Silver can't seem to get out of its own way, which is not surprising in a flight to safety. Silver's higher beta and industrial component hold it back a bit in this kind of environment.

When silver joins in, we might start thinking of a big cyclical bottom in precious metals. This bear market leg in a generational bull market is getting very long in the tooth and the free float of gold in New York and London is getting light.

The US dollar slumped a bit, again shining the light on gold even more.

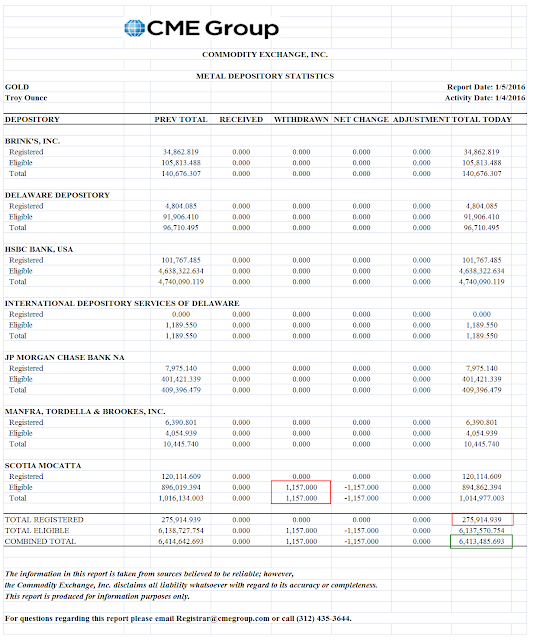

The Bucket Shop was quiet yesterday with no precious metal deliveries, and some cursory movement in the warehouses.

After the close it was announced that Greg Fleming, the President of Morgan Stanley, will be leaving the company in an unplanned manner. Morgan Stanley is a bacterial culture even amongst the moral swamp pits of Wall Street. Let's see if there is any followup news. Perhaps he just wanted to spend more time with his family. Or he is entering presidential politics so he can spend more time with his firm's money.

KB Homes will report tomorrow morning.

Gold is moving from West to East, and for very good reasons if one has their eyes open.

Have a pleasant evening.