On Tuesday I wrote:

"Since option expiry is on Monday the 28th, I would expect Blythe to throw some cards on the table and at least take a run at this rally. If it comes it will be in thin trading and likely into the weekend."

Yesterday in an intraday commentary I said:

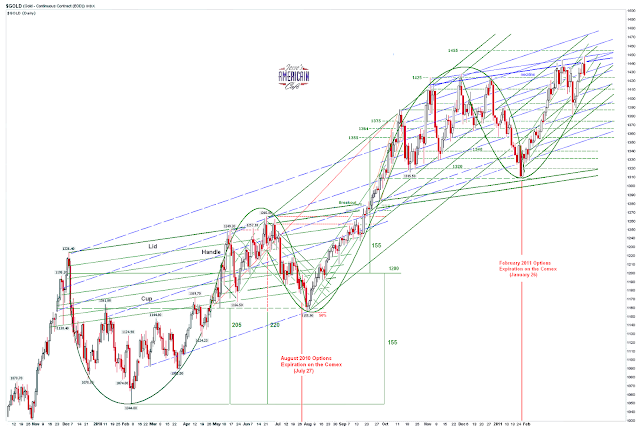

"Gold is right up against the big inverse head and shoulders neckline around 1440. I am struggling to see a breakout here, but it is possible. The last big neckline breakout took place around a failed option expiration gambit... I take profits, holding bullion but trading paper, and retire to the kitchen for the evening trade."

So gold and silver ran higher today, and then suffered a savage bear raid in the late trade in New York, before Asia wakens, and while the European are eating their dinners. The CME announced they would be raising margin requirements again on Friday.

Let's see if Blythe can follow through with this tomorrow. I was a little surprised that they made their move today, especially with the news from Portugal, and especially so blatant an intervention. But the financial and political communities in the US are riding high, in the euphoria that comes with self-serving schemes going well, just before their downfall.

"I have no spur

To prick the sides of my intent, but only

Vaulting ambition, which o'erleaps itself,

And falls on th'other. . . ."

Macbeth Act 1, scene 7. 25–28

It seems to be this way, doesn't it, this pride just before a fall? One has to wonder if it is merely bravado, or if supposedly educated people can be that willfully arrogant and ignorant of the consequences of their actions. And then faced with failure, pride takes the next step, madness is unleashed, and tragedy begins.

"We can never be gods, after all. But we can become something less than human with frightening ease."

N.K. Jemisin

I did come back into the market near the end of the US trading day, buying gold and silver and shorting broad equities in a paired trade, but lightly for now. I want to see what Blythe has left for Act II of this opera buffa.

Blythe Calls Forth Hell's Fire and Vengance on the Silver Bulls

Der Hölle Rache kocht in meinem Herzen,

Tod und Verzweiflung flammet um mich her!

fühlt nicht durch dich Sarastro Todesschmerzen,

so bist du meine Tochter nimmermehr.

Verstoßen sei auf ewig,

verlassen sei auf ewig,

zertrümmert sei'n auf ewig

alle Bande der Natur

wenn nicht durch dich Sarastro wird erblassen!

Hört, Rachegötter, hört der Mutter Schwur!

W.A. Mozart, Die Zauberflöte