"If once you forfeit the confidence of your fellow citizens, you can never regain their respect and esteem."

Abraham Lincoln

"It is lack of confidence, more than anything else, that kills a civilisation. We can destroy ourselves by cynicism and disillusion, just as effectively as by bombs."

Kenneth Clark

"At the root of America's economic crisis lies a moral crisis: the decline of civic virtue among America's political and economic elite. A society of markets, laws, and elections is not enough if the rich and powerful fail to behave with respect, honesty, and compassion toward the rest of society and toward the world."

Jeffrey Sachs

Shanghai is emerging as the new center of the gold trading world, as the price shenanigans of London and New York discredit their exchanges, and accelerate the flow of gold from west to east.

The volumes on the LBMA and the COMEX are larger but misleading, because for the most part they represent the passing around of paper claims, at a leverage of 50 to 1 or more, against a diminishing pile of actual gold bullion. They are now running on custom and momentum, but losing substance and confidence with every passing day.

This is the direct result of not allowing the market to set the price, and the moral hazard of not restraining overly cynical, if not overtly fraudulent, representations of value and risk.

The market operation that took down the price of gold which we saw earlier this year on the COMEX was so blatant, so heavy handed, so patently obvious that it jarred the world markets, and had the opposite effect to which one might presume it was intended. It was a bureaucratic over-reaction, panic more precisely, to the Bundesbank's request for the return of their national gold.

If the Anglo-Americans did not use this opportunity to secure the return of the gold bullion which had been leased out, it was a strategic blunder of epic proportion. It may be viewed in retrospect as the watershed moment in which London and New York squandered away the confidence of the world. In their cynical and amoral self-delusion, and a contempt for other people, they assumed that maintaining public confidence is a function of being bolder and more skillful liars. Nicely played, gentlemen.

Integrity is the prerequisite for confidence, and bad behavior drives out the good. A loss of confidence after repeated abuse is a genuine risk whether one properly accounts for it or not.

Weighed, and found wanting.

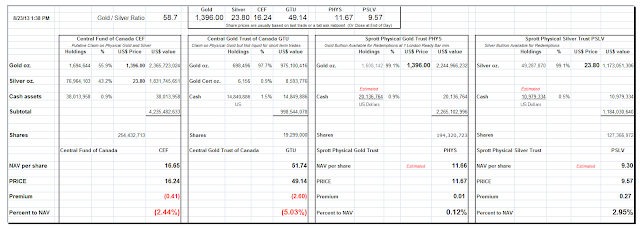

The original article from which this chart has been taken can be found

here.