Weaker than expected Jobs Report for June had stocks in retreat after the end of quarter run up of the last week, and a false euphoria over a European solution.

06 July 2012

SP 500 and NDX Futures Daily Charts

Weaker than expected Jobs Report for June had stocks in retreat after the end of quarter run up of the last week, and a false euphoria over a European solution.

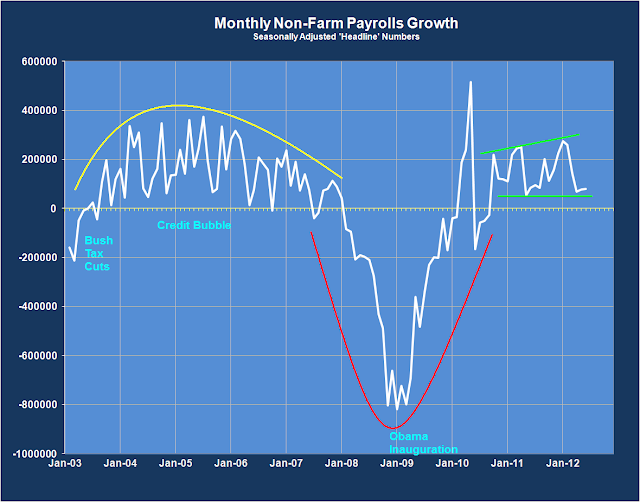

Non-Farm Payrolls Report for June 2012 - Bush Slump and Obama Recovery, Still Weak

"Global megabanks have an incentive to deceive customers, including both individuals and nonfinancial corporations. Their size confers both market power and the political power needed to conceal the extent to which they engage in economic fraud. The lack of transparency in derivatives markets provides them with an opportunity to cheat, but the abuses are much wider – as the Libor scandal demonstrates.

The ripoff is not just of retail investors. Chief financial officers of major corporations should be up in arms. Boards and shareholders of companies that buy services from big banks should be asking much harder questions about all kinds of derivatives transactions – and who exactly is served by the terms of such agreements."

Simon Johnson, Lie More As a Business Model

The weak recovery from the depths of the economic slump caused by the credit bubble collapse continues, with 80,000 jobs added.

I did not notice anything unusual in the compilation and adjustments of the numbers.

If anything the number appear to be understated a bit.

The economy is moving from a housing centric focus to something else. But what is that something else to be?

That in large part is the problem.

Manufacturing? The global trade regime still suffers from labor arbitrage and exchange rate 'tinkering' in the mercantilist Asian countries.

Government is not growing but instead remains flat to down from the layoffs in the state and municipal sectors.

Service? The service sector is already outsized in comparison to the rest of the economy, and the jobs added there tend to be lowpaying on average, except for the unusually large salaries in the FIRE sector which is also shrinking as a result of the bubble.

If there was ever a need for a strong national policy to stimulate rebuilding of infrastructure this is it. And this is unlikely to happen because of the political gridlock in Washington, and the continuing power of the financial sector and corporate lobbies over lawmakers.

But as you know from reading this blog, the big drag on policy action and real economic activity is the stubborn corruption at the heart of 'the rotten financial system.'

Brown's Bottom: Why Gordon Brown Sold England's Gold On the Cheap To Bail Out the Banks

Although this is nothing new, as I and several others have reported this several times in the past, with a very nice documentary on it having been done by Max Keiser, this is still a very important article for two reasons.

First, it lays out rather nicely the gold panic of 1999 and Brown's Bottom, which is the low in the price of gold achieved by the dumping of 400 tons of gold into the world market at an artificially low price by the British government.

This was done apparently to bail out a bullion bank or two who were enormously and irretrievably caught short of gold by the carry trade.

Second, it provides a good description of the gold carry trade. When gold is leased out by a central bank, the bullion bank takes possession of it and sells it into the market, and invests the proceeds. At the end of the lease period, the bullion bank buys the gold bank in the open market and returns it to the central bank.

Although the gold likely never changes physical location in this process, the claim or title to the gold does change hands, although that change in claim may not be adequately reflected in the public records.

Although the author does not mention it here, there is some thought that the 'sale' of the central bank gold at private auction is in reality a paper transaction between the central bank and the bullion banks who are short leased gold from the bank, and are unable to return it without causing a price disruption in the world market.

This is something which could be easily cleared up with the kind of disclosure one might think is owed the people when their national heritage items are sold away by the government.

And again, although it is not mentioned in the article, Britain's gold depletion to save the private banks is infamous only because of the clumsy manner in which it was conducted. It is thought that several other European central banks have gold listed on their books which they no longer have, because of this pernicious habit of lending out the gold on the cheap to the banks, only to have it sold off in the market, never to return, leaving only a stack of paper promises.

And finally, the most intractable problem which the bullion banks face today is that no central bank has a stockpile of silver left with which to bail them out. So they are caught playing a shell game, robbing Peter to pay Paul, and living in dread of the day of reckoning when their schemes will be exposed, and the markets will go into default on their naked short positions.

Telegraph UK

Revealed: why Gordon Brown sold Britain's gold at a knock-down price

By Thomas Pascoe

5 July 2012

A great deal of Gordon Brown’s economic strategy would strike a sane man as troubling. Not a great deal was mysterious. The orgy of consumption spending, frequent extensions of the cycle over which he would “borrow to invest”, proclamations of the “end of boom and bust”: these are part of the armoury of modern politicians, of all political hues.

One decision stands out as downright bizarre, however: the sale of the majority of Britain’s gold reserves for prices between $256 and $296 an ounce, only to watch it soar so far as $1,615 per ounce today.

When Brown decided to dispose of almost 400 tonnes of gold between 1999 and 2002, he did two distinctly odd things.

First, he broke with convention and announced the sale well in advance, giving the market notice that it was shortly to be flooded and forcing down the spot price. This was apparently done in the interests of “open government”, but had the effect of sending the spot price of gold to a 20-year low, as implied by basic supply and demand theory.

Second, the Treasury elected to sell its gold via auction. Again, this broke with the standard model. The price of gold was usually determined at a morning and afternoon "fix" between representatives of big banks whose network of smaller bank clients and private orders allowed them to determine the exact price at which demand met with supply.

The auction system again frequently achieved a lower price than the equivalent fix price. The first auction saw an auction price of $10c less per ounce than was achieved at the morning fix. It also acted to depress the price of the afternoon fix which fell by nearly $4.

It seemed almost as if the Treasury was trying to achieve the lowest price possible for the public’s gold. It was.

One of the most popular trading plays of the late 1990s was the carry trade, particularly the gold carry trade.

In this a bank would borrow gold from another financial institution for a set period, and pay a token sum relative to the overall value of that gold for the privilege.

Once control of the gold had been passed over, the bank would then immediately sell it for its full market value. The proceeds would be invested in an alternative product which was predicted to generate a better return over the period than gold which was enduring a spell of relative price stability, even decline.

At the end of the allotted period, the bank would sell its investment and use the proceeds to buy back the amount of gold it had originally borrowed. This gold would be returned to the lender. The borrowing bank would trouser the difference between the two prices.

This plan worked brilliantly when gold fell and the other asset – for the bank at the heart of this case, yen-backed securities – rose. When the prices moved the other way, the banks were in trouble.

This is what had happened on an enormous scale by early 1999. One globally significant US bank in particular is understood to have been heavily short on two tonnes of gold, enough to call into question its solvency if redemption occurred at the prevailing price.

Goldman Sachs, which is not understood to have been significantly short on gold itself, is rumoured to have approached the Treasury to explain the situation through its then head of commodities Gavyn Davies, later chairman of the BBC and married to Sue Nye who ran Brown’s private office.

Faced with the prospect of a global collapse in the banking system, the Chancellor took the decision to bail out the banks by dumping Britain’s gold, forcing the price down and allowing the banks to buy back gold at a profit, thus meeting their borrowing obligations.

I spoke with Peter Hambro, chairman of Petroplavosk and a leading figure in the London gold market, late last year and asked him about the rumours above.

“I think that Mr Brown found himself in a terrible position,” he said.

“He was facing a problem that was a world scale problem where a number of financial institutions had become voluntarily short of gold to the extent that it was threatening the stability of the financial system and it was obvious that something had to be done.”

While the market manipulation which occurred when the gold reserves were sold was not illegal as the abuse at Barclays may have been, the moral atmosphere in which it took place was identical.

The crash which began in 2007 and endures still was the result of an abdication of responsibility across the financial sector. This abdication ranged from the consumer whose thirst for goods pushed him beyond into grave debt to a government whose lust for popularity encouraged it to do the same.

Responsibility is evaded by all bar those on whose shoulders it ought to rest. The gold panic of 1999 was expensively paid for by the British public. The one thing politicians ought to have bought with that money was a lesson in the structural restraints which needed to be placed on banks now that the principle that they were ultimately public liabilities had been established.

It was a lesson which could have acted to restrain all players in the credit market boom of the 2000s. It was a lesson which nobody learnt.

05 July 2012

Gold Daily and Silver Weekly Charts - Metals Rigging Worse Than LIBOR

"Or one may say that there were no real human villains; that given the economic and political cues, actors would have been in the wings to come on and play the parts which circumstances dictated.

Certainly there were many others as reprehensible and irresponsible as those who played the leading roles. The German people were the victims. The battle, as one who survived it explained, left them dazed and inflation-shocked.

They did not understand how it had happened to them, and who the foe was who had defeated them."

Adam Fergusson, When Money Dies: The Nightmare of the Weimar Collapse

The loss of confidence in their money, their fiat currency, which to some people becomes the touchstone for all value in their life, is almost too difficult to adequately describe, and for most people too awful, unthinkable, to fully understand.

And yet it happens. I have seen it happen first hand in Russia. It is happening now again in Europe and elsewhere. And it will bring a sea change, and an anger and despair that is hard to imagine in advance in its enormity.

The work of one's life can be stolen in an instant by the modern money masters and their criminal accomplices, with a few touches on the keyboard and a newswire release. If you do not believe it is possible, have a discussion some time with one of the account holders at MF Global, or the holders of a tech stock post bubble.

This is the pernicious nature of a fraud, because it robs not only the confidence in the peculiar aspects of the con itself, but undermines the very confidence that allows the commerce of society among people to continue.

All the transactions of life are based on some level of confidence in the honesty of measures and the integrity of contracts and product representations.

And if that trust is sufficiently undermined, shaken to its foundations, the people will at first freeze up in fear and stop buying and selling, and then eventually rise up in anger looking for redress and justice, if they are still free to think and to act.

And there are those that would welcome that crisis, and attempt to use it for their own ends. Anarchists. Demagogues. Oligarchs. They would subvert the Constitution and the rule of law, and create a new way for themselves and their adherents, a grab for resources and power, thereby subjugating the common people, whom they secretly despise, to their will to power.

Intraday commentary here.

Subscribe to:

Posts (Atom)