01 March 2013

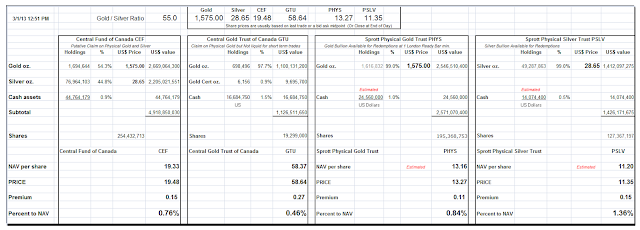

Net Asset Value Premiums of Certain Precious Metal Funds - Thin Premiums, No Bubble

Premiums are rather thin again.

One of the reasons I track this series of prices and relationships, which can all be accessed in a series by clicking on the category title at the bottom, is that I use it to keep track of any 'frothiness' in the market.

And it is well known that a 'bubble' does not exhibit this lack of enthusiasm in what are largely retail instruments.

This is confirmed by the bellwether precious metal mining sector, which is not robustly priced to say the least. It looks more like gloom and depressed sentiment rather than overly enthusiastic buying.

A bubble is marked by wide public participation. And there just isn't any yet in this bull market.

Even at this stage of the bull, the 'wall of worry' is quite steep and troublesome. But this has marked every major consolidation before the next leg higher, as the metal passes from weaker to stronger hands, over and over. The paper onslaught works, until it does not.

And then the metal bears retreat to a higher level and repeat the process. It is a cynical game, and does not perform the functions of capital allocation and demand satisfaction that are the purpose of the markets with regard to the real economy. There is a great moral hazard in this that will be reconciled at some point.

What I do particularly resent is the use of the media and propaganda and obvious price manipulation to help that process along. The hedge funds and bullion banks go too far, and the regulators do far too little to uphold their responsibilities.

But for those who have been involved since the beginning of the great turn in valuations, this is nothing new, and it too will pass.

I could be wrong, but I do not think that I am. And at least I am thinking, and not merely mouthing nonsense, which is what passes for much commentary about the metals from even 'name' economists. Change is hard for the status quo.

And we are in a period of great historic change, and like most great change, it happens slowly at first, and over a long period of time. And then suddenly the greater mass of people become aware, as if that change just happened suddenly, and just fell from the sky. And it is a revelation to many who otherwise would not have given it a thought.

Category:

NAV of precious metal funds

28 February 2013

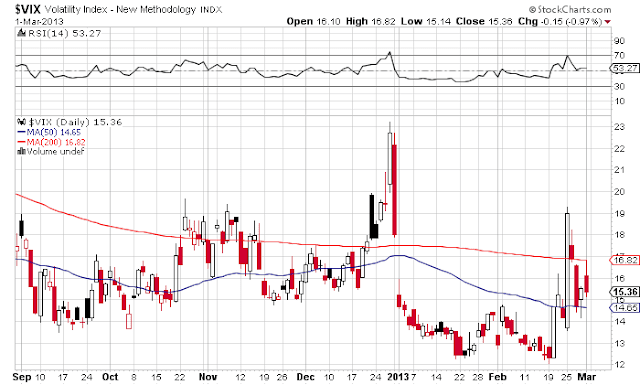

Gold Daily and Silver Weekly Charts

Intraday commentary on gold and stocks here.

I like the 'risk on/risk off' chart cited there which comes from Barry Ritholtz.

I think it speaks to action in the gold and stock markets.

As for gold and silver, we seem to be getting the post-expiration test of the market which I had suggested we might see.

I am not sure how they will fare vis à vis the sequester. I do think that stocks and the metals may be inversely correlated once again in a risk off environment.

Today I started setting the criteria by which I might take positions in the badly beaten down precious metals mining sector. The funds have been having too much of their own way there, but it does not seem that we are done with that yet. But I have created a short list, and am refining some 'tough' target prices. Obviously that list is evolving with the market and economic outlook. But for now they are below this market.

Bullion is still my preferred vehicle, but I think once we get past whatever big bump in the road is coming, we may see smoother seas more amenable for a longer term chartist such as myself.

Sequestration Is Coming. Now What?

SP 500 and NDX Futures Daily Charts - Rally Sequestered

Stocks started cranking higher on a 'better than expected' Chicago PMI and Unemployment Claims, and a so-so first revision of 4Q GDP that went slightly positive, but below consensus, but with a big jump in the deflator.

The Dow Jones Industrial Averaga, aka the Rubes' Index, was hovering just below new all time highs.

Rally rally, until the afternoon when the impasse in the Congress made traders shaky, and took stocks into the red.

After the bell Groupon gave CEO Andrew Mason the boot.

Let's see how the sequester plays out and how they buy and sell around the news.

Intraday commentary and a 'crash warning' here.

FWIW, stocks are trading like commodities here, and thinly. So there are a range of non-reality based possibilities, until and unless the music stops. I am somewhat coyly skeptical in my trading here, with a more 'value-based bias' as much as one can in the fog of currency war and control fraud.

Sequestration Is Coming, Now What?

Subscribe to:

Comments (Atom)