You may be reading more and more commentary about

the platinum coin solution, and arguments why it doesn't really matter if the US does it or not.

To summarize the concept, the Treasury creates one special platinum coin, with a stated face value of $500 billion or so.

They trot down to the Fed and deposit the special coin(s), redeeming that amount of US notes and

voila. It is a overt monetization, but the platinum coin adds a novel touch, and a bit of shiny misdirection.

Some mainstream economists seem to be toying with the idea of climbing aboard the train with the Modern Monetary Theorists.

Enthusiasm Builds for Trillion Dollar Coin . Paul Krugman has a typically obtuse take on this in a recent column titled

Monetary Rage.

I am not going to argue the pros and cons of this approach at this time. I have said quite a bit about this, and MMT, before. For me it shows that economic silliness is not the exclusive domain of the Austerians.

But I do want to firmly draw your attention as to

why this particular solution and approach to the debt is important, and why it raises concern among many, even though that concern is often scorned and ridiculed by the economic savants. And by the way, this is very reminiscent of the same reactions to Alan Greenspan's policies, TARP, and the housing bubble with many of the same players in similar roles.

From a Bloomberg story entitled:

Why We Must Go Off the Platinum Cliff.

"In case you're not familiar with this idea: In general, the Treasury Department is not allowed to just print money if it feels like it. It must defer to the Federal Reserve's control of the money supply. But there is an exception: Platinum coins may be struck with whatever specifications the Treasury secretary sees fit, including denomination.

This law was intended to allow the production of commemorative coins for collectors. But it can also be used to create large-denomination coins that Treasury can deposit with the Fed to finance payment of the government's bills, in lieu of issuing debt."

Currently it is against the laws of the land for the Treasury to issue debt, and for the Fed to buy it directly, as opposed to running that debt through the test and discipline of the markets. I researched this a number of years ago, and do not recall the particular law offhand, but in effect the Treasury cannot sell debt directly to the Fed.

It must pass through the marketplace first to be valued.

This is all the difference between a democracy, as imperfect and occasionally corrupted as it may be, and a

diktat by a central authority.

The platinum coin solution uses a statute regarding commemorative coins to evade that law of money. If the Treasury creates money out of nothing on its own volition, whether it be by assigning a purely whimsical value to a platinum coin, a wooden nickel, or a magic money wand, and deposits that symbolic object with the Fed, it is a game changer. It is purely arbitrary monetization.

And that step requires debate and a proper law, if the country chooses to accept it.

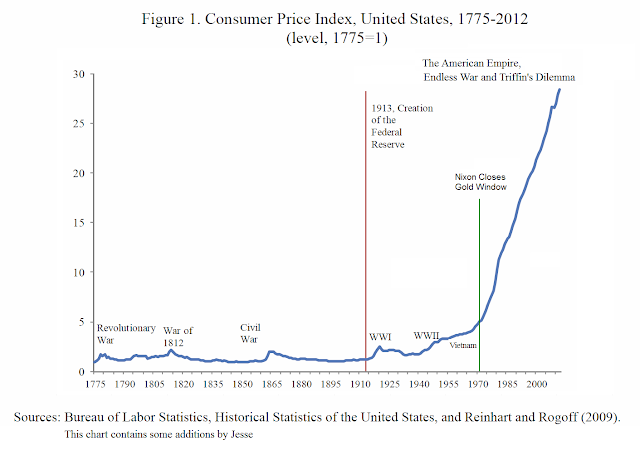

Now one might argue that this sort of overt monetization means nothing. And the MMTers have plenty of convoluted arguments why it does not matter, at least to them. And if anyone objects to their sophistry, they are ridiculed. They might say that the Fed is monetizing the debt already, and inflation has not resulted. But that is not the point. The Fed are pretending that they are NOT doing it, and are thereby maintaining appearances and some level of deniability.

But what people forget, or rather, what they would like us to forget, is that a modern fiat currency is based on the full faith and credit of the issuer, and the willingness of people in the market place to trust them, their word as contract, and the integrity of their actions.

Trust is a funny thing. One can bend it, twist it, and strain it by their actions over time. But at some point it may break, and the parties expected to maintain that trust may say, 'enough!'

And trust is gone, broken. And retracing one's steps to regain it is not a simple matter of a apologizing for and remediating their latest transgression, but a long slow climb back through what in many cases are years of continuing abuse and broken promises.

It is good to note that when dealing with people's resistance to accepting this monetization and artificiality of value, the MMTers quickly resort to arguments that involve the use of force, legal but even physical, in order to stifle dissent to an arbitrary monetary power.

That is the significance of taking the step of overt monetization at will, which is what the gimmicky platinum coin solution is all about. And those who promote it best understand that this is what they are doing, and be prepared for the consequences.