skip to main |

skip to sidebar

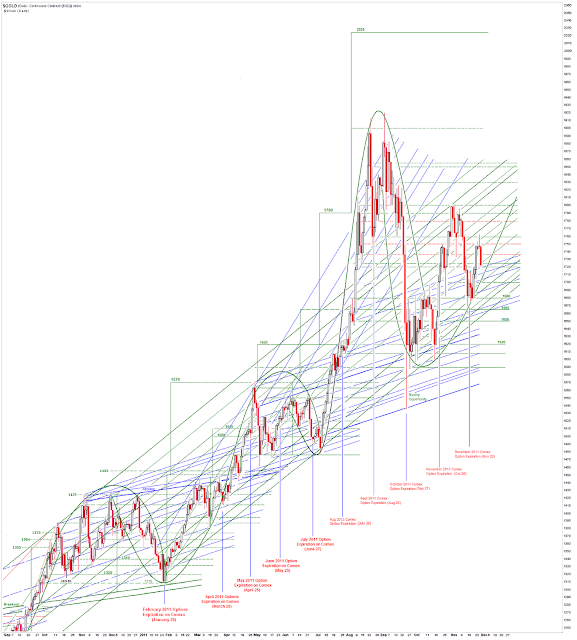

Here is a message to some trading friends this morning with gold around support at 1710.

They normally hit the miners hard before a smackdown in gold and silver. They did this on Friday. But today we saw the opposite happening, at least this morning. Earlier I had sent out a message saying, 'I think the bottom is in.'

Denver Dave and I had come to the same conclusion after some email exchanges and a search of the news.

See Hecla?

They are buying the miners while smacking down bullion.

And now it reverses.

I bought it pretty hard bullion and some miners.

I hedged the stocks with index shorts keyed on the SP.

They started buying some of the miners, especially some of the silver miners, in numbers and aggressively even while they were still smacking down gold and silver spot prices to the lows.

Those lows were an almost perfect hit on the accumulation-distribution trend on my chart.

I think this type of price action gives them the opportunity to buy some decent positions in the higher beta miners without trading against themselves in the market. The negative bullion price action keeps most of the public buyers on the sidelines.

It is not illegal to buy one thing and sell another. I am running long bullion/miners and short the SP at the same time.

But it is not allowed to manipulate prices in commodities on the futures markets to game the stocks. And today's action in the precious metals futures was especially heavy handed in smacking price and running stops. Is anyone trading the futures markets anymore except for insiders? Probably not so many directly, but through things like ETFs and some funds, perhaps more than they realize.

I am not sure we are out of this nonsense yet because of so many guys standing for delivery this month, and the negotiations that are always going on in cash to buy out the longs w/o taking delivery.

But these sorts of moves tend to set up bigger moves higher. Barring the disintegration of Europe in the short term of course.

Speaking of heavy handed, is Standard and Poors working off some sort of community service sentence? Do they have to wear orange jumpsuits while issuing negative statements and downgrades on foreign sovereign debt in high coincidence with US policy measures?

The pressure they are putting on the Europeans to back up Timmy's policy advice (thinly veiled directives) to them is a bit much. I understand the advice is to cut their rate 50 bp or more tout de suite to stop making Ben look bad and smooth the way for the US QE3 without knocking the dollar off its pedestal. And of course they must act to bail out the TBTF banks.

Is Tim going to be appointed financial Viceroy of Europe by the Banks? Would that be an IMF or Treasury title?

One can only look on in wonder these days.

P.S. I have had no position in Hecla today at all. I watch it and a few others as bellwethers.

Words like 'shameful' and 'national disgrace' do come to mind.

Rutgers University Working Paper

Categorizing the Unemployed by the Impact of the Recession

By Dr. Cliff Zukin, Dr. Carl E. Van Horn, and Charley Stone

In August 2009, the John J. Heldrich Center for Workforce Development at Rutgers, The State University of New Jersey began following a nationally representative sample of American workers who lost a job during the height of the Great Recession.

The research began with a cross-sectional sample of 1,202 who had said they had lost a job at some point in the preceding 12 months (between August 2008 and 2009). They were resurveyed in March 2010, again in November 2010, and then in August 2011.

A total of 3,972 individual surveys were completed over the two years. Well over half of the original respondents participated in all four waves of the project, meaning they spent, on average, 50 minutes of their time responding to roughly 200 questionnaire items.

This resulting measure combines an assessment of the respondent/family’s current economic status with the magnitude of change in the quality of daily life, with an assessment of whether this change represents a new normal or is a temporary stay in limbo. Combining answers to these three questions result in a typology with five groups, defined as follows:

Workers who have MADE IT BACK consider themselves in excellent, good, or fair financial shape and have experienced no change in their standard of living due to the recession.

People ON THEIR WAY BACK have largely experienced a minor change to their

standard of living, but say the change is temporary. They also consider themselves in excellent, good, or fair financial shape.

Workers who have been DOWNSIZED meet one of three conditions; they have

experienced: a minor change that is permanent; a minor change that is temporary, but they are in poor financial shape; or a major change in their standard of living that is temporary and they are in at least fair financial shape.

Workers classified as DEVASTATED have experienced a major change to their

lifestyle due to the recession. They can be either in poor financial shape and think the change is temporary, or in fair financial shape but think this change is permanent.

Workers that have been TOTALLY WRECKED by this recession have experienced a major change to their lifestyle that is permanent and are in poor financial shape.

Read the rest of this working paper here.

“The world is short water, energy, & commodities. We’ve under-invested in our natural resources as a society and as a consequence, we’ll see higher prices around the globe.”

Mark Cutifani, CEO, AngloGold-Ashanti

Gold was hit early on, and silver shortly followed, despite the rally in stocks and the falling dollar.

This struck me as price manipulation tied to the settlement negotiations that are being done at the Comex as the December positions still standing get resolved for cash with a premium.

Later in the day all prices dropped, with stocks retaining some gains, on news that Standard & Poors would place all the Euro nations on ratings watch, with a pointed reference to the summit meeting later this week.

Speaking of debt, here is a chart showing the worst of the G10 nations in terms of total debt in their economy. As you may recall, I hav said that before the US economy falters, the UK will go first.

On Sunday I read The Hunger Games at the suggestion of she-who-must-be-obeyed in my role as the judge and chief taster of things that the household children might consume that could-be-of-a-questionable-nature. This goes for books, movies, and food. I am also in charge of spider and other unappealing creatures disposal.

It was an easy story and diverting for those who like futuristic science fiction. While a bit dark it was not inappropriate for the 13+ set. I picked up books 2 and 3. I believe there is a film coming out on this book next year.

The stock markets rallied early on with the news that a deal had been struck between German and France.

The volumes were very light and lacked conviction with little follow through even as the SP 500 seemed to break out of its triangle formation.

In the afternoon another headline swept the markets, that Standard & Poors would be placing the entire Euro zone on ratings watch depending on what happens at the Euro summit later this week.

The demimonde is talking stocks up aggressively for 1300+ into year end, or a six percent rally from here.

I went very short on the stock rally, with a corresponding increase in my gold bullion position.