skip to main |

skip to sidebar

"When nothing seems to help, I go and look at a stonecutter hammering away at his rock, perhaps a hundred times without as much as a crack showing in it. Yet at the hundred and first blow it will split in two, and I know it was not that blow that did it, but all that had gone before."

Jacob Riis

Gold had another up day with stocks, as it was 'risk on' with renewed hopes for fresh infusions of liquidity as we saw from the Bank of England.

I tended to view this action as more 'technical' than fundamental.

I don't like the headline correlation between stocks and the metals like gold and silver which would normally function as a safe haven in a time of increased risk.

Notice the new lines of broad support and resistance levels on the gold chart. We have not yet broken to the upside, so caution is advised.

"Heroes are not giant statues framed against a red sky. They are people who say: This is my community, and it is my responsibility to make it better. Interweave all these communities and you really have an America that is back on its feet again. I really think we are gonna have to reassess what constitutes a 'hero.'"

Studs Terkel

Big up day, third in a row, ahead of the Non Farm Payrolls report.

It was 'risk on' today. Let's see if it can hold through the weekend.

I would like to see a flat financial transaction tax enacted, applicable to any exchange. The tax would be $1 (or £1 or €1 or ¥100 for example) for any trade on any exchange public or private, for any registered security including derivatives, without regard to the size of the trade. I would even consider a lesser amount, say $.25 for example, based on better tax revenue estimates.

The real economy is being slowly strangled by an outsized financial sector that has purchased a politically sanctioned franchise for outsized fees and public subsidies.

The financial transactions tax would be paid on the buy side. No exemptions. None. Zip. Not even for 'wholesale' traders or banks, or those who own 'seats' on the exchange. It is a cost of doing business. You buy, you pay $1 for each purchase.

The purpose of the tax would be to fund the regulation of the financial industry and the Consumer Protection in the financial industry.

The tax 'burden' would fall most heavily on those engaged in High Frequency Trading. It would not halt the phony 'bid stuffing' phenomenon which would have to be dealt with in other ways. But it would help.

The money would be 'earmarked' for the Regulatory bodies. The government would not be able to divert it to other uses. This is similar in concept to the gasoline tax in the US which is a flat rate per gallon of gasoline, which is used to expand and maintain their Interstate Highway System.

The most common objection is that it would make the domestic exchanges less competitive, and that people would find ways to 'cheat.'

If this rule were to drive more fruitless speculation out of country, then perhaps one might add some incentives for these speculative companies to leave, and take more of their white collar con men with them. Let them see how they fare in Asian countries when they are caught in a fraud. Perhaps their could be a pay per view for the punishments.

Liquidity objections are a red herring, a joke. HFT adds no liquidity, it amplifies short term movements. It is not the same as the specialist system, not at all.

As for cheating, with a more fully funded set of regulatory bodies with professional career employees with an in depth understanding of the industry and continuity in position, not these revolving door suits who can't wait to work again for the industry companies they regulate, the cheating might become more manageable.

By the way, and in an somewhat unrelated discussion, I would use these funds to immediate tighten the regulations and enforcement against naked short selling, especially in the US and Canada.

Next up, reform of the transfer pricing abuses that allow international corporations to realize revenues in the country of their choice.

As for personal taxes, significantly raising the income triggers a flat 25% AMT to let's say $400,000 but tightening the exemptions until they include any 'income' of any sort from any source would be a good place to start. That is quickly achievable. We might also consider a modest AMT for corporations based not on 'income' but on reported revenues from whatever sources.

Businesses do not 'create jobs' like benificent gods. They respond to market opportunity and consumer demand for products and services. Incenting business in the face of failing demand cause by stagnant median wages and high unemployment is just a variation of the trickle down economic theory.

Create sustainable demand, and independent businesses will rush to fill it. The problem lies with the inefficient businesses, the zombie cartels, monopolies, and rentiers who have 'purchased' public franchises to take fees by buying politicians and favorable legislation.

These reforms would be almost easy to achieve, given a functioning political system responsive to the voters, compared to the biggest and most intractable problem facing the US, which is campaign finance reform, and the crowding out of the individual from the political process.

Never happen you say? I would agree that any proposals along these lines would be ignored, and if they gained notice, ridiculed and shouted down. It would be fun and informative to watch who screams the most, and who they do it for.

Well, all right then, but do not expect there to be any sustainable economic recovery.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.

As Hermann Hesse oberved, "When the suffering become acute enough, one moves forward."

A nice bounce in the metals with gold up to key resistance.

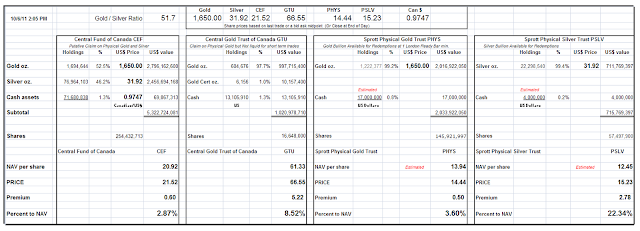

The trusts and funds are responding as well as the mining companies, ahead of tomorrow's important September Non-Farm Payrolls report.

One notable variant in this is the unusually large premium being given to the Central Gold Trust. This is almost certainly due to a short squeeze as it is one of the least 'liquid' of the closed end funds with only 16.6 million units. The premium on PSLV is expansive but it is usually so.

I have done some redrawing of the daily Gold chart which will be released this evening.