04 March 2013

China's Extreme Real Estate Bubble: Globalization Is a Fraud, a Castle Built On Sand

Quite a few people know about this, but they really do not understand it. It is a fraud that surpasses by far any in history, including the South Sea and Mississippi bubbles.

China is an extreme bubble fueled by artificially low wages and an autocratic industrial policy that is distorting the economy of the entire world.

The monied interests of the West have been riding the trend of deregulation and globalization to their personal enrichment and benefit. But it is an empire of illusion, with a foundation of sand, held in place by the corrupting power of money.

There are some ways out of this that the Chinese leadership might take, but I suspect that their powerful oligarchs will be caught in the same credibility trap that has kept Western leaders from taking the appropriate policy actions for the good of their own people.

This is a story of betrayal, powers and principalities, of the rulers of darkness in this world, and evil in high places. And the Anglo-American establishment has played a key part in it.

Sorry for the commercials, but the video is worth watching because it carries a visual impact that words alone do not quite capture.

China's richest woman says in a related interview not included on the aired program that the 'Chinese people are craving for democracy.'

So are the Arabic people, and the people of Europe and the Americas, who often have the illusion of choice, from amongst a series of choices allowed by technocrats acting for a ruling elite.

Category:

bubble,

bubble-nomics,

China Bubble,

Corruption,

globalization

01 March 2013

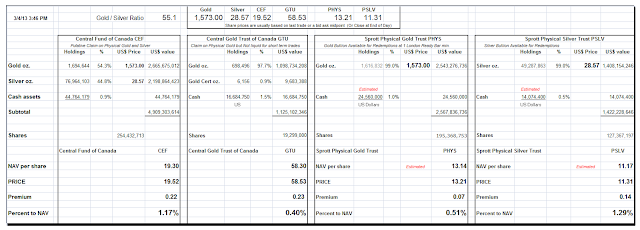

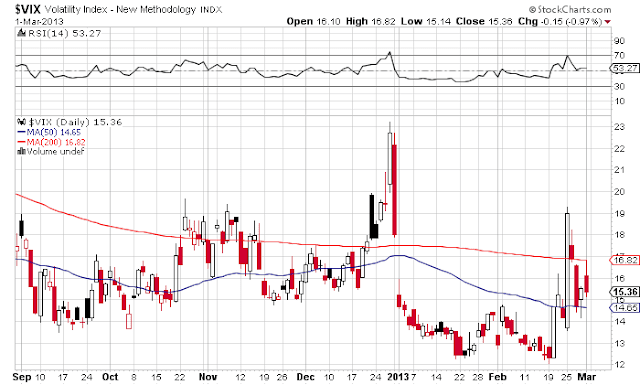

Gold Daily and Silver Weekly Charts - Sequester Will Harm Effectiveness of the CFTC

CFTC Chairman Gensler noted on financial television that the sequester will make the enforcement efforts of his agency to police the markets harder, and it will be more difficult to 'stop the bad guys on Wall Street.'

Isn't he the one that just went to court and filed a brief in support of market manipulators to overturn the Federal Energy Commission's successful $30 million fine against an Amaranth natural gas trader because the FERC was doing 'his job?'

Chairman Gensler also noted today that LIBOR is useless for ensuring the integrity of commercial business interest rates. Can't dispute that testimony.

Not to put too fine a point on the irony, but speaking of concocted numbers without genuine merit, and of little value in setting prices for the real economy, has the Chairman looked at the silver futures markets lately?

Have a pleasant weekend.

|

| 'Oh lawdy, this is grim. My Grand Slam breakfast!' |

Category:

CFTC,

silver manipulation

Subscribe to:

Comments (Atom)