"It is no exaggeration to say that since the 1980s, much of the global financial sector has become criminalised, creating an industry culture that tolerates or even encourages systematic fraud. The behaviour that caused the mortgage bubble and financial crisis of 2008 was a natural outcome and continuation of this pattern, rather than some kind of economic accident."

Charles H. Ferguson

“Thus did a handful of rapacious citizens come to control all that was worth controlling in America. Thus was the savage and stupid and entirely inappropriate and unnecessary and humorless American class system created. Honest, industrious, peaceful citizens were classed as bloodsuckers, if they asked to be paid a living wage.

And they saw that praise was reserved henceforth for those who devised means of getting paid enormously for committing crimes against which no laws had been passed. Thus the American dream turned belly up, turned green, bobbed to the scummy surface of cupidity unlimited, filled with gas, went bang in the noonday sun.”

Kurt Vonnegut, God Bless You, Mr. Rosewater

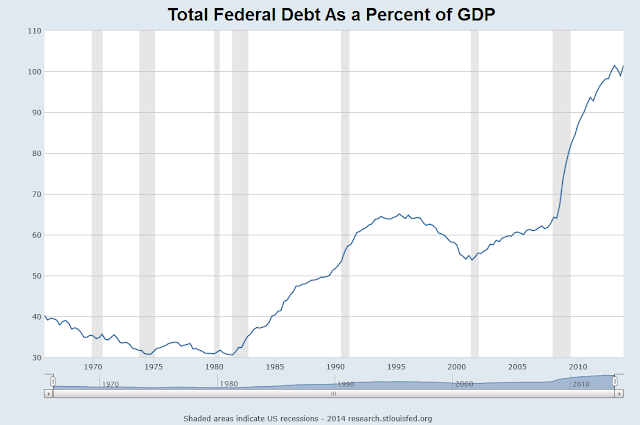

"Call me dark, but what I see here is a toxic relationship between deregulation, underpriced risk, and exorbitant, inefficient pay scales that contribute to the growth of inequality, not to mention the shampoo economy (bubble, bust, repeat)."

Jared Bernstein, A Striking Picture of Pay and Deregulation in Finance

A country foolishly deregulates the safeguards created by their forefathers, trusts to the natural goodness of those most hungry for wealth and power, and increases the incentives for enormous wealth by creating loopholes and cutting tax rates, and de-penalizing even the most shocking kinds of white collar crimes. They recreate the mistakes of history with a wanton disregard for the consequences.

And still they wonder why. Why do we persecute the poor, and idolize those who would rule us all, without pity or even normal cautions against crises ? And they say, for God and freedom.

Financial corruption has twisted and perverted public policy, distorted the economy, and polluted the corridors of political and economic power with a flood of easy money.

h/t Jared Bernstein

Related:

A Brilliant Warning On Robert Rubin's Proposal to Deregulate Banks, circa 1995

Andrew Jackson Day Remembered