skip to main |

skip to sidebar

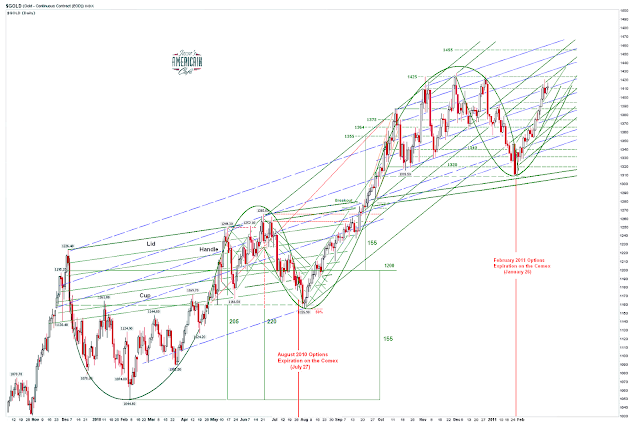

Tumble on the markets today as oil and the metals surged higher with the troubles in the Middle East spreading towards Saudi Arabia.

The market is looking to the ADP employment report tomorrow morning, as an forward indication of the Non Farm Payrolls report on Friday. It has a mixed record.

Weak market, but it held key support for now.

Lots of hand-wringing and wonderment amongst the financial demimonde today as a former McKinsey and Goldman Director with a Harvard MBA Rajat Gupta was charged with the widening insider trading case, for disclosing the Buffett investment in Goldman a minute after it was disclosed to the board, among other things. I smell a hand slap on this one, but the scapegoat pedigrees are getting a little tonier, but still not part of the real in-crowd.

Let's see if the SP futures can hold the important support around 1295. Below that support is indicated on the chart. If stocks fall below the Pivot things could get dicey.

Antics intraday with a funny kind of a bear raid in silver that also hit a couple of the mining stocks exceptionally hard. I actually stepped in and bought some mining positions from my watch list because the prices became almost silly, and the volume indicated selling motivated not for profit but for a lower price. I can surmise that some of the new regulations intended to constrain naked short selling of non-SHO stocks are making some of the fundies 'edgy.'

Trapped shorts are often creative in their desperation. And of course the TBTF giants have huge daily needs, and in these thin markets it becomes harder and harder to make the standard plays pay. Just look at what the easy spreads drying up led Bernie Madoff to do.

This is the first delivery week for silver and the Comex shorts are squirming.

Stand and deliver, or as the famous bear Daniel Drew once said:

He who sells what isn't his'n,

Must buy it back, or go to prison.

Unless of course you have blind regulators, ETFs, and an exchange always willing to facilitate cash settlements for their friends.

Still, all in all, the noose appears to be tightening.

Thin market, light volumes, hollow rally, liquidity driven.

It is quite important to remember that the market's price is set at the margins, and the distribution of the marginal price is not uniform.

What more can I say?