skip to main |

skip to sidebar

Obama speaks tomorrow, and the Swiss are joining the fiat flight to the bottom of the barrel, as each nation tries to beggar their neighbor and join the mercantilist daisy chain.

So the financiers had to hit gold to take it out of the spotlight. We may see more bear raids in the paper trade, supported by physical buying as Asia and the developing world recapitalizes their banks with precious metals, shedding the dollar reserve currency, which is a holdover from the declining order of international finance.

The most blatant raids were put on gold last night with orchestrated selling hitting it in the off hours, including a two percent drop in minutes as massive paper selling hit the bids.

"Spot gold dropped nearly $40, two minutes after U.S. gold tumbled about $50 over three minutes. Cash gold prices since regained some lost ground to $1,836.26 an ounce by 0559 GMT, down 1.5 percent. U.S. gold GCcv1 dived to as low as $1,818.2, and was trading at $1,839.10, down 1.8 percent from the previous close. "Someone dumped a big position with little care, which set off stops and caused the price to cascade even lower," said a Singapore-based trader. Some traders talked about some 4,000 lots of gold being dumped on COMEX…"

Reuters

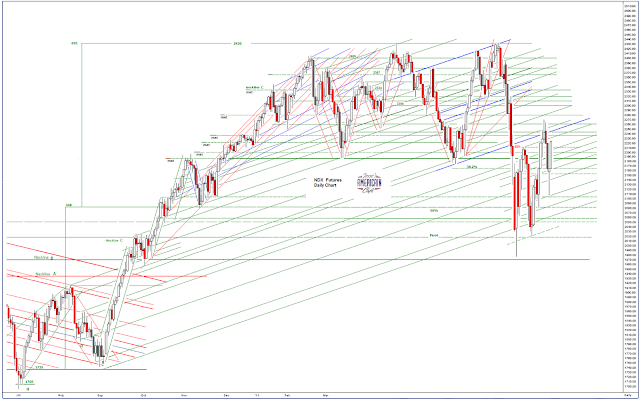

And yet the price found resilient support in the 1820 area where we expected it, despite the overshoot on the big decline into the 1790s.

I bought back some of my gold position today as the price overshot support and dropped below 1800. We have a confirmation of a familiar support level around today's lows.

They try to make these things look complex, and frightening, but they are really not.

The debts will be discharged by growth or by default, or some combination thereof. The defaults will be done largely by printing money.

Growth is a dirty word in the west, because the fortunate and powerful are in control and wish to impose their brand of neo-feudalism, similar to that which is already in place in China and Russia with their own brands of authoritarian oligarchy, masquerading as capitalist markets.

And so we will see printing around the world, by the debtors and the exporters. Where this will all end who can say with certainty. But it will end, and badly.

Big rally today and a relaxation of the fear trade.

Republican candidates debate tonight.

Obama, more right of center than the raving socialist than the spinsters paint him, should join them as a placeholder for the Nelson Rockefeller wing of that party.

Ron Paul will stick out like a sore thumb. He is third party material, although his libertarianism suits the rapacious. Still, he is not in favor of supporting the Wall Street Welfare Queens and the Military Industrial Complex in the manner to which they have become accustomed, so he will be marginalized by the GOP.

Better accept your corporate masters, or the socialists will take your money and give it to the weak, the immigrant, the unworthy. Such simplistic arguments rarely fail to sway the unthinking and the fearful.

The plight of US corporations, which are enjoying the lowest effective tax rates and fattest profits in years, and who are still digesting the gains of fraud from deregulation and pocket politicians, will be trotted out en masse like a Memorial Day Telethon for Pig-itis.

Cut corporate taxes, deregulate, free the market from the burdens of government, and the riches will trickle down to the middle class. That is what we will hear, with little to the contrary.

One would think that CEOs are standing in breadlines, the banksters are going to Coney Island instead of frolicking in the Hamptons, and their wives are driving Fords instead of Ferraris.

Where is the Justice? Where is the Reform?

Please bear in mind that the DX dollar index will become increasingly irrelevant because of its outdated structure, heavily weighted to the euro yen and the pound, to the exclusion of the emerging currencies and the precious metals.

The shorter term chart has been rallying largely on euro weakness. We might see another eurodollar short squeeze if things continue to deteriorate in the European banking system.

A stronger dollar is something that the wealthy and the financial sector may enjoy, to the detriment of the rest of the country and any hopes of economic recovery. However the realities of things make a stronger dollar problematic.

So the next best thing is to slowly devalue the dollar by printing money and selectively distributing it, with tax benefits, to the most powerful and fortunate members of society.

In a 'free market' for currencies the dollar would have been much lower by now because of the persistent trade deficit, and the enormous dollar balances held by some of her trading partners.

The financial engineers favor a slow decline so as not to disclocate any of the major banking concerns. The currency discussions between China and the US are political theater for their respective peoples and the currency tourists, i.e. the small speculators who provide a snack for the wolves.

As a reminder, the choice between inflation and deflation in a fiat currency system that is not otherwise externally constrained is a policy decision.

In a democratic republic that is also a net debtor with a trade balance problem, the most likely outcome from a financial credit contraction is stagflation.

However, this does not mean that deflation is not possible. I want to be completely clear on this point. A program of artificial austerity, in which painful cuts are visited upon the bulk of the people, further exacerbating slack aggregate demand, with the creation of national wealth flowing to the top few percent, makes a prolonged deflation, economic stagnation, and a national misery, possible.

This is characteristic of many third world countries, wherein the majority live in povery while the few monopolize the nation's wealth and income. The government would have to become a more overtly repressive authoritarian oligarchy to support this for any length of time.