skip to main |

skip to sidebar

Updates to this report are available here.

"Updated on March 21, 2011 21:20 (JST)(Japan Standard Time) nGy/h (nano- Grays per hour)Realtime radiation data collected via the System for Prediction of Environment Emergency Dose Information(SPEEDI) These Results are the maximum values of the space those rate distributions shown from local governments in the latest updated date and time.

Not surprisingly, Miyagi , Fukushima and Ishikawa are completely N/A, as every single reading is Under Survey, may be unavailable sensors because of Tsunami (or maybe censored?)."

Background radiation comes from many sources, including medical x-rays, radon and cosmic rays as the usual suspects. Radon is a decay product of the uranium series, and decays by emitting an alpha particle. The direct parent of Radon is Radium, which emits gamma and alpha particles. Radon gas has different levels of concentration in buildings and can vary considerably.

In the cases from around the world, in normal areas, the dose rates were less than 100 nano Grays per hour (0.01 milli rem).

Those in Japan who can take reliable radiation readings and report them to a central independent source can do so here.

They are struggling to take the equity markets higher, but the short term downtrend is still intact.

There was an air of disassociation with reality in the markets today in honor of options expiration.

The Fed announced the results of their stress tests, and began to allow the banks to increase their dividends and buy back their stocks. This is a windfall for wealthy shareholders and corporate insiders, supplied by the Fed using what are essentially public funds, as subsidies to the monied interests.

But it does not help to revitalize the real economy, even while it continue to debase the currency. This is the root cause of a future inflationary episode that will rock the status quo to its foundations.

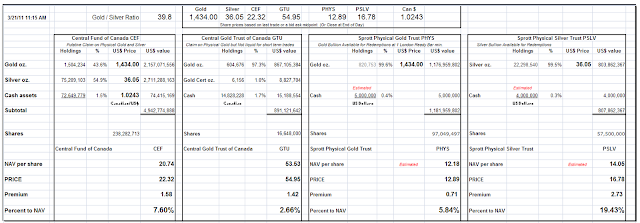

Gold and silver rallied back with the G7 intervention in the currency markets on behalf of the Japanese yen.

I think the rationale that this was in support of Japanese exporters is more rationale than fact. The exporters' biggest problem is that their supply chains and manufacturing are disrupted.

Rather, the intervention at this time was most likely in response to what the central bankers euphemistically call 'disorderly markets.' The intervention and its timing had everything to do with the yen carry trade, and the pressures that the extraordinarily strong yen was placing on global financial institutions, especially in their hedges and spreads. There was also some concern that the dollar was falling too far, too fast.

I am rethinking my estimates of a hyperinflation. There is also and increase in the forecast of inflation that will accompany the stagflation to which I am more positively inclined in the intermediate to long term forecast.

I consider a real deflation very unlikely, only as a policy decision. The risk as I see it is an inept slide into a deeper inflation than the central bankers intend.

As such I am now even more inclined to protect my own assets in hard currency and precious metals.