18 April 2012

17 April 2012

Senate Banking Committee to Hold MF Global Hearing Next Week

"How can people trust the harvest, unless they see it sown?"

Mary Renault

Here is the cast of players for the next Senate Hearing on MF Global as reported by the NY Times.

The problem that this hearing will seek to address is the lack of confidence in the markets and how to restore it.

The appearance of Mr. Freeh is new, and the characterization of it by the Times is interesting.

I doubt anything new will come of this hearing, however. The link in this scandal is Edith O'Brien.

The CFTC is a shadowy reflection of the Congress and the government, which maintains a complaisant tolerance of fraud and corruption as a means of doing business in the markets by powerful finacial interests, despite what they might say or pretend to do when they are pressured by their outraged constituents.

The reform of the markets is not rocket science. But accepting huge sums of money and attempting to please the donors, while merely appearing to reform the markets and enforce the law and doing little of substance, is what is complicated.

NY Times

Senate Banking Committee to Hold MF Global Hearing

By AZAM AHMED and BEN PROTESS

April 17, 2012

A former director of the Federal Bureau of Investigation who has come under fire as the bankruptcy trustee for MF Global will appear next week before a Congressional panel examining the collapse of the brokerage firm.

Louis Freeh, who has the responsibility of returning assets to creditors of the commodities brokerage firm, is expected to testify alongside regulators as well as another trustee responsible for the return of missing customer funds. The two trustees, whose missions in some ways are at odds, have been facing off over the privacy of documents and the distribution of assets.

The hearing, slated for April 24 before the Senate Banking Committee, will be the sixth Congressional inquiry stemming from MF Global’s bankruptcy and the disappearance of customer money. Nearly six months later, farmers, hedge funds and other customers of MF Global are still owed an estimated $1.6 billion.

Unlike previous hearings, which focused on the wrongdoing that may have led to the firm’s collapse, the Senate Banking Committee’s hearing will focus on ways to better protect customer money and improve regulatory oversight.

“As investigators seek to recover MF Global customer funds and hold accountable those responsible for any wrongdoing, Congress needs to focus its attention on preventing future abuses and the other critical public policy issues raised by the collapse of MF Global,” Tim Johnson, a South Dakota Democrat who is chairman of the committee, said in a statement. “This hearing will help us identify ways to restore market confidence for farmers, ranchers and investors through improved regulatory oversight and strengthened protections for customer accounts.”

The hearing will be the first time that the public hears from Mr. Freeh, who has faced pressure over his handling of the bankruptcy process. He initially declined to share certain documents with regulators and his fellow trustee, James W. Giddens. In addition, a furor arose when it emerged that Mr. Freeh had been contemplating awarding bonuses to MF Global executives who remained at the firm, a common practice in bankruptcies.

Mr. Freeh’s fellow panelists are all experienced in MF Global hearings. Mr. Freeh and Mr. Giddens, the trustee responsible for recovering customer money, will be joined by regulators, including Robert Cook, director of trading and markets at the Securities and Exchange Commission; Richard Ketchum, head of the Financial Industry Regulatory Authority, and Terrence A. Duffy, chairman of the CME Group, MF Global’s front-line regulator.

Jill Sommers, a commissioner at the Commodity Futures Trading Commission, will also appear before the committee. The trading commission was MF Global’s federal regulator and is leading the investigation into wrongdoing at MF Global, along with federal prosecutors and the F.B.I....

Read the rest here.

Category:

MF Global

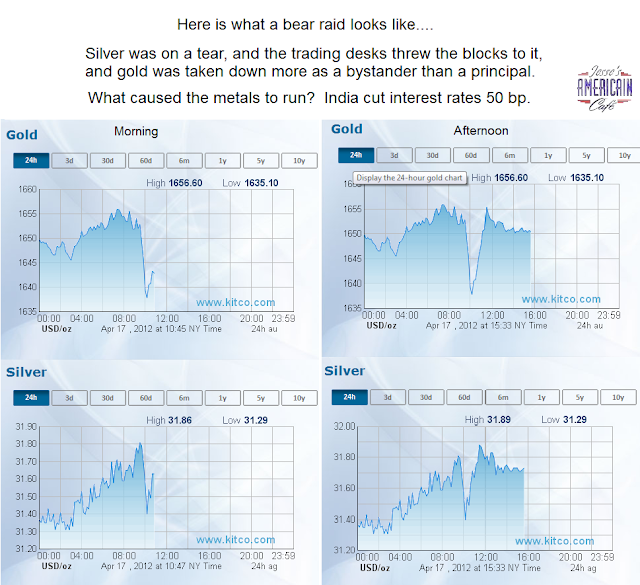

Gold Daily and Silver Weekly Charts - Bear Raid Breaks Momentum

The paper money munchkins and metal bears are making their stand for gold at $1650 and silver at 32. That seems fairly obvious. They will hold it until they cannot, and then will fall back to defend a slightly higher price level. I like to think of it in American football terms. The bulls are going for a first down, and the bears are trying to hold them back.

Silver came in this morning with some serious momentum, and so we saw a fairly quick and sharp bear raid. See the first chart. Yes, the bear raid 'failed' but it broke the upward momentum which was the point.

Silver registed for delivery at the Comex is down to historically low levels again. They will have to be replenished before the next big delivery month.

Some of the commentators are remarking on the unusually low open interest in gold at Comex. While that could be a bullish or bearish indicator depending on how you wish to twist it, it could also very well indicate that the players are shunning the US futures market and so volume is down. Before these scandals work themselves out I expect it to fall much lower.

India cut its interest rate by 50 basis point, and this was most likely the fundamental reason for the rally in commodities and stocks.

It looks like the metals and stocks are moving together again, so one might put the long metal short stocks hedge back on again.

SP 500 and NDX Futures Daily Charts - Risorgimento della Gola

The IMF raised it's world growth projections from 3 to 3.5%. Since the only group that is worse than the IMF projecting growth rates is the Fed, I think we can write than one off to jawboning at best, but nothing of lasting substance.

The rally was in part a wash and rinse, a way to catch the bears off balance, and was triggered largely by India which cut interest rates by 50 basis points.

After the bell Intel beat estimates, for the 17th time in a row. IBM beat as well. Their accounting reports are as reliable and substantial as a politician's campaign promise, so the markets may not be overwhelmed by them.

And before you ask, that is not literal Italian in the title, but a rather loose double edged pun.

Subscribe to:

Comments (Atom)