"The money was all appropriated for the top in the hopes that it would trickle down to the needy.

Mr. Hoover didn’t know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night, anyhow. But it will at least have passed through the poor fellow’s hands.”

Will Rogers, St. Petersburg Times, Nov 26, 1932

“Much like Herbert Hoover, Barack Obama is a man attempting to realize a stirring new vision of his society without cutting himself free from the dogmas of the past, without accepting the inevitable conflict. Like Hoover, his is bound to fail.”

Kevin Baker, Barack Hoover Obama: The Best and the Brightest Blow it Again, Harper's

"In regards to the price of commodities, the rise of wages operates as simple interest does, the rise of profit operates like compound interest.

Our merchants and masters complain much of the bad effects of high wages in raising the price and lessening the sale of goods. They say nothing concerning the bad effects of high profits. They are silent with regard to the pernicious effects of their own gains. They complain only of those of other people.”

Adam Smith, The Wealth of Nations

“We Americans are not usually thought to be a submissive people, but of course we are. Why else would we allow our country to be destroyed? Why else would we be rewarding its destroyers? Why else would we all — by proxies we have given to greedy corporations and corrupt politicians — be participating in its destruction?

Most of us are still too sane to piss in our own cistern, but we allow others to do so and we reward them for it. We reward them so well, in fact, that those who piss in our cistern are wealthier than the rest of us."

Wendell Berry

“Trickle-down theory - the less than elegant metaphor that if one feeds the horse enough oats, some will pass through to the road for the sparrows.”

John Kenneth Galbraith

"Fascism is capitalism plus murder."

Upton Sinclair

15 May 2014

The Most Destructive Bubbles of All: Corporate Profits Amid Private Poverty

Category:

audacious oligarchy,

corporatism,

Crony Capitalism,

oligarchy

14 May 2014

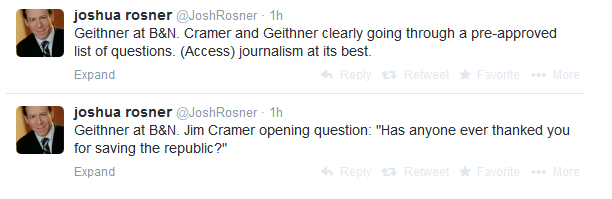

Tweeting the Decline and Fall of Western Civilisation, One Institution At a Time

“[Edmund] Burke said that there were Three Estates in Parliament; but, in the Reporters' Gallery yonder, there sat a Fourth Estate, more important far than they all.”

Thomas Carlyle

"In the First Amendment, the Founding Fathers gave the free press the protection it must have to fulfill its essential role in our democracy. The press was to serve the governed, not the governors. The Government's power to censor the press was abolished so that the press would remain forever free to censure the Government. The press was protected so that it could bare the secrets of government and inform the people."

Hugo L. Black

"The TV business is uglier than most things. It is normally perceived as some kind of cruel and shallow money trench through the heart of the journalism industry, a long plastic hallway where thieves and pimps run free and good men die like dogs, for no good reason."

Hunter S. Thompson

“We become slaves the moment we hand the keys to the definition of reality entirely over to someone else, whether it is a business, an economic theory, a political party, the White House, Newsworld or CNN.”

B.W. Powe

Quod erat demonstratum. (that which was to be demonstrated)

Category:

corporate media,

propaganda

Gold Daily and Silver Weekly Charts - O Brave New World

Oh, wonder! How many goodly creatures are there here!

How beauteous mankind is! O brave new world,

That has such people in ’t!

William Shakespeare, The Tempest

The capping of gold and silver at these levels continues.

This being an inactive month for the metals, the CME offers even less insight as to what is going on in the real world than it normally does.

Three futures traders have filed a lawsuit alleging a conspiracy of price rigging and deception at the CME.

The LBMA has decided to give up the silver fix, for a lack of interest in a thoroughly corrupted system of price discovery. Principled resignation is more of a British tradition; the Yanks will hang on, stubbornly to their lies, until the bitter end. So I don't expect to see any reforms on the CME until it is forced into a de facto default and a conversion to pure paper.

I do not expect to see a real hyperinflation, or a 'proper bankruptcy' in the US. On this the MMT crowd is most likely correct, at least technically, although all things are possible since the issue is one of human choice, and these jokers are certainly all too human in the worst sense. If your debt is in dollars, and you can pay it in dollars, and you cant print dollars at will, the internal logic is sound. But certainly circular and self-referential, and quite likely divergent from practicality.

There will likely be some sort of default on the debt, or a significant change in the system. But technically it will not be a bankruptcy. Again, more likely a serious bout of stagflation supported by increasing levels of fraud and force.

When the use of force starts to breaks down, if in fact it does, we will either see a managed devaluation, a consolidation, or a change in management. We are in a long running Ponzi scheme of a fiat currency that must continue to keep expanding, or begin to collapse.

There is a method in the madness of Washington, and their insatiable desire for more. But is has little or nothing to do with the public welfare or the health of the republic. This is the 'me generation' and their watchword is greed.

We may see Britain falter first. Or a greater portion of Europe. Self-love is throwing your own people and then your friends under the bus first, when your schemes begin to fall apart, because they are closest to hand.

We come in peace.

Have a pleasant evening.

Category:

hyperinflation

SP 500 and NDX Futures Daily Charts - And the Small Caps Shall Lead Them...

This is a particularly situation here in the equity markets.

Deception is rampant in the accounting for company numbers. The trading is very 'technical' and the underpinnings of the stock market are as sound as a three card monte game.

Forget the fundamentals for now. Unless there is an exogenous shock, I think the market can continue to rise in a very Ponzi-like manner, perhaps to what will in retrospect be viewed as a 'blow off top.' If a shock comes, or if enough time passes to lower the bar for a 'trigger event' sufficiently, a meltdown is certainly possible.

Watch the Russell, as the SP is the lead sled dog for leveraged manipulation, and the DJIA is strictly for tourists. The broader market for small caps will give you the temperature for things as they are, moreso than the headline indices.

I am not short equities. Not yet. But I am watchful, and am holding a conservative portfolio, holding no US stocks.

This might be more entertaining to watch, if I were not in such close proximity to it. Call me Ishmael.

Have a pleasant evening.

Subscribe to:

Posts (Atom)