China shocked the world markets overnight by devaluing their currency by the most in two decades.

A devaluation of this sort is designed to improve the domestic economy by stimulating exports, lowering domestic costs of production relative to other sources, and to inhibit imports by raising their relative prices.

In other words, China clearly signaled that the US dollar, to which they were matching their own currency, is overvalued relative to the state of the global economy, and especially their own and their competitors in Asia.

China is 'the canary in the coal mine' for the global economy, a major source of labor and supply. Their own economy is sick because demand from overseas is down.

And why is demand lower? Because multinational corporations and the banking system have been financializing nearly everything to increase corporate profits and the wealth of a very few, pretty much at the expense of everyone else.

So if the people do not have the money to buy, and cannot keep increasing their private debt to service consumption because of the predatory lending rates and usurious fees in the system, guess what happens to aggregate demand? Duh.

This is not new. This is not unknown to economists. Thanks to Wall Street On Parade for reminding us of Franklin Roosevelt's campaign speech delivered at Oglethorpe University in 1932 during the depths of the Great Depression.

"Our basic trouble was not an insufficiency of capital. It was an insufficient distribution of buying power coupled with an over-sufficient speculation in production. While wages rose in many of our industries, they did not as a whole rise proportionately to the reward to capital, and at the same time the purchasing power of other great groups of our population was permitted to shrink.

We accumulated such a superabundance of capital that our great bankers were vying with each other, some of them employing questionable methods, in their efforts to lend this capital at home and abroad. I believe that we are at the threshold of a fundamental change in our popular economic thought, that in the future we are going to think less about the producer and more about the consumer.

Do what we may have to do to inject life into our ailing economic order, we cannot make it endure for long unless we can bring about a wiser, more equitable distribution of the national income.”

The central bankers have everyone focused on their interest rate antics while they have inflated their balance sheets obscenely, primarily for the benefit of the denizens of the FIRE sector who are acquiring productive assets and establishing monopolies with that paper. The Fed is a key regulator of the banking system. And they are failing badly.

You may disagree with the methods that FDR used during his 'New Deal' but I think his analysis of the problem was correct. Andrew Jackson made similar observations in a different time and used different methods to address the issue. They are outlined in his famous Farewell Address.

"But with overwhelming numbers and wealth on their side they are in constant danger of losing their fair influence in the Government, and with difficulty maintain their just rights against the incessant efforts daily made to encroach upon them.

The mischief springs from the power which the moneyed interest derives from a paper currency which they are able to control, from the multitude of corporations with exclusive privileges which they have succeeded in obtaining in the different States, and which are employed altogether for their benefit; and unless you become more watchful in your States and check this spirit of monopoly and thirst for exclusive privileges you will in the end find that the most important powers of Government have been given or bartered away, and the control over your dearest interests has passed into the hands of these corporations."

The problem was not paper money per se, but the concentration of power and wealth which the abusive use of the paper monetary power had granted to a few powerful individuals and institutions. No system is foolproof when a foolish people will allow the unscrupulous few to operate it in secrecy and without transparency, accountability and the rule of law. And if anything is clear, the crony regulation by the Fed and other regulators of the Banking System, or lack thereof, is a failure and the source of much of our mischief.

And the primary reason we cannot acknowledge the facts of our own situation is that our political and financial class are caught in a credibility trap. They cannot speak the truth without compromising their own personal greed and will to power.

And this is daunting to us because FDR was a bit of an outlier, an odd combination of personal advantage and profound physical suffering, in a time that gave rise to terrible demagogues in the US and other countries. And 'Old Hickory' was hardened by service, sorrow, and conscience to duty first. How many like these do we see today?

The implications of this are an intensification of the currency war as the financial powers continue their stranglehold over the governments and the economic systems, inflating money but keeping the most of it for themselves, so that wages and income for the great mass of the public remains slack and a broad sustainable recovery is not thereby driven. Say's Law, which decrees that increased production creates its own demand through necessarily increased wages, is as great a canard as the efficient markets hypothesis.

So, the central banks will continue to game the system by adding money, leveraging a broad tax on everyone who holds their currency, by using a number of means to devalue their currencies. And creating a few winners and many losers by running the confidence game, large and in charge, of being wise and perfectly objective administrators, and not cronies and viceroys for the moneyed interests. As James Montier pointed out in his essay here:

"Lest you think I am being unduly harsh on the world’s poor central bankers, let me turn to the wider idolatry of interest rates that seems to characterise the world in which we live. There seems to be a perception that central bankers are gods, or at the very least minor deities in some twisted economic pantheon. Coupled with this deification of central bankers is a faith that interest rates are a panacea.In response the economists are poking their noses even more deeply into these otherworldly models, and ignoring the carnage which their cockeyed world views have helped to cause. Not because they are at fault, but because they distract many charged with observing these things from the widespread plunder which they enable, and they provide a cover for the inefficacy of official policy.

Whatever the problem, interest rates can solve it. Inflation too high, simply raise interest rates. Economy too weak, then lower interest rates. A bubble bursts, then slash interest rates, etc., etc. John Kenneth Galbraith poetically described this belief as “…our most prestigious form of fraud, our most elegant escape from reality… The difficulty is that this highly plausible, wholly agreeable process exists only in well-established economic belief and not in real life.”

The US Dollar did not soar as measured by the DX index, but instead was flat as shown below. As I noted, it is outdated and is now primarily the inverse of the Euro. I would imagine the dollar and gold and other alternative safe havens got legs when priced in Chinese Yuan.

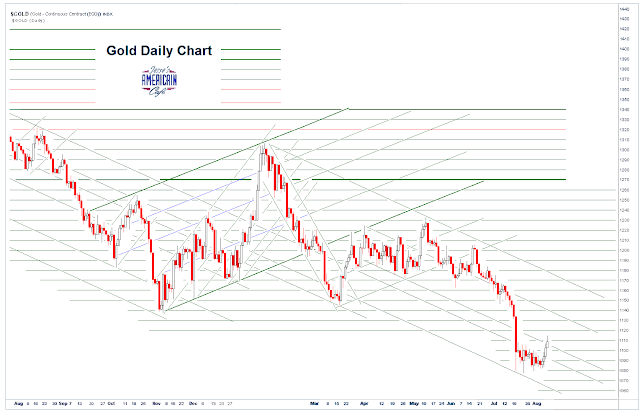

I tend to agree with Pater Tenebrarum that Gold Stocks Are At An Interesting Juncture. But my posture for now is tinged with a serious concern about the equity markets overall. I just cannot seem to get off my focus on bullion sans intermédiation of a producer or leverage. Of course at some point when the bull revives this will be a sub-optimal approach. But for now I am content to sit in a more defensible position.

Stay tuned, because the action is just beginning.

Have a pleasant evening.