"...we are overdone with banking institutions which have banished the precious metals and substituted a more fluctuating and unsafe medium, that these have withdrawn capital from useful improvements and employments to nourish idleness, that the wars of the world have swollen our commerce beyond the wholesome limits of exchanging our own productions for our own wants, and that, for the emolument of a small proportion of our society who prefer these demoralizing pursuits to labors useful to the whole, the peace of the whole is endangered and all our present difficulties produced..."

Thomas Jefferson

Today was just another lingering moment on the monetary odyssey of Ben Bernanke.

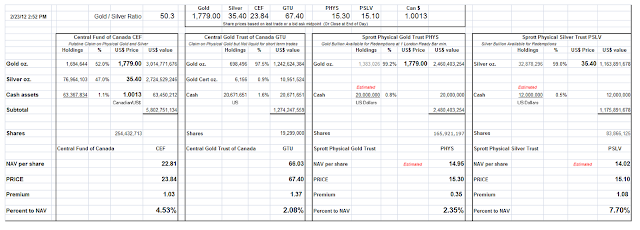

Gold and silver held up well today for silver's option expiration.

The wheel of fate grinds slowly, but exceedingly fine.

Bernanke Agonistes

...No! I am not Prince Hamlet, nor was meant to be;

Am an attendant lord, one that will do

To swell a progress, start a scene or two,

Advise the prince; no doubt, an easy tool,

Deferential, glad to be of use,

Politic, cautious, and meticulous;

Full of high sentence, but a bit obtuse;

At times, indeed, almost ridiculous—

Almost, at times, the Fool.

I grow old … I grow old …

I shall wear the bottoms of my trousers rolled.

Shall I part my hair behind? Do I dare to eat a peach?

I shall wear white flannel trousers, and walk upon the beach.

I have heard the mermaids singing, each to each.

I do not think that they will sing to me.

I have seen them riding seaward on the waves,

Combing the white hair of the waves blown back,

When the wind blows the water, white and black.

We have lingered in the chambers of the sea,

By sea-girls wreathed with seaweed red and brown,

Till human voices wake us, and we drown.

T. S. Eliot, The Lovesong of J. Alfred Prufrock