They are talking about a 'super-currency' for international trade, and not to replace any currencies for domestic use.

I have been reporting on this for quite a few years. It is a movement whose time has come as the US dollar reserve currency falters, and the Fed expands the monetary base for domestic concerns.

You can click on either of the subject headings at the bottom of this blog entry, and all of the past postings with those subjects will be selected for your reading.

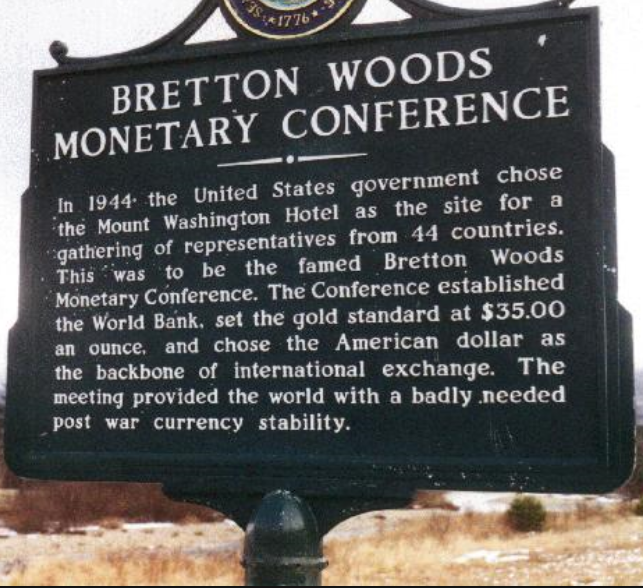

The major countries will no longer tolerate the monetary manipulation with the global currency in the same unilateral manner with which Nixon changed the Bretton Woods agreement back in 1971 by ending dollar convertibility to gold, rather than devaluing against it.

For lack of a better alternative or term, I settled on the SDR, made up of a new basket of currencies and commodities, almost certainly including gold, and quite possible silver, if China, Russia, et al. have their way.

Right now the nations are in the 'negotiation stage,' with the Anglo-American banking cartel putting up a strong resistance for any changes to their 'exorbitant privilege.' I would not be surprised to see more forex and precious metal games played as the Lords of Finance flex their monetary muscles.

And then there is the question of the tangled web of rehypothecation of bullion without public disclosure. It could prove to be very embarrassing to some.

But change is coming, one way or another.

China Daily

Replace dollar with super currency

By Michael Barris in New York,

Fu Jing in Brussels and

Chen Jia in Beijing

2014-01-29 09:04

The World Bank's former chief economist wants to replace the US dollar with a single global super-currency, saying it will create a more stable global financial system.

"The dominance of the greenback is the root cause of global financial and economic crises," Justin Yifu Lin told Bruegel, a Brussels-based policy-research think tank. "The solution to this is to replace the national currency with a global currency."

Lin, now a professor at Peking University and a leading adviser to the Chinese government, said expanding the basket of major reserve currencies — the dollar, the euro, the Japanese yen and pound sterling — will not address the consequences of a financial crisis.

Internationalizing the Chinese currency is not the answer, either, he said.

Lin urged the international community, especially the US and European Union, to play a leading role in currency and infrastructure initiatives. To boost the global economy, he proposed the launch of a "global infrastructure initiative" to remove development bottlenecks in poor and developing countries, a measure he said would also offer opportunities for advanced economies.

"China can only play a supporting role in realizing the plans," Lin said. "The urgent thing is for the US and Europe to endorse these plans. And I think the G20 is an ideal platform to discuss the ideas," he said, referring to the group of finance ministers and central bank governors from 20 major economies.

The concept of a global "super currency" tied to a basket of currencies has been periodically discussed by world leaders as well as endorsed by 2001 Nobel Memorial Prize-winner Joseph Stiglitz. A super currency could also be tied to a single currency, but the interconnectedness of world financial markets and concerns about the volatility that can occur as a result of the system being tied to one currency have made this idea less popular...

Arguments in favor of a global currency resurfaced during October's US budget impasse, which forced the government to shut down.

"It is perhaps a good time for the befuddled world to start considering building a de-Americanized world," a Xinhua News Agency commentary said on Oct 14. The piece argued that creating a new international reserve currency to replace reliance on the greenback, would prevent government gridlock in Washington from affecting the rest of the world.

In March 2009, China's central bank governor, Zhou Xiaochuan, called for the creation of a new "super-sovereign reserve currency" to replace the dollar. In a paper published on the People's Bank of China's website, Zhou said an international reserve currency "disconnected from individual nations" and "able to remain stable in the long run" would benefit the global financial system more than current reliance on the dollar.

On that note, David Bloom, global head of FX research at HSBC, said US monetary policy change "will bring fluctuations for emerging countries' currencies and lead to financial instability".

Chen Wenling, chief economist at the China Center for International Economic Exchanges, a government think-tank, said, "A supranational currency may be a new direction for development of the global financial system. It also requires different countries to cooperate in coordinating macroeconomic policies..."