skip to main |

skip to sidebar

Anyone who is familiar with the markets and has a shred of decency is absolutely appalled by this outrageous theft from customer accounts and breach of fiduciary trust. And the wall of silence from the financial system and the Obama Administration is deafening.

If this stands, then there will be more abuse of funds and selective defaults to come, especially for any non-US citizens with assets in the US financial system that involve commodities and precious metals.

Title and ownership mean nothing in an unfolding kleptocracy. If one does ill and profits, then so shall they all.

The Economic Times of India

MF Global activity 'suspicious': CFTC official

15 Nov, 2011, 10.15PM IST, Reuters

A US futures regulator said on Tuesday that activity leading up to the bankruptcy of brokerage MF Global appears to be "either nefarious or illegal."

Bart Chilton, a Democratic commissioner at the US Commodity Futures Trading Commission, said on CNBC that he could not comment specifically on the agency's investigation, but that the activity "looks suspicious as heck."

"It's either nefarious or illegal in my personal opinion," he said.

An MF Global representative was not immediately available for comment.

Neither MF Global nor its former head Jon Corzine has been charged with any wrongdoing.

MF Global filed for bankruptcy protection on Oct. 31 after concerns over risky bets on European sovereign debt sped its collapse. The CFTC and other regulators are still searching for roughly $600 million in customer account funds.

When asked about whether customers will get their money back, Chilton said: "It depends on what is there."

Meanwhile, it was reported that MF Global Holdings Ltd may have faced a shortfall in customer funds even as far back as Oct. 27, four days before the US futures brokerage filed for bankruptcy protection.

Just hours before the bankruptcy filing, MF Global executives told regulators they believed a shortfall had somehow occurred, possibly starting on Oct. 27 or Oct. 28, it was reported.

Customer funds were found to be short by about $200 million on Oct. 27.

The CFTC is also examining whether hundreds of millions of dollars in customer accounts were transferred at MF Global during the week that began Oct. 24, the paper said.

According to CFTC, the transfers were not recorded in the firm's general ledger reviewed by exchange officials, the paper said.

MF Global filed for bankruptcy after its bets on European sovereign debt unnerved investors, credit agencies, customers and counterparties, causing liquidity to disappear.

Thereafter, regulators are seeking to find some $600 million missing from the company's customer accounts.

A spokesman for MF Global said last week that the firm is cooperating with regulators and the bankruptcy trustee trying to find the missing money, according to the Journal.

MF Global could not immediately be reached for comment by Reuters outside regular US business hours.

What time is the next swan?

No I am not referring to the famous ad lib from Czech operatic tenor Leo Slezak.

"One of the most famous ad-libs in theatrical history came from the great tenor Leo Slezak. One night, while playing the title role in Wagner's opera Lohengrin, he ran into an unexpected problem. At the end of the opera, a swan appears at the back of the stage, drawing a boat that is to return Lohengrin to his place with the Knights of the Holy Grail.

This night, however, a stagehand erred and sent the swan boat off prematurely. It was the end of the opera, but there stood Slezak, watching the swan boat sail off without him. It was an awkward moment for the performers on stage and members of the audience, who were familiar with the opera's famous ending. As people began to fidget in their seats, Slezak brought the house down when he turned to a singer next to him and ad-libbed:

"What time is the next swan?"

My favorite Leo Slezak story is about when he went to Bayreuth, and was permitted to audition there for the grand dame herself, Frau Cosima Wagner. Herr Slezak obtained a very hard reception indeed when he chose to sing Vesti la giubba from Pagliacci for his stunned audience. Slezak later said that he did not know that the works of Italian composers were strictly verboten in the home of Richard Wagner. “Even the attendant who had ushered me in tottered when I sang," he admitted.

His memoir, Song of Motley: Being the Reminiscences of a Hungry Tenor is a fun read for opera aficionados.

As an aside, Leo's son Walter became a famed character actor in his own right, with a memorable role in Lifeboat, and published a delightful memoir titled 'What Time's the Next Swan.' After his long career he settled in New Hope, PA.

Rather, I am wondering when the next black swan will make its arrival. It seems a bit overdue.

As the big retail names in the commodity brokerage world keep collapsing in various frauds, like Refco and MF Global, one has to wonder what event will cause the next wave of failures and collapses, in highly leveraged operations that are dashed on the rocks of hard reality.

As the great economist John Kenneth Galbraith observed, "All successful revolutions are the kicking in of a rotten door." And as rotten doors go, the current financial system run by the Anglo-American banking cartel run out of NYC and London is teeming with vermin.

When the action starts it might come in a hurry. So now is the time to prepare.

Stocks appear to be coiling for a move.

I am tending to take the short side here, in a paired trade with long gold without leverage. No miners. I adjust the mix intraday to try and capture some of the games as the wiseguys do a wash and rinse with the index.

I do not wish to be caught long until some semblance of order comes to the European debt situation. And not only is it not getting better, but the US seems to be tottering to a reckoning of its own.

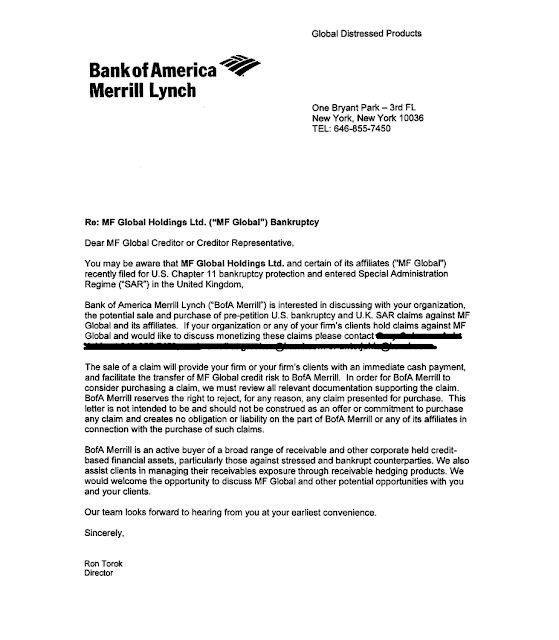

Bank of America's Merrill Lynch unit is soliciting for the purchase of claims against MF Global.

As you may recall, Bank of America is one of the major creditors of MF Global with JPM, and is reported to be one of the Debtors, along with JP Morgan, involved in the litigation trying to obtain superiority of their claims over customers whose money was taken/lost/stolen by parties unknown for now.

I have nothing against vulture funds per se, although what I hear a few of them have done with two of the failed Icelandic Banks and their former directors proves Rule Four of ZombieBankingland: Always Use the Double Tap.

But doesn't this seem like a bit of an impropriety, if Bank of America is one of the holders of assets, or affiliated in a court action with such a holder of contested assets, that would ultimately make customers whole? Is it conceivable that this is a conflict of interest?

I mean, it does seem that BofA with one hand is acting with others to give its own claims superiority in the Trustee liquidation, and on the other hand it is offering to buy up the claims it has weakened by these legal actions.

MF Global has the wafting odour of scandal that keeps on intensifying.

I cannot wait to find out the whole truth. But that might have to wait for kingdom come, if it is in the same justice delivery system as the silver manipulation inquiry.

But for now the pampered princesses of the NY financial media are bubbling with excitement over the clubbing and gassing of peaceful protesters under cover of darkness.

It appears that MF Global is phase two: the clubbing and looting of unsuspecting customers and clients.

When in doubt, get out.