"Gold has worked down from Alexander's time... When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory."

Bernard Baruch

"After we came out of the church, we stood talking for some time together of Bishop Berkeley's ingenious sophistry to prove the nonexistence of matter, and that every thing in the universe is merely ideal.

I observed, that though we are satisfied his doctrine is not true, it is impossible to refute it.

I never shall forget the alacrity with which Johnson answered, striking his foot with mighty force against a large stone, till he rebounded from it--

"I refute it, thus!"

Boswell, Life of Samuel Johnson

"For centuries, gold had a profound impact on history, as a symbol and a storehouse of wealth accepted universally around the world. Gold functions as a medium of exchange, particularly in areas where currencies are distrusted.

Yet gold has not been without controversy. The influential economist, John Maynard Keynes, referred to gold as a 'barbarous relic.' Later in the 20th century, former Chairman of the Federal Reserve’s Board of Governors, William McChesney Martin, praised gold as 'a beautiful and noble metal. What is barbarous,' Martin said, 'is man’s enslavement to gold for monetary purposes.' Clearly, this precious metal has aroused great passion. It undoubtedly will continue to do so long into the future."

New York Federal Reserve

"The commerce and industry of the country, however, it must be acknowledged,though they may be somewhat augmented, cannot be altogether so secure, when they are thus, as it were, suspended upon the Daedalian wings of paper money, as when they travel about upon the solid ground of gold and silver.

Over and above the accidents to which they are exposed from the unskilfulness of the conductors of this paper money, they are liable to several others, from which no prudence or skill of those conductors can guard them."

Adam Smith, Wealth of Nations

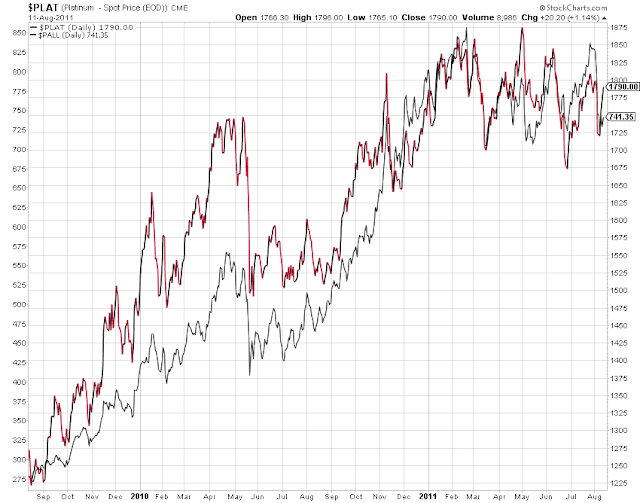

Gold has moved in price from $250 in the year 2000 to roughly $1,350 today. In other currencies the move has been much more pronounced.

The period of 1996-2000 is a good time to pick a start for this monetary episode, because this is when the global monetary regime, which had been in place since the end of WW II with a significant change made by fiat in 1971, began to change, substantially in the most proper sense of the word.

Some like to cherry pick a study of recent gold performance from the prior top of $1,900, but that says more about them and their intentions than it does about gold. They know that all bull markets climb a wall of worry and can offer significant retracements from new highs while remaining intact.

And given the structure of global supply and demand, and the vast movements in the global economy, it is likely to go much higher, unless it becomes a fixed asset in a global monetary system once again and its price becomes set by fiat.

More likely it will become a floating asset with a more 'official' status than it has today when some central bankers will hardly recognize its existence in public, although they own it, and worry over it in private.

As shown in the second last quote above from the NY Fed, which unfortunately is no longer found on their web site, some central bankers find the attractive, and yet restraining, qualities of gold as a standard to be cloying, because it restrains their degrees of freedom to act as they would like.

And even when it is not a standard it does tend to utter some 'unpleasant truths.' But there is no denying its role as a refuge during periods of monetary instability, especially for those who are not currently holding the financial power.

And gold is certainly not the only hedge, and only safe harbor available. But that is a far cry from saying it has not served many people very well during serious financial crises, and worked exceptionally to retain its value during a currency crisis and reissue/reflation. Even a cursory look at historical crises show that. The value is to study the nature of crises, and to understand the situation one has, not the one you wish you had, or even worse, the one that serves your mistaken point of view.

By the way, I am not advocating a gold standard as a cure for our ills. What our financial system requires is genuine reform from top to bottom. It is capable of corrupting, for at least a protracted period of time, virtually any single solution that one can imagine. Look what they have done to the civic impulse for genuine change that became that industry-born frankenstein, Dodd-Frank.

They create a desert, and whimsically call it the 'new normal.'

So let us then consider this paper below, titled

Gold Has Never Been a Great Hedge Against Bad Economic Times.

Not meaning to be rude, but there are some telling flaws in this paper. But even then I would not have been moved to respond to it, if they had not had the cheek to use the word 'never' in the title, and to employ such sloppy criteria in their hypothesis as 'bad economic times' and 'major macroeconomic declines,' which they tend to confute with stock market performance.

And that is not to say that any very broad sweep of data over time, without sufficient attention to the particular character and context of the various situations described within, can easily be misleading, or be used to 'prove' something else when using it to draw broad and poorly defined conclusions.

What

kind of crisis was it? Was it a crisis period or not? What

caused it, what policy actions helped to precipitate it, if any, and what were the policy

responses? How are you measuring the asset? Was the change uniform, or different across areas and economies, and what were those differences?

In the Weimar inflation, for example, gold among other assets was a spectacular hedge in a financial crisis, but so were some stocks. So one can see that using the 'stock market' as your defining variable of a macroeconomic disaster might not be effective. This is not a quibble. It is calling out some very fuzzy thinking which characterizes this analysis, that does not support such a sweeping hypothesis.

It may surprise you, but not all crises are the same. And I do not hold gold to be a panacea, not at all. Nor do I consider it to be a outlier or aberration, which is the converse of this, that some others seem to do. 'Gold has

never been a hedge against bad economic times.' The use of the word

'never' is a deep tell about their mindset and predisposition.

What variables do tend to have a correlation with gold over periods of crisis? I have found in my own research that they tend to be risk spreads in bonds, the growth in the broadest money supply, other risk factors, and of course the relative strength of the currency in which you are expressing gold's value. But even this is not uniform over time, especially in non-crisis or managed price periods, such as when gold is fixed as a 'standard.'

Most assets will smooth out over a long period of time, unless they are artificial constructs,like some stock indices, which are altered by throwing losers out and putting winners in to achieve a semblance of growth.

There is an ebb and flow in everything.

It takes someone with the time and ability and most importantly the open, inquisitive mind not bound by some school of thought or orthodoxy to go into the various situations where something

has happened, and happened with a particular cause and effect that was widely acknowledged, in order to really understand the mechanisms and nature of a thing.

When I first began studying money as a practical consequence of my international business dealings, and later with first hand experience to the Russian currency crisis, I could have given two hoots about gold or silver. They were never even mentioned in any of my business or economic courses. But later as I continued to study this as an avocation, their role in the history of money and current events could not be ignored.

But never mind what is happening all around you. Don't buy any gold, and don't like it. Laugh at the rest of the world which

is buying it. Tell them to eat trillion dollar platinum coins because you say so. It doesn't matter. Keep believing, believe in memes and quaint canards and slogans like the 'efficient market theory' and 'printing money endlessly doesn't matter.' Keep applying top down monetary stimulus and ignoring the results of your serial policy errors and asset bubbles.

So called experts have their noses stuck so deeply into 'what everyone in their profession knows' as an accepted orthodoxy that they can understandably fail to see the forest for the trees. They miss the big changes, the 'sea-changes.' They are well trained for a world that is changing all around them, using inflexible models too often based on deeply flawed assumptions.

In 2006, the central banks of the world became net buyers of gold bullion for the first time in 30 years, and are continuing to do so in a very big way. Gold has been moving

en masse to the emerging economies of Asia, the biggest beneficiaries of 'globalisation.'

And there is a reason for this, that is not based in some quirk or personal idiosyncrasy.

But arguments based on faulty hypotheses such as this paper, or even worse, on almost nonsensical or

ad hominem arguments, seem to poke their heads up every so often, either when the banks, or some other major players, get their panties in a bunch because of their exposure to bad bets in the metals markets, or when some central banks start to feel nervous about their ability to manage the markets in their currencies to achieve their financial engineering goals.

Those economic policy goals get in trouble, by the way, because the policy itself is quite possibly running against the markets, and is also misdirected in addition to being ineffective. We have certainly had enough first hand experience in this for the the past twenty years or so.

But at the end of the day, people may say what they will, but money talks. The real economy has a message to tell for those who will listen to it. Or not.

There will be those who will continue to say, 'this is not happening' even while a tsunami of change rolls over them. That is their prerogative.

The time for warnings was

then. This is

now.

And events are underway that will have something like the character of a force of nature.

GOLD HAS NEVER BEEN A GREAT HEDGE AGAINST BAD ECONOMIC TIMES: Evidence from decades of US and global data

Gold has not served very well as a hedge against bad macroeconomic and stock market outcomes. That is the central conclusion of research by Professors Robert Barro and Sanjay Misra, published in the August 2016 issue of the Economic Journal. Their study draws on evidence from long-term US data on gold returns, as well as gold returns during some of the worst macroeconomic disasters experienced across the world.

Gold has historically played a prominent role in transactions among financial institutions even in modern systems that rely on paper money. What’s more, many observers think that gold provides a hedge against major macroeconomic declines. But after assessing long-term US data on gold returns, the new research finds that gold has not served consistently as a hedge against large declines in real GDP or real stock prices.

From 1836 to 2011, gold delivered low average real price appreciation and experienced high average volatility. The mean real rate of price change was 1.1% per year, close to the 1% average real rate of return on three-month US Treasury Bills and comparable assets. The standard deviation of annual gold returns was 13.7%, almost as high as the 16.7% on the US stock market...

Royal Economic Society, Gold Has Never Been a Great Hedge Against Bad Economic Times