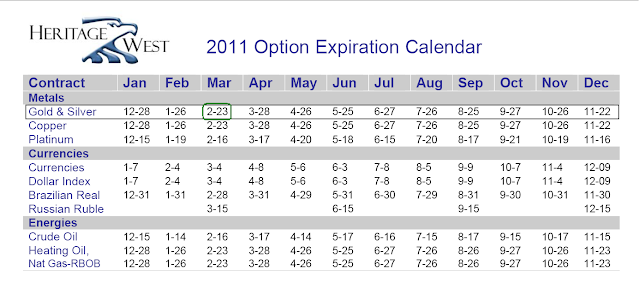

Did we mention that this is an option expiration week at the Comex? Tomorrow is the day.

Silver was reaching for a definite high note while Uncle Thug was on vacation yesterday. And the sell off in equities helped to shake it back down on profit taking to the strong hands. So far normal market action.

If you do not care for volatility you will not like silver. It is tough to sit it out, because if there is a break in the commercial positions known as a 'commercial signal failure' the price could easily go up several dollars per day.

In this case given the insiders who are short, and the semi-official backing which I suspect they have, I doubt they will fail all at once, but in stages and over time, and so the price will continue to creep higher until the market clears.

"To anticipate the market is to gamble. To be patient and react only when the market gives the signal is to speculate."

Jesse Livermore

Well I have to confess to a little more than speculation perhaps, as I read a signal from this market that it had reached bubble territory, and that the 'rally' into option expiration last week was hollow, and went heavily short US stocks into the close on Friday.

Flat now, and waiting for the market to tell us which way next. The support is fairly obvious. I will be looking at the short term indicators later on. So far we do not have a general 'sell' signal on more than the short term.

As a caution, not all option expirations are created equal, in terms of the shenanigans and market moves that they precipitate.

The breakout in gold and silver came off an option expiration.