10 June 2013

NAV Premiums of Certain Precious Metal Trusts and Funds

The Gold/Silver ratio is at a high point given its recent history.

I think there are signs of speculative excess to the downside. The professionals seem to have been covering their short positions in gold and to some extent silver.

The disappointment one feels with the regulators at the CFTC and the SEC does not seem to be misplaced given recent revelations of a lack of integrity and honor amongst corporate management and government officials overall. There is always an element of society without shame. Unfortunately it has risen into the halls of power. This is an age where corruption, greed, pride, and selfishness are not only tolerated, but have become fashionable as a mark of the fortunate few.

Unfortunately this is not a recent trend, but an extension of a trend that has been in place for some time. It will change, and when it does, there will be a greater hope for a sustainable economic recovery.

Category:

NAV of precious metal funds

08 June 2013

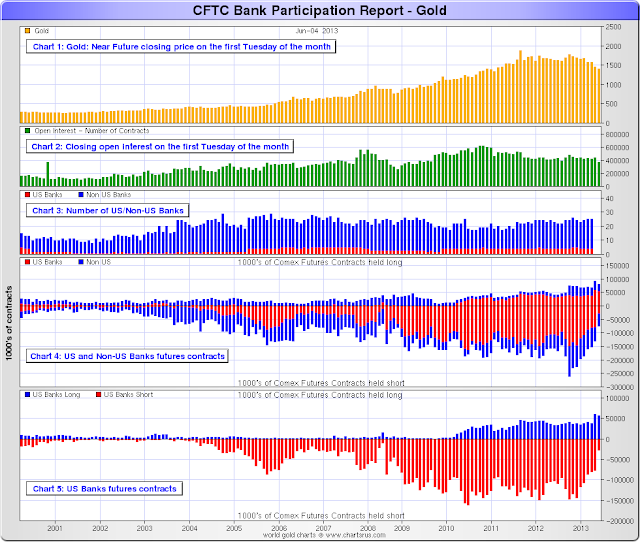

CFTC Gold and Silver Bank Participation Report - Ted Butler's Comments

The US Banks have gotten net long of gold in this last report.

The charts below are from Sharelynx.com.

Here is what Ted Butler of Butler Research had to say about this report today:

"Since the BPR of February 5, the US bank category position (in effect, almost exclusively JPMorgan) has swung by a net 100,000 contracts, from net short 70,000 contracts to net long 30,000 contracts (all rounded). There has never been a move of such magnitude before. Over that same time, the total net commercial short position (in the COT) declined by 113,000 contracts, meaning that JPMorgan accounted for almost 90% of the entire commercial decline. It is not possible for that extreme degree of concentration and market share not to be manipulation, pure and simple.

And here’s the manipulative icing on the cake – JPMorgan was able to flip a net short position in COMEX gold of 50,000 contracts in February to a net long position of 50,000 contracts on a gold price decline of as much as $350. I would submit that the singular purchase of 10 million ounces of gold (worth the equivalent of $15 billion) within four months on a greater than 20% price decline could only be accomplished if the price was manipulated lower by the purchaser. No other explanation would be possible...

JPMorgan’s emergence as the big COMEX gold long changes the dynamic of the gold market. In addition to conclusively proving that this is the most crooked and evil financial institution ever to exist, it confirms the extremely bullish set up for the gold price...

Of course, if JPMorgan can continue to accumulate inventory on lower prices, we will get lower prices temporarily. But having JPMorgan confirmed as being on the long side of gold is a game changer. That’s why I continue to throw money out the window on silver call options."

I read Ted twice a week for color commentary on the metals markets. Its a subscription service. I tend to take some confidence from what he says about the bullish set up because several other things that I watch carefully are inclining to show the same setup for a serious short squeeze on the funds.

He also had quite a bit to say about silver, which is his area of special interest and unsurpassed expertise, but you will have to subscribe to read that.

I took my first silver position in a while on Friday and expanded my gold position on that weakness.

Category:

bank participation report

C. A. Fitts On Debt, Centralization, Money, Equity Markets, Currency Wars, and Gold

Catherine Austin Fitts served as managing director and member of the board of directors of the Wall Street investment bank Dillon, Read & Co. Inc., as Assistant Secretary of Housing and Federal Housing Commissioner at the United States Department of Housing and Urban Development in the first Bush Administration, and was the president of Hamilton Securities Group, Inc., an investment bank and financial software developer.

Fitts has a BA from the University of Pennsylvania, an MBA from the Wharton School and studied Mandarin at the Chinese University of Hong Kong

The discussion gets particularly interesting after the 9 minute marker.

For your convenience here is a written summary of the main points of this interview.

I agree with much although it is important to remember that there are quite a few assumptions underlying it.

People are being 'conditioned' to prefer equities over other risk management products like bonds and commodities.

And this is not so simple a task because there is not one world government and one currency. We must never forget that this is where quite a few of the oligarchs, who are already thinking of themselves as borderless, are trending.

And as we all should always remember there are black swans and fat tails.

The word for today is enantiodromia. It pairs nicely with hubris.

In their pride people who have too much power and not enough restraints can go to far and achieve an effect that is unexpected and even the opposite of what they had intended.

Subscribe to:

Comments (Atom)