"Price discovery is not a sexy function of markets, but it is critical to the efficient allocation of scarce capital and resources, and to the preservation of the long term wealth of investors and the economy as a whole. If price discovery is compromised by manipulation, then we will all be gradually impoverished and the economy will be imbalanced and unstable."

London Banker, Lies, Damn Lies, and Libor

"Delivery takes on a note of finality, of a reckoning, when the available supply has become rehypothecated into little more than a digital entry and a state of mind. The unanswered call for delivery begins the final lifting of the veil."

Jesse

Gold managed to hold a rally around 1090 and silver at 14 almost on the nose.

Some of the miners were spanked, in what could have been related to the January stock option expiry. Or not.

There is a general repricing of the mispriced risks from last year going on if you had not noticed in the general equity markets. It is possible that the miners are being caught up in that urge to liquidate uncertainty. A miner is a leveraged 'if-come' bet on the metal with varying degrees of uncertainty.

If the trends continue as they are then this is the year I think we may see the first very visible (to the general public) manifestations of the divergence between synthetic gold derivatives trading and the physical gold bullion trade. But let's wait for that event to happen in its own time.

I have made up the new calendars for gold futures and futures options for 2016 and have included them both below.

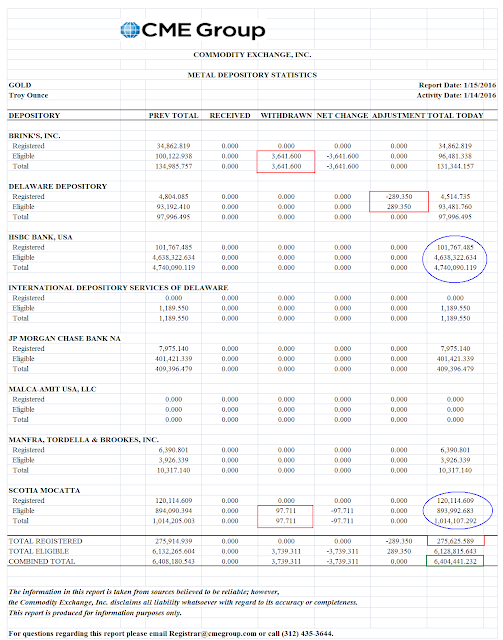

The Bucket Shop was quiet as usual, although we saw a little action in silver.

As a reminder the US markets will be closed for the observance of Martin Luther King day on Monday.

Please try to carry on without their guidance with regard to values.

Have a pleasant weekend. See you on Monday evening.