skip to main |

skip to sidebar

Bounce today on a flight to safety, a concept that is still valid except during option expiration periods and panic liquidations perhaps.

There is a growing difference between the physical market and the paper markets. At some point they will converge.

"So the Western central banks got together, leased out some gold and the bullion banks sold the gold. The central bank gold being unloaded by the bullion banks is not to get the best price, but to smash the price. The smartest way to sell the gold would be to do it in the liquid sessions. But the pattern during the decline was they were selling it in the overnight session when things are quiet. This was no different that what we saw at the end of April, beginning of May on that coordinated smash.

You have to ask the question, why would anyone sell at the most illiquid times? It is not to get the best price, it is to move the market in the direction you want to move it...

The Asians have been buying like crazy, all through this takedown they have been buying. We have seen massive premiums and bottlenecks in supply, they simply cannot get enough physical metal as the prices have dropped. The demand has literally been insatiable. As I have stated before, the central bank gold, which was used to sell the market down, has gone to vaults in Asia. That’s a one way trip, it doesn’t come back into the market..."

'London Trader' at KWN, Insatiable Demand for Physical Gold

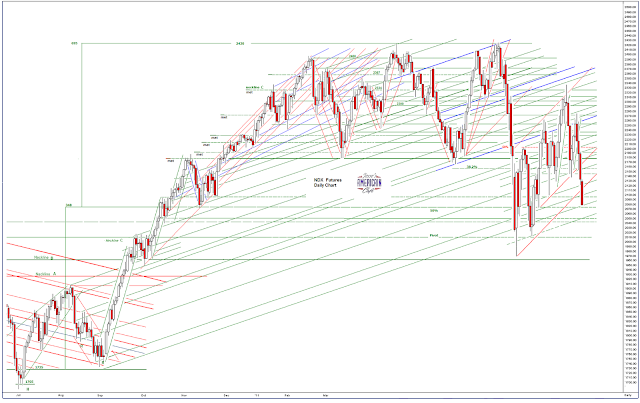

The downtrend is still not broken yet.

The equity markets are going to keep hacking up hairballs until Benny and Mario Draghi, Jean Claude's successor, gives them the big fat bowl of monetary cream that they want.

Downside on the stocks which went out on their lows, led by the financial stocks based on fears of contagion from a Greek default.

A few people have asked me about the recent story concerning France banning cash sales of gold and silver. The story originated here but was picked up by quite a few other sites last week. I was waiting to get some additional information before I posted it as well.

This is different from the reports of limits specifically on gold and silver sales in Austria.

"According to the bank representatives and manager we spoke with, Austrian banks have now been ordered to restrict the sale of gold and silver bullion purchases and are limiting personal acquisitions of precious metals to 15,000€ (approximately $20,700 USD) at a time, or 11 ounces of gold at today’s prices."

Here is a link to the French law that has caused this latest discussion.

Tightening the Noose: France Bans Cash Sales of Gold/Silver over $600

By Mac Slavo

September 23rd, 2011

"...It looks like this trend of restricting the peoples’ ability to acquire assets of real monetary value is expanding. If a recent report from France is accurate, and based on the French governments official web site it looks like it is, then as of September 1, 2011, anyone attempting to sell or purchase ferrous or non-ferrous metals, which includes gold and silver, will be required to pay for their purchase via a credit card or bank wire transfer if it exceeds 450€ (~ $600 USD)...

...According to independent reports the law was passed to curb the illegal sale of stolen metals like copper, steel, etc. Given the rampant rise in thefts of these metals from telephone poles, construction sites and businesses here in the United States, we can certainly see this as a reasonable assessment for why the French passed this law.

However, the fact that no exception was made for gold and silver simply cannot be ignored. The new law effectively makes it illegal to purchase even a single Troy ounce of gold or around 18 ounces of silver in cash."

So I asked an aficionado of the metals in France what the straight story is on this, and here is the reply:

This law is basically saying that retail “metal” transaction OF ANY AMOUNT cannot be paid in cash. It further says that there is a limit to how much metals can be transacted via retail up to a limit set by decree (not yet specified).

Any retail transaction above 450EUR must be paid via bank transfer (ACH). This is encompassing all goods and services, not just metals.

I called a gold coin & bar dealer whom I know in Paris.

They told me that their legal counsel is awaiting for the final interpretation of this new law sometimes this week.

In the mean time, they still sell gold to retail customers and accept cash payments without requiring an ID for transactions up to 3000 EUR per day per person.

She warned me that it may change any time.

And so there you have it. If you wish to buy gold and silver unobtrusively in France you may wish to do so now. Otherwise be prepared to start using bank transfers including credit cards for all transactions in any metal, and all large transactions for anything it seems.

It is hard to accurately judge official motives in this sort of action. It *could be* to restrict activity in stolen copper as some have said. It may very well limit demand for the 500EUR note. lol.

But it could also be to limit the incentive for a run on the banks by making cash less useful to hold. It also helps to channel more transactions through the fee-taking banks, which is a tax on the real economy.

And it might very well be designed to restrict a run on the metals if the western currencies are devalued. I have heard elsewhere that this is tied to the revaluation of gold relative to other currencies which will be included in the new composition of the SDR. I have also heard that one or two countries will include gold in their official reserves and tie it to their currency at some official rate that is substantially higher than the current spot prices, setting up an interesting change in market structure.

In other words, this law has the flavor of currency controls to prevent a bank run in preparation for a devaluation. And given the current nature of their trade deficit, I think it is a bit naive to assume that the US will stand idly by and not participate in this coordinated devaluation as well. Even that stalwart of hard assets Switzerland had to give way and weaken its currency to preserve its exports.

Restricting and manipulating short term prices can only go so far. At some point it appears they must also try to regulate and restrict access by private individuals if there is a market dislocation and a change in status quo. I fully expect that all exchange defaults will be force settled in cash at an official rate. And the retail bullion inventory would likely disappear from the shelves overnight except at the most outrageous prices.

With Asia moving to more widely encourage private ownership of gold and silver, the international dynamics may become most interesting.

This reminds me somewhat of restrictions and laws regarding foreign currency in Moscow and other eastern European countries in the 1990's. There was a state dictated exchange rate, and all currency was to be done in an official exchange office.

The practical effect was that no one wanted roubles except grudgingly, and most non-official transactions were made at street rates in hard currencies like Swiss francs, Deutsche marks, or Dollars. And there were official shortages of many staples as the markets moved 'underground.'

My, how times have changed. But they will never learn.

As I wanted to look into the gold and silver situation, and the concentrations there amongst the Anglo-Americans I left out an important fact about derivatives in general.

The US OCC report does include not only commercial banks and trusts with US subsidiaries, but also "Bank Holding Companies."

The bank holding company report, while shown at a high level, is not included in the breakdowns of positions in gold and silver, so it is not correct to assume that these fellows do not have positions there. Rob Kirby informs me that this is because the OCC has regulatory oversight for commerical banks and trust, but the Fed has authority over the holding companies.

As you can see from the attached below, Morgan Stanley is a huge player in the derivatives market, but at the Holding Company level. I am privately informed that they are also major players in the gold and silver derivatives trade.

This to me is important, since their CDS are recently amongst the weakest in the US banks, as Bloomberg has been recently emphasizing, and so they probably present some of the highest counter party risk amongst the current crop of players. As the OCC does not break down positions held at the holding company level, even though they claim to include off balance sheet items, it presents an incomplete picture.

Perhaps under regulatory reform, the Fed will begin to disclose more information to the OCC, and to the public, as to the true health and holdings of the Bank Holding Companies. The difference in the two categories with respect to derivatives positions is roughly $83 trillion.

I neglected completely to mention this and even contrasted Morgan Stanley with Goldman at the commercial bank level.

I ask your indulgence for this omission.