15 February 2013

Gold Intraday

Hard to miss the deliberate price smackdown.

As I said yesterday, "I will not be surprised to see a final big move to run the stops to the downside in the precious metals, and take additional shares and units of paper claims before the markets break free."

So is this 'the final big move?' Of course I do not know, no one does. But gold is now deeply oversold, and we are nearing the rinse phase of the wash-rinse cycle, at least according to the technical indicators.

Things like this are a pity, because they make a sham of the markets. But what else is new.

Three day weekend ahead. And the currency war is on.

Category:

Gold Price manipulation

14 February 2013

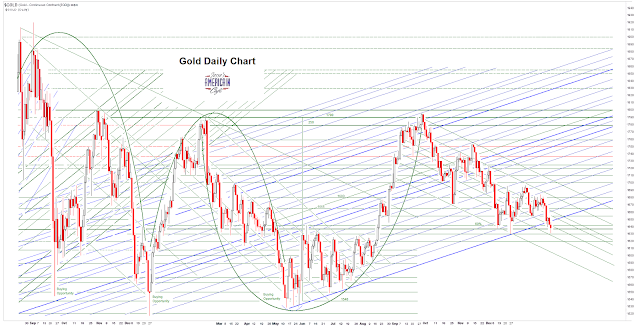

Gold Daily and Silver Weekly Charts - The Art of Currency War

“Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.”

Carroll Quigley, Tragedy and Hope, p. 278

"Of course, convergence of finance and monopoly capitalism with monopoly communism was always the long-range goal of the Money Power, as William Gladstone called them...

The conflict between the East and West was designed to scare the people of the world into accepting a convergence of these two monopoly systems of authoritarian power. The end result was to be a new Imperial Order and a New World Empire run by an elite self-perpetuating oligarchies from the leading nations of the earth."

Carroll Quigley, Tragedy and Hope, p. 860

Crazy, huh? Quigley was a professor of history at Georgetown University, and was a mentor to Bill Clinton, having recommended him for his Rhodes scholarship.

It seems a bit less crazy today than it did when I first read this in the 1990's.

Speaking of quotes, this particular quote came to mind today as I thought about the metals markets.

“Appear weak when you are strong, and strong when you are weak.”Why the big show of control over the markets? It is fairly obvious if you watch the daily action on the tape.

Sun Tzu, The Art of War

I *think* that the financial system is quietly unraveling behind the scenes again, and that at some point this great complacency is going to break, and hard. But the gaming will continue until something provokes a change in the short term equilibrium, which I believe is false.

I will not be surprised to see a final big move to run the stops to the downside in the precious metals, and take additional shares and units of paper claims before the markets break free.

Subscribe to:

Comments (Atom)